The Pivot and the Plague

I’ve been researching and writing about the shale oil and gas industry for over 10 years now. For much of that time I’ve seen the U.S. shale industry treat gas (aka methane) as a waste product. In the Bakken they were flaring and venting up to 25% of the gas that came out of the ground because they wanted the oil and the methane was just a waste stream. In 2020 when I was writing about how the Bakken had peaked I recall coming across an oil industry insider commenting on the Bakken saying, “The Bakken is a gas play now.” This is not how you want someone talking about your oil play. In the shale industry it's a clear sign of the beginning of the end when your wells start producing more gas than oil. So imagine my surprise when I read the following statement about the Permian last week by an executive of a company who had recently invested billions in Permian oil production.

"The Permian is much of a water and gas business with oil as a secondary product there," Chris Doyle, CEO of Civitas Resources

What?!! Oil is a secondary product in the Permian, the largest oil field in the world? Is he saying the Permian is a gas play now? This is pretty wild.

Five years ago the CEO of Exxon said he didn’t get the point of electric vehicles. And now we’ve got a CEO of an oil company describing the world’s largest oil field as a water and gas business. Do they know how crazy they sound? Or are they too scared to notice?

This is a big deal. To see how big a change this is, let’s go way back to 2023 to see what this same guy was saying about the Permian acreage he just dropped $5 billion on.

"We will soon have nearly a decade of price-resilient, high-return drilling inventory,” Chris Doyle said, according to Reuters.

Reuters also reported that by spending $4.7 billion on Permian acreage that Civitas got, “Plenty of tier-1 acreage still available, indicating shale oil production will grow through to the end of this decade. Reuters added, “Permian is an obvious target for producers looking to increase their inventory.”

In November of 2024 we got an update from Chris at Civitas and the news was very good.

“we've identified approximately 120 Wolfcamp D locations in the inventory with mid-$40 [per barrel] oil breakevens."

