US LNG - Debts No Honest Man Could Pay

Before the epic U.S. housing and commercial real estate crash of 2008, bankers were applying innovative approaches to lending. One of their new products was the NINJA loan, which stood for “No Income, No Job, No Assets.” You might be thinking, “How could anyone be so dumb to loan someone money when it is obvious they have no way to pay it back?” That would be reasonable. But the people making the loans got their cut up front and did not care if they were ever repaid. It wasn’t their problem. If you have no ethics, America is a good place to get rich. Knowing that there is money to be made by the people making loans even if the loans are never paid back is a helpful thing to understand when looking at the continued expansion of the U.S. LNG industry.

With that in mind, let’s take a look at a recent quote in Natural Gas Intelligence (paywall) from a president of an LNG company.

“Not once did I get asked a question by a banker: ‘Hey, if I lend you the money, will you get paid back?’” he said. “The only question I ever got asked was, ‘Do you have a permit? Or can you get a permit?’”

Is this LNG executive telling the truth and bankers are uninterested in the details about getting their LNG loans repaid? It’s always a crapshoot with getting the truth from a fossil fuel CEO but in this instance I’m inclined to believe him as there are numerous projects being financed right now that have a very low likelihood of having the loans repaid.

In February I explained the obvious reasons why continued investments in U.S. LNG export projects will likely lose money in the piece titled, “Adventures in LNG Investing” where I reviewed the business model of the U.S. LNG exporter Venture Global and shared my take that, “Any idiots who invest in this deserve to lose everything.” That stock debuted at $24 a share and now is around $7 which means the company is valued at around $18 billion – which is a much smaller number than the amount of debt they need to pay back. Did the CEO get fired for destroying so much of their investor’s money? Not at all. He is a multi-billionaire and will remain that way even if the company goes bankrupt. If you get paid up front, you don’t worry about having to pay back your debt (Disclaimer: this option only available for people with no ethics). If you think this is unusual, you may enjoy my article from 2018 titled, “Flip This Well: How Fracking Company CEOs Get Rich While Losing Billions.”

There are many problems with the Venture Global business model but most of those seem to be getting priced into the stock price these days. What isn’t priced in is the market realities of U.S. LNG exporters due to the massive global LNG supply glut (See this piece for more information on the specific challenges facing Venture Global).

Nick Cunningham at Gas Outlook just published a great overview of those market realities and how the LNG glut will hit U.S. exporters first and hardest as this quote highlights.

“In a cyclical downturn for global gas, falling prices will amplify specific risks to the US LNG sector."

So the idea is that if global gas prices go lower than the U.S. LNG market is in trouble.

In November of 2024 European natural gas prices (TTF) were around $14/MMBtu. This November they were around $10/MMBtu. That’s a pretty big drop and might be cause for concern if it were to continue down. Meanwhile, Natural Gas Intelligence reported that Goldman Sachs analysts now are estimating TTF could fall to around $4/MMBtu in 2028 and 2029. The math isn’t hard on how this will destroy the economics of the U.S. LNG export industry. Goldman Sachs bases this projection on the massive coming oversupply of LNG which leads to the question that is the title of Cunningham’s article: Where will all the new LNG go?

As I’ve explained, LNG is economically uncompetitive with various alternatives that are actively drinking its milkshake. This article on China’s falling LNG demand explains that, “Gas-fired power plants are facing intense competition from coal and rapidly expanding renewables such as solar and wind.” Ten years ago it was reasonable to assume LNG would be needed to provide power to global markets and potentially power fleets of LNG-powered trucks. In those ten years the economics of power production and transportation have been radically changed and the economics of LNG no longer work for those applications. This screen capture of news search results from two articles this year basically tells the whole story (note the bit about how “other fuels become more attractive).

