Oil and Gas Industry Admits Blue Hydrogen is Too Expensive

In 2021, I wrote how the economics of blue hydrogen would not work in an article titled, “The ‘Big Lie’ of Blue Hydrogen Starts With Ignoring Basic Economics.” Blue hydrogen is the theoretical product where hydrogen is made from methane (natural gas) but the methane has very low emissions when produced and transported and then 95% or more of the carbon emissions produced while turning that methane into hydrogen are captured and permanently sequestered. This has never been done on a commercial scale despite multiple well-funded attempts.

It was clear in 2021 that the real role blue hydrogen would play would be as another oil and gas industry distraction and delay tactic that relied on everyone ignoring that it 1) wasn’t clean and 2) wasn’t possible due to the failure of carbon capture technology. In 2022, I wrote an op-ed for The Intercept noting again how the industry’s “pivot” to blue hydrogen strategy wasn’t going to work.

The industry maintained that they could achieve 98% carbon capture rates (Exxon claimed this in 2023) for blue hydrogen production and have continued to maintain the lie that U.S. natural gas production has low methane emissions. But now that draft regulations for clean hydrogen tax credits exist and companies like Exxon need to put up real money to back up their blue hydrogen claims — they are walking away.

Exxon now claims its Baytown project, that the company previously promised would produce blue hydrogen with 98% carbon capture rates, will be scrapped if the current regulations are finalized. For reference, no major carbon capture project has ever come close to even capturing 90% of emissions. If Exxon could build a carbon capture project that had 98% capture rates it would be a huge win for the fossil fuel industry. That they are choosing not to do so, is pretty indicative that they can’t do it, which is no surprise because many billions have been spent trying on past projects and none have come close.

Source: IEEFA

With Exxon threatening to walk away from blue hydrogen, expect more potential investors to give up on the charade of methane-based blue hydrogen being economically viable.

Last month Energy Intel reported that Nick Dell’Osso, CEO of Chesapeake Energy, one of the largest methane producers in the U.S., was not optimistic about the future of selling methane to potential blue hydrogen projects.

“I think there are some real benefits to [blue hydrogen], but I’m not convinced the economics are winning the day at the moment, and so I’m not sure how fast it’s going to grow,” Dell’Osso said. “The regulatory support for carbon capture is sketchy at best … which makes it very hard to form capital around it.”

Blue hydrogen will never be clean and attempts at carbon capture will always be expensive. Blue hydrogen was always just a ploy by the gas industry to find another use for natural gas (aka methane), a point the industry was quite clear about in a 2021 gas industry conference presentation which asked if hydrogen and carbon capture would "save the natural gas industry."

Image: Hydrogen and Carbon Capture: Will they save the natural gas industry?

Is it good news that Exxon isn’t going to build out more infrastructure to process methane for hydrogen? Yes. Does that mean they will now switch to clean green hydrogen made from renewable energy and water? No. Now that Exxon admits it is unlikely to invest in blue hydrogen, this development highlights two major problems with current U.S. clean hydrogen policy.

Blue Hydrogen Hubs

Four of the seven winning projects to get federal money to create “clean” hydrogen hubs include blue hydrogen projects. While the industry is being forced to admit that the economics of blue hydrogen don’t work, the U.S. government is approving projects to pursue blue hydrogen. Even though these projects are a long way from being funded, it certainly seems that now would be a good time to review if the money should be going to fund actual clean hydrogen production for use in areas like U.S. green steel production. If these blue hydrogen hubs go forward, I expect the results will be similar to the federal funded “clean coal” efforts” where the government funded eight projects, of which only one was ever fully operational, and then it was shut down in 2020 for “economic reasons.”

While some argue it's not the federal government’s job to pick winners when funding technology, it should be the government’s job to not fund known losers that are handouts to the fossil fuel industry.

All Carrot, No Stick Policy

The second big problem with current U.S. policy is that it is all based on carrots (incentives) and no sticks (penalties). The reason there is such enthusiasm for green hydrogen projects in the U.S. (outside of the oil and gas industry) is the generous financial incentives to make actual clean hydrogen. This will be quite effective at driving U.S. clean green hydrogen production but does not guarantee that the U.S. oil and fertilizer industries will stop making the approximately 10 million tons of dirty hydrogen (known as gray hydrogen) the industry now produces and which contributes significant carbon dioxide and methane emissions (global production of hydrogen currently produces 2% of the world’s CO2 emissions and significant methane emissions).

For example, Exxon saying it likely won’t move forward on blue hydrogen production to replace its current dirty gray hydrogen production does not mean that Exxon will move to green hydrogen instead. Exxon will simply keep making dirty gray hydrogen. There is nothing that will stop them from doing that.

I have been arguing for several years that the transition to clean energy is being driven by the favorable economics of clean technology and we are really lucky this is true. This is certainly one reason why the gas industry was talking about needing to be saved in 2021.

And it just keeps getting more favorable. Coal’s decline in the U.S. was driven in large part by the fact that it was more expensive than gas and renewables. Now the same thing is happening to gas development as renewables continue to deliver lower costs.