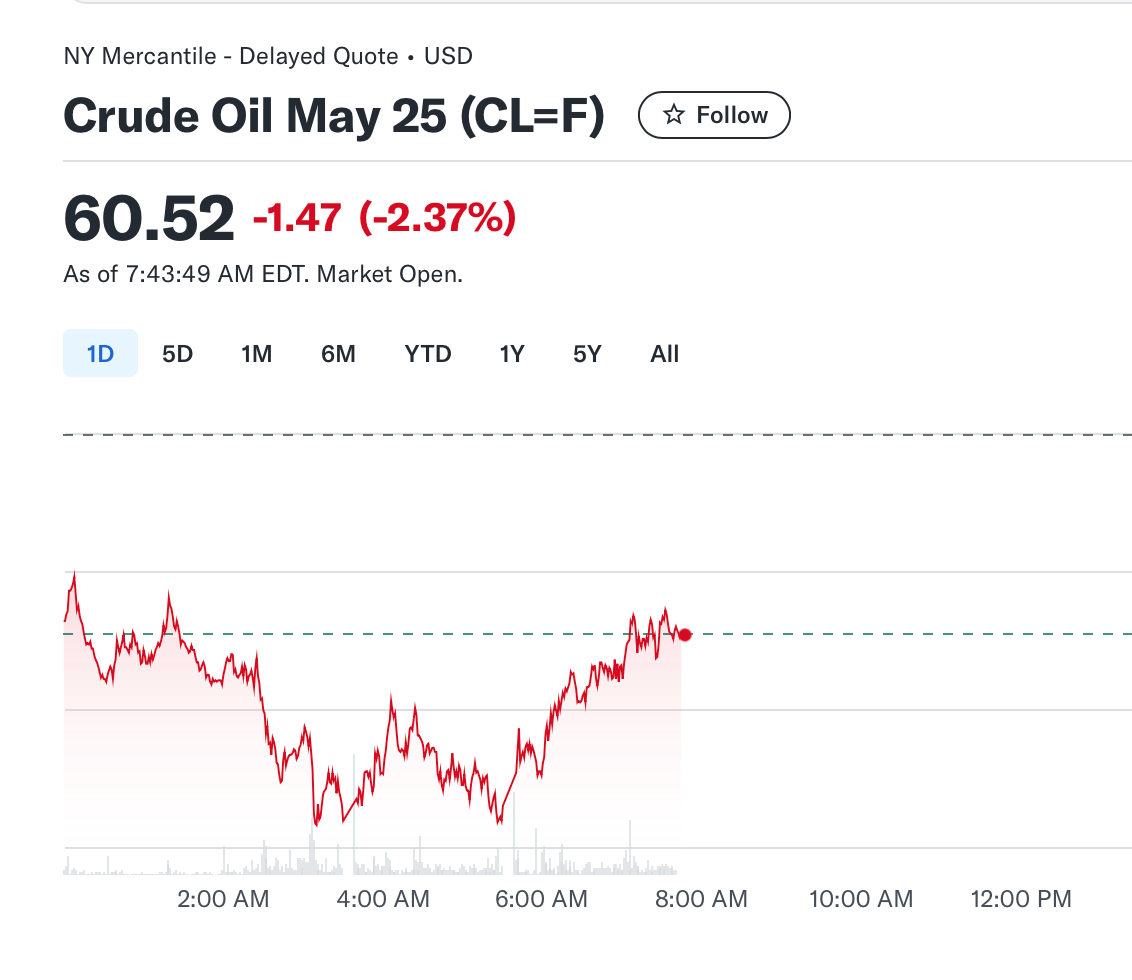

That was six months ago. Now, in an article in Yahoo that notes that the Permian is peaking, Chris is saying oil is a secondary product. He was saying that at $70 (remember $70 oil?). Anyone confused by that? If I’d invested $4.7 billion in an oil field I would be.

The article includes bits of the truth that have not seen much light in the mainstream press despite being obvious for a long time. And even Trump’s favorite oil CEO Harold Hamm has conceded defeat when he admitted that, “U.S. oil production is already beginning to plateau.”

I summed up why this is happening a year ago. I’ve also written about how a peaking oil industry in the U.S. deserves some policy consideration, how a peaking oil industry means the industry will try to walk away from its debts, and how all of this means the U.S. plans for exporting oil and gas are delusional. I’ve also written about the fraud in the oil industry and about how much of that fraud was based on the idea that there were decades of profitable shale oil just waiting to be fracked for profit. Now that they are admitting the oil isn’t there, the fraud is much more evident. I expect I’ll have to wait many more years before the mainstream press is willing to write that story.

Reuters' Ron Busso also recently commented on the global oil industry’s new phase of managed decline which also included notes on the industry’s big plan to address the oil issue by not growing oil production but instead to “focus on growing liquefied natural gas sales.” Another article quotes Shell’s CEO saying, “We want to become the world’s leading integrated gas and LNG business.”

Shell’s plans sound eerily similar to every other oil and gas company in the world. Whether it’s gas for data centers or gas for LNG, everyone is talking about gas as being the future for big oil and gas companies. But as the investors in the U.S. LNG boom are beginning to learn, in the fossil fuel industry the rule is that if you have a boom, the bust is on the way. Remember a few months ago when a group of the biggest banks in the world told us all that Venture Global’s IPO was going to be one of the biggest energy IPO’s ever? They said it was worth $110 billion. Three months later it is worth $18 billion. This is the industry they want you to believe is the future. Good luck with that.

Enter The Pivot

What to do when oil loses its lustre? Pivot to gas. And the industry is doing just that like a plague of lemmings rushing towards a cliff. However, we now must talk about facts and lemmings.

Lemming Facts

A group of lemmings is called a plague.

Lemmings do not run off of cliffs in groups. This is a myth. Other myths about lemmings are that "lemmings explode if they become sufficiently angry" and that they rained from the sky in large groups.

We must let go of myths to see clearly.

While myth busting, another myth it is good to debunk is that Exxon's Permian acreage breaks even at $30 a barrel.

Now, why would so many people believe Exxon can break even at $30 a barrel in the Permian? The answer relates to the history of lemming behavior myths.

"But the biggest reason the myth endures? Deliberate fraud. For the 1958 Disney nature film White Wilderness, filmmakers eager for dramatic footage staged a lemming death plunge, pushing dozens of lemmings off a cliff while cameras were rolling. The images—shocking at the time for what they seemed to show about the cruelty of nature and shocking now for what they actually show about the cruelty of humans—convinced several generations of moviegoers that these little rodents do, in fact, possess a bizarre instinct to destroy themselves."

Deliberate fraud involving complete disregard for the environment or other forms or life while pursuing personal profit. So now you know the true story of the US oil industry lemmings mass suicide myth.

And now the lemmings are pivoting to gas. If you think this sounds familiar, you may have read this in 2018. They have few new ideas in this industry but perhaps Shell is on to something? Shell says the future money is in LNG and this headline confirms that the company will “double down” on LNG. Of course, so does Exxon who according to this headline is “high on LNG.” Oil major Total plans “significant” investments in more U.S. LNG export capacity.