In March I wrote a piece in response to the optimistic outlooks for India LNG demand that explains why it was highly unlikely India would double its LNG imports by 2030. With only a month left in 2025, it is a safe bet that India will import less LNG than it did in 2024. Meanwhile, none of the facts you just read are mentioned in the slick new video from Shell on why LNG has such a bright future in India. In the video they also do not address the question raised by Gas Outlook, “Where will all the new LNG go?” or why anyone would pay for expensive LNG when there are other more attractive fuels. The oil and gas industry has a long history of using slick video marketing to mislead people. It’s not surprising they would try this bit of deception again. However, it’s a lot easier to lie to people about science and climate change than it is to lie to them about the price of energy (see: Trump and his ilk lying to Americans about inflation and the price of gas and Americans not buying it).

The Goldilocks Window Has Closed

If Goldman Sachs is right and the LNG glut causes EU gas prices to head towards $4/MMBtu for a couple of years there will be a lot of economic pain in the LNG world. However, that is an extreme forecast and an outlier….for now. But that is not the only risk facing the U.S. LNG market. As I explained in this piece, as the U.S. exports more gas, it drives up the prices of domestic gas in the U.S. which also can make U.S. LNG exports economically uncompetitive with other global LNG suppliers (and coal and renewables). I used the term “Goldilocks Window” to describe how a lot of factors had to all line up perfectly to create future profits in U.S. LNG exports.

One factor that is critical is the price of domestic gas and I reported on one analysis that addressed that:

In January the Oxford Institute for Energy Studies released an analysis of the future LNG market. Their high cost assumption for HH pricing through 2050 is $4.62 where they say, “with Henry Hub at $4.62 per MMBTU in 2050, the margins are very tight, suggesting that a lot of U.S. LNG would simply be shut-in.” So what happens when it is $5 next year?

