Mexico’s Plans for Natural Gas Dependence Will Harm Economy

Mexico’s increasing dependence on natural gas (methane) imports from the U.S. will lead to higher energy prices for Mexico while missing the opportunity to rapidly transition to solar plus storage.

- Mexico’s energy system is heavily reliant on imported U.S. natural gas, giving the U.S. incredible leverage over Mexico. The current situation in Cuba where the country is going dark due to the U.S. blocking oil imports is a clear example of what is possible for Mexico’s future due to its reliance on U.S. gas. Cuba is “living through near-constant power outages amid an economic crisis worsened by the Trump administration’s steps in recent weeks.”

- Despite wide-spread acknowledgement that this situation puts Mexico at risk, the Mexican government is planning to increase its dependency on U.S. gas imports and supports the building of LNG export terminals by U.S.-owned companies to export U.S. gas from Mexico.

- Mexico’s LNG plans are ill-timed as the world is facing a global LNG supply glut and LNG demand is declining in China which was the main market for the proposed LNG export terminals on Mexico’s Pacific coast. LNG projects on the U.S. Gulf coast are being cancelled and delayed. If projects to export Texas gas from the Gulf Coast don’t make sense, projects to export Texas gas from Mexico make even less sense.

- U.S. natural gas production will not be able to keep up with existing U.S domestic gas demand, Mexican gas demand, U.S. LNG export gas demand and the new wave of gas-powered data center demand. This will drive natural gas prices higher in the U.S. and Mexican markets.