Japan is one of the world’s biggest players in the LNG space. They are really doubling down on plans to produce and trade LNG on the global markets. They are buying more gas assets in the U.S. and even trading their integrity for promises to invest in Alaskan LNG. Meanwhile the EU has more LNG than it needs and has also been considering getting into the global LNG trading game like everyone else. IEEFA recently published an analysis explaining why that likely won’t work out well for them.

What about China, you say? In this article we learn that “China’s energy giants are increasingly pivoting to natural gas” and the reason given there is, “Big oil morphs into big gas in China as EVs slash fuel demand.”

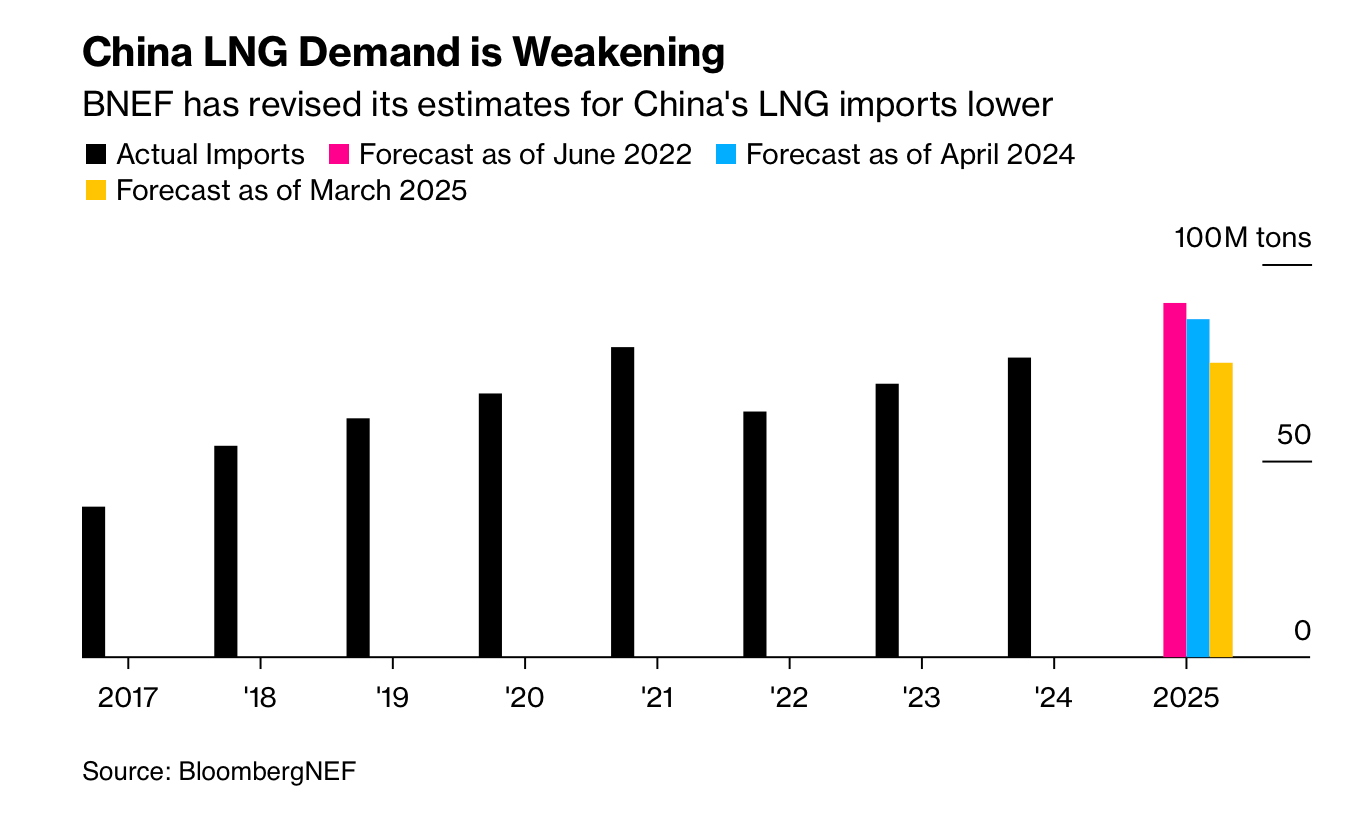

So, lots of excitement about all of the major players in the world becoming LNG traders. They will just buy it and sell it to the highest bidder and the profits will just roll in. All is needed are customers. When it comes to selling things in this world, it is good to have something to sell that China wants to buy. So, how is that going? (note: I am highly critical of the financial media’s failure to accurately inform readers about markets. So I just want to give a big shout out to the caption writer for this image who snuck in the truth. Well done!”

Right there in the caption. The assumption for all of this investment was that China would buy any LNG that was for sale. This will not happen despite what Shell says. From that article.