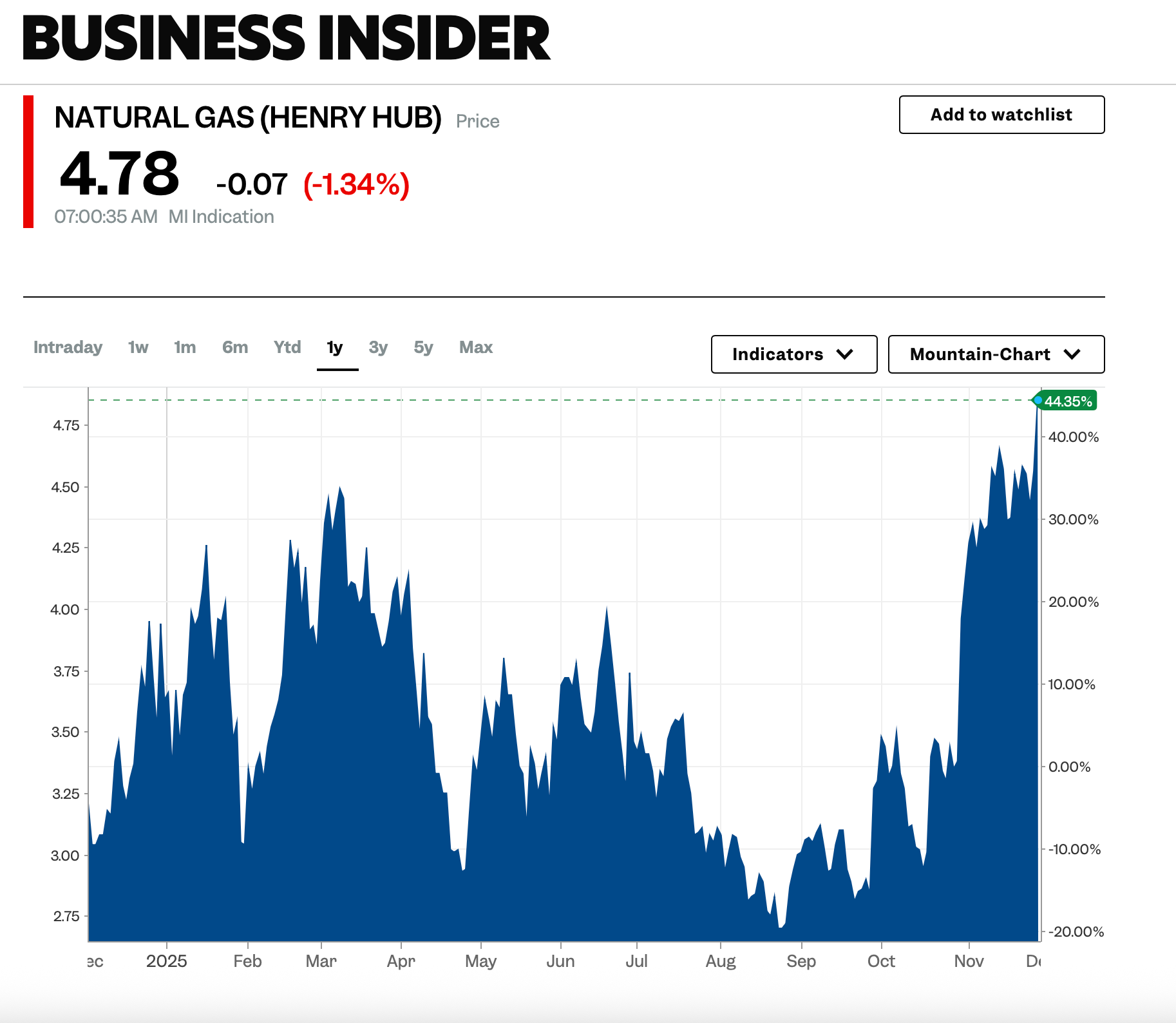

The explanations for why $5 pricing next year is likely are explained in that piece but the main point to understand is that if Henry Hub (U.S. domestic gas price) gets that high it causes big problems for the U.S. LNG export industry. That Oxford Institute analysis didn’t expect Henry Hub to reach those prices until 2050 but at the time I pointed out that they would likely be even higher by 2026 as LNG exports drive the price higher. Here is the price today.

The more gas the U.S. exports as LNG, the higher that price goes. And the U.S. is just beginning to ramp up its LNG exports in a big way which will drive the price higher. The low odds of the global LNG industry lining up perfectly so the U.S. producers could profit within the “Goldilocks Window” are looking very low right now.

Et Tu, Souki?

In 2019, when I first explained how the current scenario was a highly likely outcome, it was a great time to be an LNG CEO. Charif Souki was an LNG CEO then and a media darling and appeared on Mad Money with Jim Cramer talking big about the U.S. LNG industry and touting his new company Tellurian. I was never a believer and pointed out in 2021 that his company was in trouble when short sellers took notice of his company’s problems and in response Souki mocked them.

“Permits are nice. Contracts are better.” Remember in the beginning of this article where the banker was only worried if the LNG facilities had permits, not about how the loans would be paid back? Tellurian had permits. It never developed the project and the site was sold to Woodside in 2024. Souki and I have held fundamentally opposed positions on the future of U.S. LNG for quite some time which makes his recent switch to agreeing with me rather remarkable.

“Where 10 years ago, a global utility might have signed a contract because they were afraid of not receiving supply, that fear is gone,” Souki said. “The people who should be worried are the American producers who may not have a market for their gas if they don't have an international buyer. That’s how I see the LNG market evolving.” (emphasis added)

I like to keep things simple. Permits are required to build but international buyers are required for profits.*

*This statement is based on the general trend evident in human history that it is impossible to make money making products that no one wants to buy.