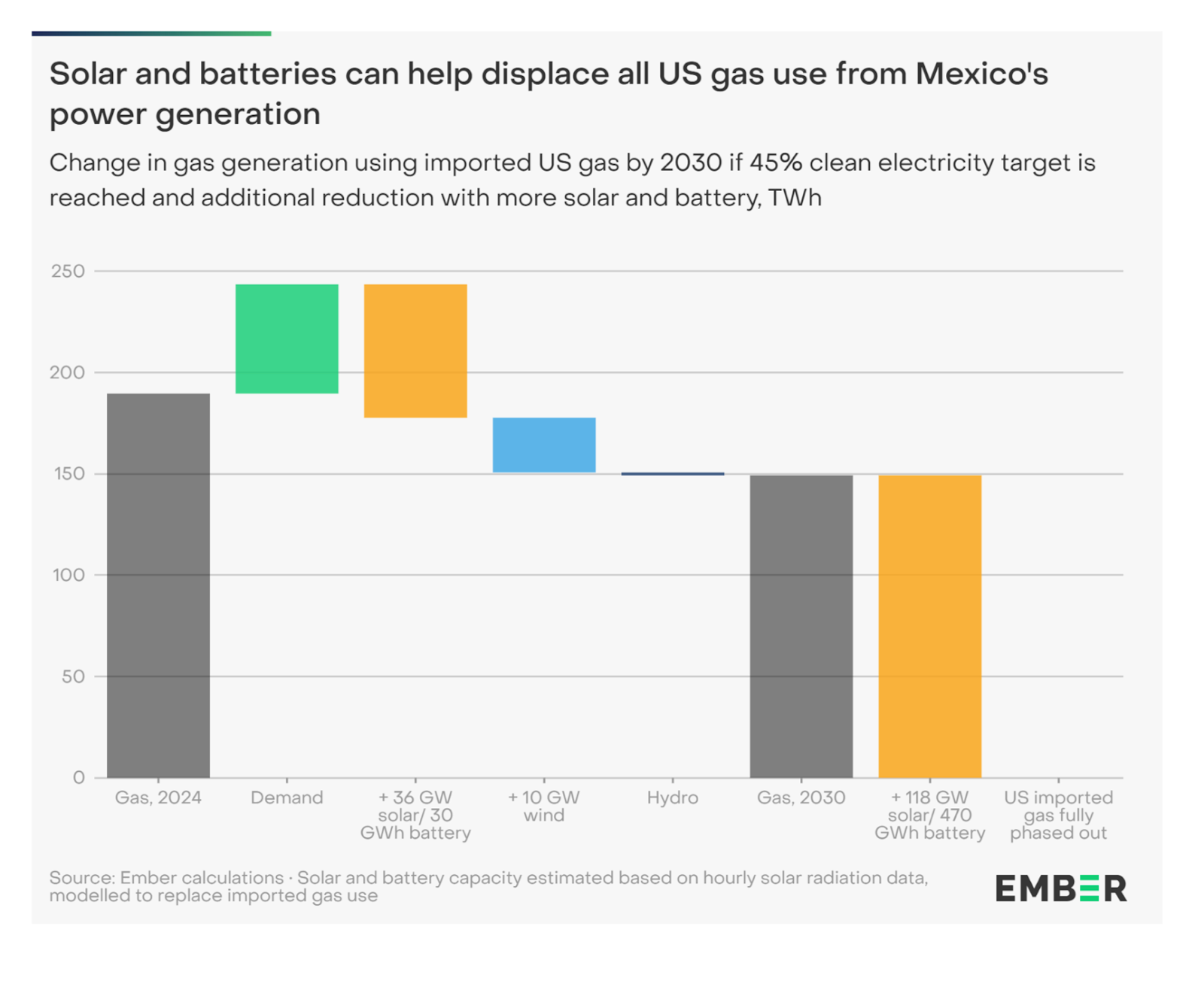

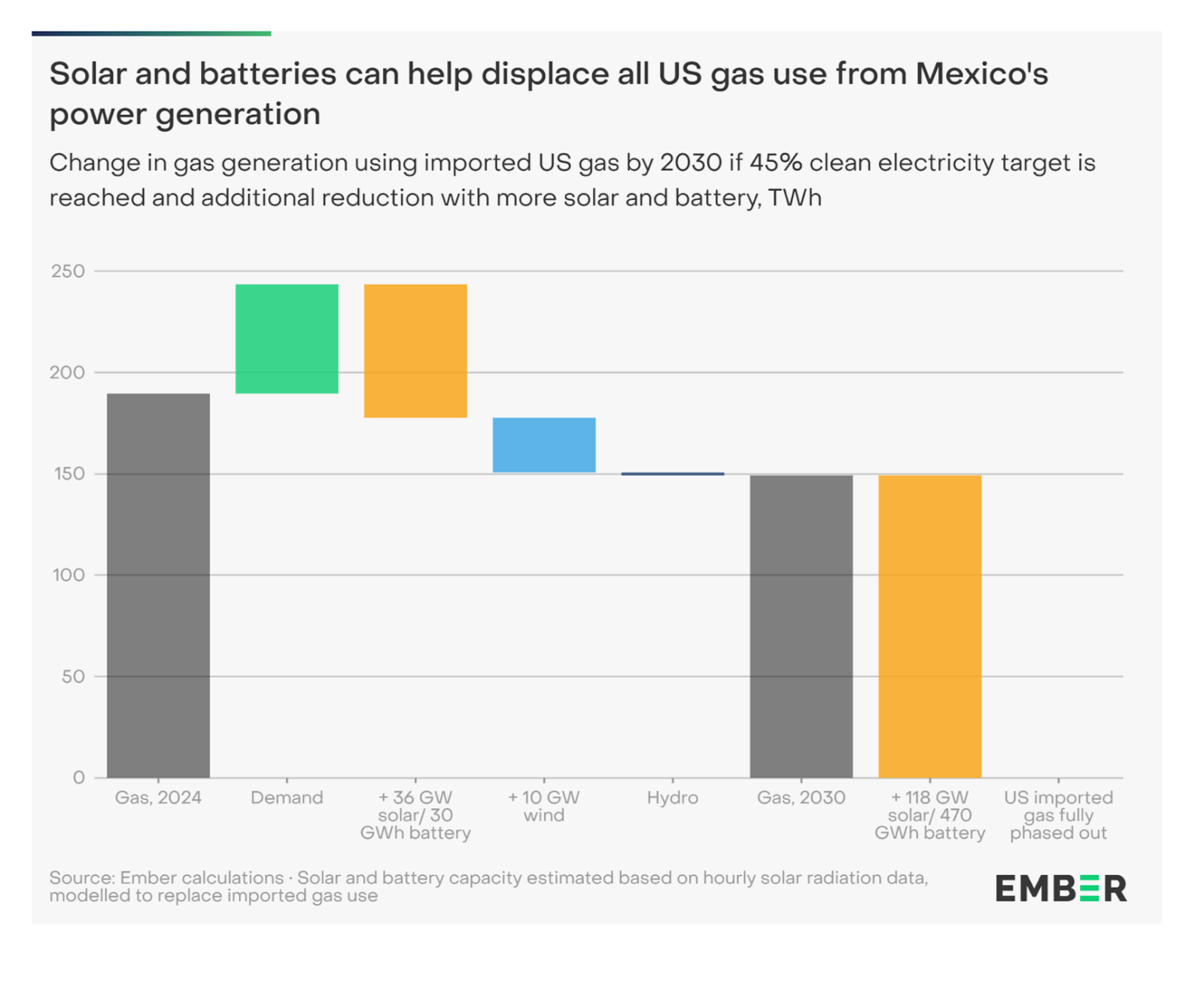

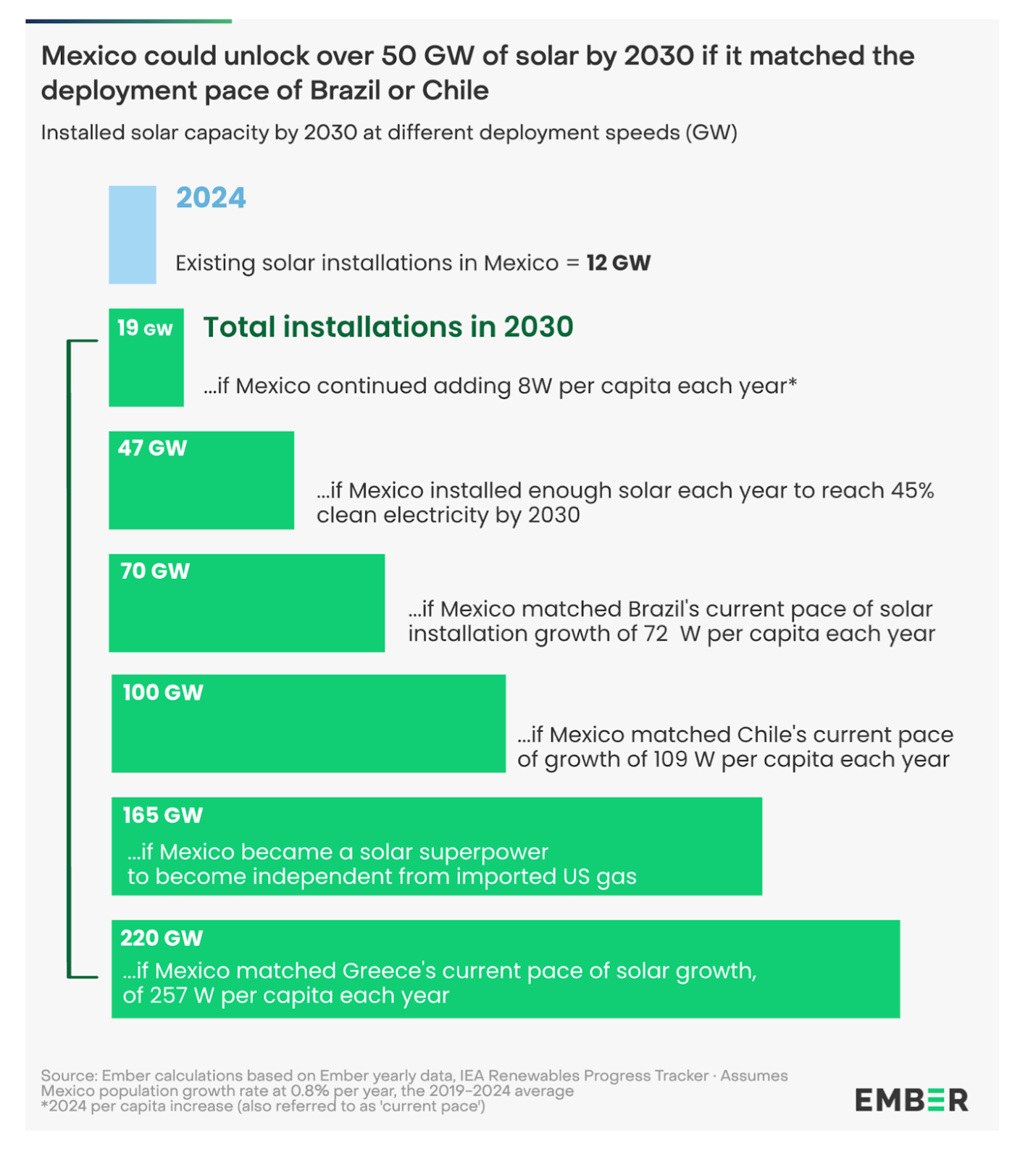

- Mexico has some of the best solar power potential in the world and research from Ember shows how Mexico could rapidly wean itself off of U.S. natural gas; increasing its energy and national security and lowering energy costs for the public and industry.

The Coming U.S. Natural Gas Shortage

U.S. natural gas demand from LNG exports, data centers, normal U.S. domestic use and Mexico is expected to be much higher than U.S. gas supply in the coming years which will drive prices higher for all users of U.S. gas. This month the Wall Street Journal published an article where a major fossil fuel company predicts “North American natural gas demand to increase by 45 billion cubic feet a day from 2025 to 2035, the equivalent of adding the entirety of the European gas market over 10 years.”