"Chinese purchases of liquefied natural gas will fall this year for the first time since 2022, according to BloombergNEF, which had earlier foreseen record-high deliveries."

I’ve already explained why the optimism about India picking up the LNG slack is delusional. The economics don’t work. Remember when the plan was to power Pakistan with more LNG? How’s that going? They have moved on to solar in a big way. While everyone in the oil and gas industry wants you to think India will become a big buyer of LNG in the future, it might be good to consider that Pakistan is actually the model that will be followed by most countries. There is a phrase in that article that should scare any smart LNG executives (there must be some?): “anything with a flat roof and a balance sheet.” The evidence is growing that shows that people with a balance sheet who can do the math choose solar for their power generation (see also: Texas).

US LNG’s Balance Sheet Blues

The titans of the global energy industry are all pivoting to gas and predicting a bright future. It would seem like the U.S. LNG industry should be poised for a windfall. Unfortunately for them they built their whole industry on a few bad assumptions. Money will be lost.

Here is one problem that LNG analysis Seb Kennedy of Energy Flux points out in a piece titled, “US LNG’s affordability crisis.”

"Now, there’s another paradox rearing its head: cheap oil will make US LNG less competitive in key importing markets across Asia."

The global LNG market has an economics problem but the U.S. is in an even weaker position. LNG is used for power generation but is expensive. This would be great for the LNG industry if there weren’t various other ways to generate power which weren’t significantly cheaper. But coal and solar and wind all exist and they are drinking LNG's milkshake. And when it comes to the global LNG market, the U.S. is a high priced seller. Others can sell to Asia much cheaper. Just as U.S. gas becomes more expensive. The irony is that U.S. gas is becoming more expensive due to the LNG industry exports. The more the U.S. exports, the higher the price gets for U.S. LNG feed gas, the more expensive U.S. LNG gets.

To be completely fair to the LNG crowd, renewables dominance of power generation wasn’t expected to happen this fast. Battery costs have dropped very fast. And LNG projects take a long time to build so if you started out ten years ago thinking this was the future, it was reasonable. Now, it's dumb.

But it seems investors are catching on. Despite all of the hype and the announcements of the Trump admin handing out LNG permits like candy, no new U.S. LNG facilities were funded in the first quarter of 2025. As I’ve explained, the real pause in the LNG industry is due to economics. And now it’s here.

This Gas Outlook article by Nick Cunningham notes how the Trump tariffs are not helping the LNG industry.

“Retaliation by trade partners could result in counter tariffs on US LNG in the short term and impact long-term LNG contract discussions/investments. Potential levers to replace US LNG are Qatari LNG and more Russian pipeline gas (for China),” S&P Global Commodity Insights said in a statement.”

Tough to compete with Qatar on LNG pricing. This has been evident for years to anyone bothering to pay attention to global LNG markets. Last year I posted this on Bluesky.

hat tip to @nickcunningham.bsky.social See if you can see why I've been saying Qatar will win the LNG wars and the US will lose bigly. "Analysts estimate Qatar's unit cost of LNG production to be as low as $0.3/mmBtu, versus $3-$5/mmBtu globally" www.reuters.com/business/ene...

— Justin Mikulka (@justinmikulka.bsky.social) February 29, 2024 at 3:03 PM

[image or embed]

So where does that leave us? The U.S. LNG market is in a bad spot economically and has a huge amount of new LNG export capacity coming online in the next 5 years. The rest of the world is realizing they don’t need as much as they thought so they plan to sell their excess contracted LNG to other countries (they are on the hook to buy the LNG even if they don't need it). The Australasian Centre for Corporate Responsibility did an analysis of Shell’s LNG forecast that includes a lot of great info. Look at this slide.

First up, look who Shell predicts will be the world’s biggest customer for LNG? Shell. Note the comment that about half of this forecasted demand is from traders who “have no intention of using the LNG.”

The world’s oil producers know they are in for trouble trying to make profits on oil and are painting a rosy picture for investors about how they will all just buy and sell LNG to each other even if there are no end users for the LNG. This will not end well for people hoping to make money in this business.

To support this myth they are actually calling the world’s largest oil field “a water and gas business with oil as a secondary product.” I expect that the mythology of lemmings and oil and gas investors will continue to share key traits. The 1958 Disney movie narration contained a line that really applies here.

"A kind of compulsion seizes each tiny rodent and, carried along by an unreasoning hysteria, each falls into step for a march that will take them to a strange destiny."

We may find that like lemmings, LNG investors also, “explode if they become sufficiently angry.” Their strange destiny awaits.

Comments ()