Additional recent noteworthy news

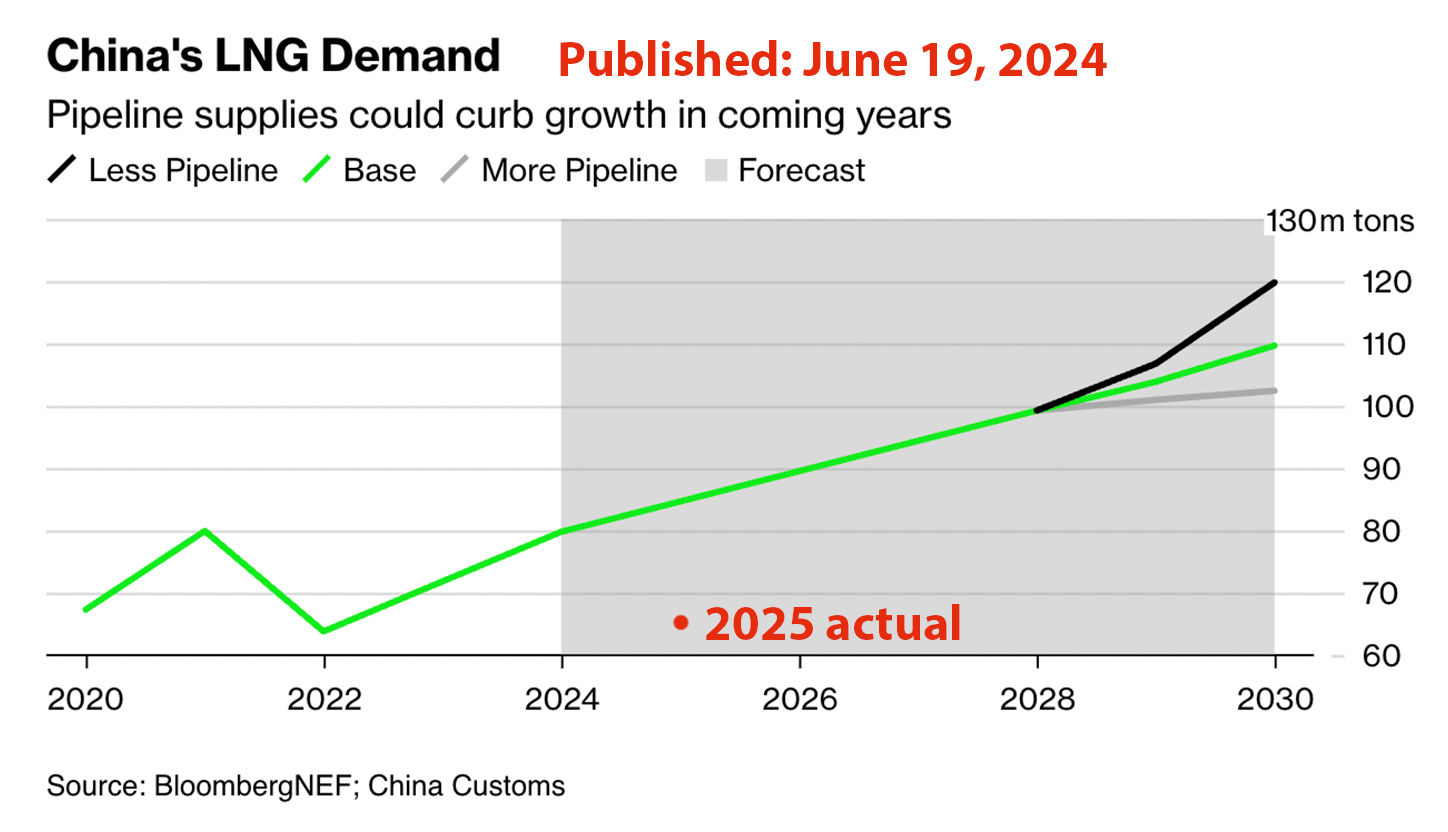

China LNG imports down again - China will be importing less LNG in 2025 than it did in 2024. And this new article mentions that, “The outlook for 2026 is also not encouraging: Overall gas demand is set to slump, suggesting it has decoupled with GDP growth, BNEF analysts said at a summit this week.”

I’ll be writing an end of the year piece on the twilight of U.S. shale oil. JP Morgan now says oil might go to the $30s. Seems like they are believers in the oversupply issue. Interestingly, none of the analysis on the coming oil glut is willing to talk about the obvious reason for the oil glut (demand destruction) which I covered in my last article. Since I published my article pointing out that a lot of people were underestimating oil demand destruction for various reasons including the rapid rise of electric trucks in China, there have been several new pieces noting how electrification of Chinese trucking is taking off much faster than anyone expected.

And finally there is this. Nigeria has a lot of oil and yet….Nigeria Bets Big on Renewables as Oil Troubles Deepen

Update: New numbers for China's actual 2025 demand on graph from last year of what BNEF expected. In 2022 BNEF had expected 100 million tons of LNG demand from China. Last year they were expecting around 85 million tons. Actual will be around 65 million tons.

Comments ()