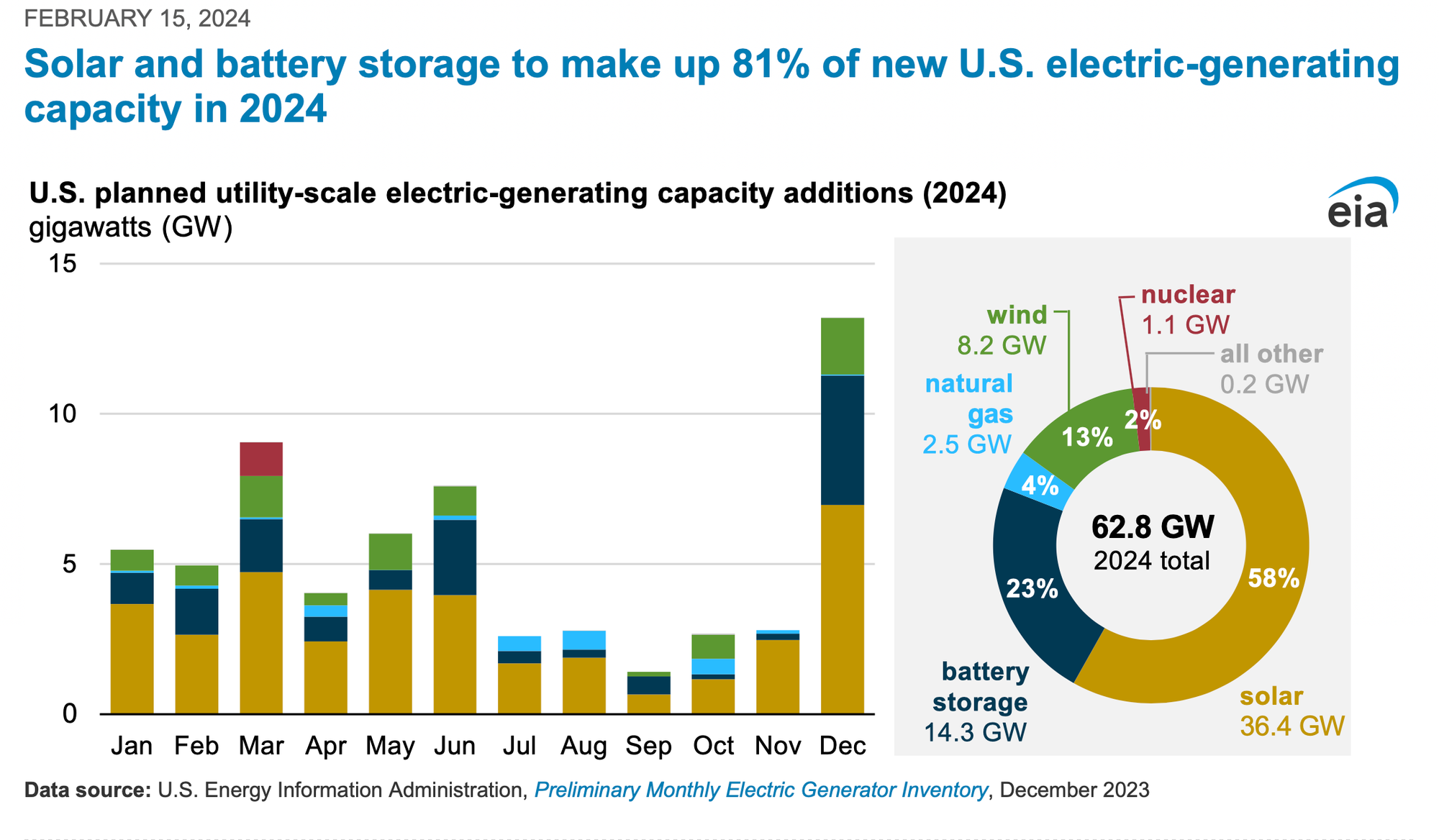

Source: Energy Information Administration

That said, in some applications fossil fuels are the cheapest solution. Especially when corporations like Exxon have already built the infrastructure. Exxon can keep making gray hydrogen with its existing facilities and it will likely be a smart economic move for Exxon, unless the U.S. changes its policies to include some sticks to change the equation. Without policies to phase out fossil fuel production and requirements to replace current dirty hydrogen with clean green hydrogen, we won’t succeed in meaningfully reducing fossil fuel emissions.

This weekend we saw a big article in CNN that reported how Toyota is actively working against electric vehicle adoption. The CEO of one of the leading steel companies in the U.S. is adamant that they will not stop using coal to make steel. And we see the U.S. oil industry doubling down on oil and gas production while blaming everyone else for the climate problems that are now so evident even oil CEOs can’t deny them. The fossil fuel CEOs clearly are comfortable with cooking the world with their products. We have tried giving them big piles of cash to choose clean alternatives. They are refusing. It seems obvious that the only thing that will succeed at this point are policies that force the rapid change needed.

I am writing this from the Denver Airport (home to Blucifer) on my way to the Permian region of Texas. I will be writing about that visit next week. These reporting efforts are currently reader supported, so any subscriptions help.

Comments ()