If the gap between supply and demand becomes too high, Mexico risks losing access to reliable gas supply, which happened during Winter Storm Uri with serious consequences for Mexico.

Mexican president Claudia Sheinbaum is promoting projects that would import U.S. gas to Mexico where it would then be exported as liquefied natural gas (LNG). These projects benefit U.S. gas companies and foreign entities who finance and own the LNG export terminals while driving gas prices higher for the Mexican public and industry. Sheinbaum is also suggesting that to lessen Mexico’s dependence on imported U.S. natural gas, Mexico should explore the use of fracking in Mexico to increase Mexico’s domestic gas production.

Instead, as many countries are doing around the world, Mexico can shift to a less expensive and more secure energy strategy: Solar plus storage. Ember shows that Mexico has some of the best solar potential in the world

Source: Falling battery costs can unleash Mexico’s full solar potential and boost energy security

If Mexico continues on its current path, the future holds higher energy prices and potential chaos when the demand for gas for U.S. LNG exports and data centers takes priority over Mexico’s needs. As the following analysis will show, there simply is not enough gas to keep all of these players adequately supplied.

Mexico’s Dependence On US Natural Gas

It isn't hard to find energy analysts cautioning about how Mexico is in a risky position with its reliance on U.S. gas. S&P Global is an oil and gas-friendly publication and even they are reporting warnings about this reality.

“Mexico's brutal dependency on gas will not ease in the near future, but increase, said Rosanety Barrios, an independent consultant who served in the energy ministry under President Enrique Peña Nieto, who conducted a liberalization of the country's energy sector.”

Natural Gas Intelligence (NGI) is understandably another pro-gas publication but has people on staff who really understand gas markets. On a recent podcast, Christopher Lenton, NGI’s manager editor for Mexico, also highlighted these risks:

“....without US gas Mexico's lights basically go out and it has massive implications on its economy,” Lenton explained, “The pipeline exports to Mexico, if those were suddenly cut off, that could create some chaos.”

Mexican newspaper El País is also reporting on the problem.

“Mexico has doubled its natural gas imports from the United States over the past decade, with purchases reaching record levels as the country relies on its northern neighbour for over 70% of the critical industrial and electricity generation input, El País reported….High dependency on American purchases elevates the risk that the country is at the mercy of US weather contingencies and price fluctuations.”

(paywalled, Newsbase)

At the mercy of the U.S. and the weather? Two partners that could easily be described as erratic and unpredictable these days.

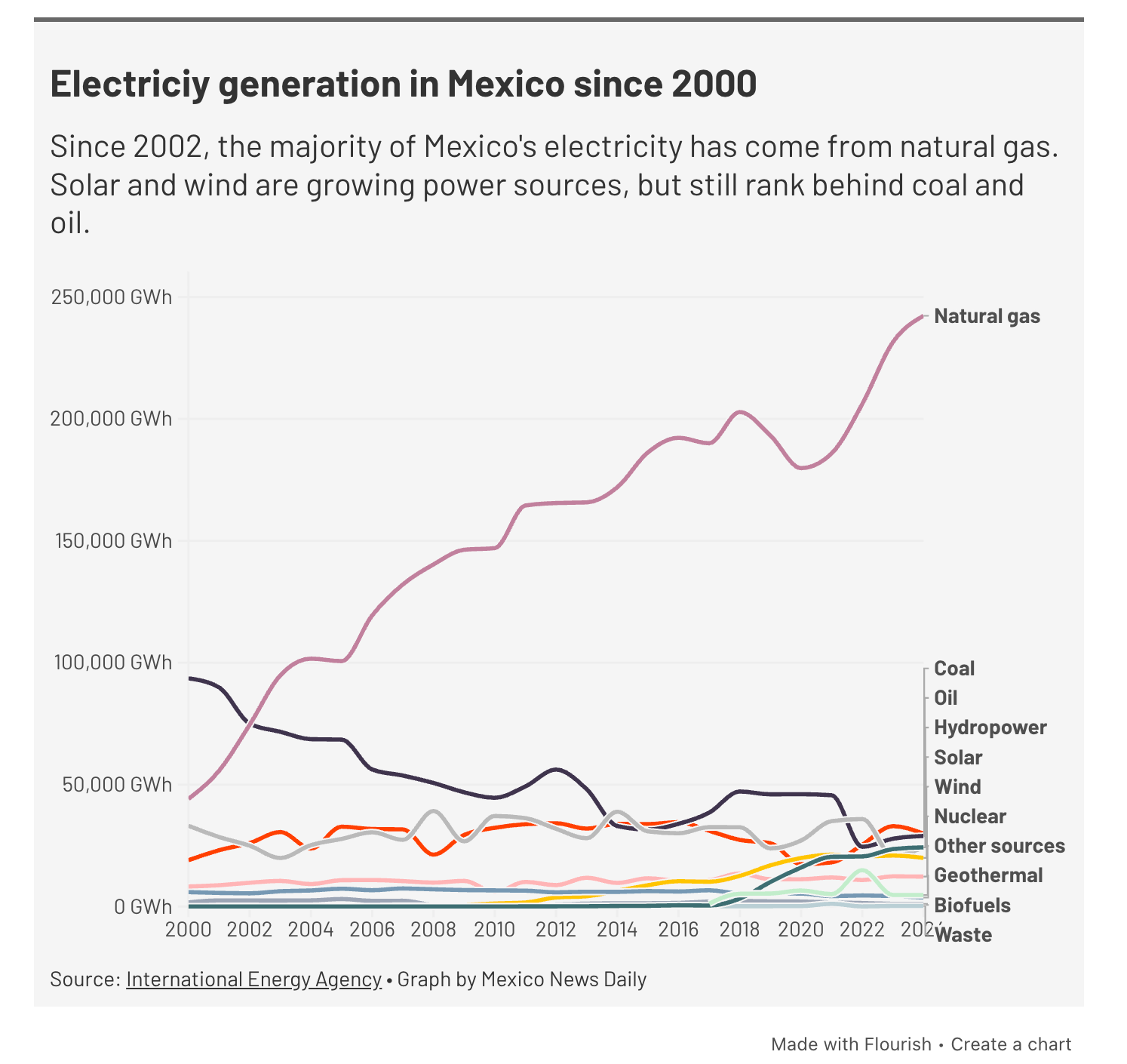

This graph from Mexico News Daily shows the extent of Mexico’s reliance on U.S. natural gas and should be driving rapid investment in solar and storage, not more gas investments.

Mexico has chosen to continue to increase its “brutal dependency” on imported U.S. natural gas. And yet now it appears the Mexican government and industry will push to become even more reliant on the U.S. for its energy.

Mexico Doubles Down on U.S. Gas Dependency

Many in Mexico are advocating to increase Mexico’s reliance on U.S. gas at a time where the unique energy and political realities are making other countries seriously reconsider this approach. In February an article in the fossil fuel-friendly Wall Street Journal advocated that Europe lessen its dependency on imported U.S. natural gas. If even the WSJ is suggesting overreliance on U.S. fossil fuel exports is a problem, it’s a problem. And yet they are still talking a different game in Mexico.

“Natural gas is going to be a solution to our problem,” Querétaro Energy Agency director Eduardo Martínez said at the 11th Mexican Infrastructure Projects Forum in Monterrey, Nuevo León in January 2026, as reported by Natural Gas Intelligence.

Fueled by the power sector, “natural gas demand is going to continue going up,” said Asociación Mexicana de Gas Natural (AMGN) President Alfredo Bejos. Natural Gas Intelligence reported, “He suggested demand would hit roughly 10–11 Bcf/d in 2030, from around 9 Bcf/d currently.”

“Narces de Carrera, CEO of Valia Energia SA de CV, said ‘the matrix in this country is and will continue being based on gas.’ She said it was a false debate between renewables and natural gas.”

When the oil and gas industry has such a captive consumer as they have in Mexico, they want to increase dependency. This is good for the U.S. natural gas industry as Mexico is one of their biggest customers and increased dependency means higher gas prices for the industry which means higher profits. However, the potential for Mexico to pay dearly for future gas or have supply cut off is a unique problem for Mexico. While Mexico produces some gas, the majority of the gas produced in Mexico is used by Pemex, the Mexican state-owned oil company and thus the economy of Mexico is highly dependent on the continued import of U.S. natural gas.

President Sheinbaum Supports LNG exports

When Mark Carney was elected in Canada there was a lot of excitement about having someone who understood climate change in the top job. And yet he very quickly embraced fossil fuel expansion including making new LNG export terminals a priority. Sheinbaum was also celebrated as a “climate-scientist turned president” but much like with Carney, since she was elected she has been a champion of fossil fuel expansion, including back tracking on her campaign promise to not allow fracking.

Caption: Like with Carney, the public was told they elected a climate champion.

Natural Gas Intelligence recently reported on President Sheinbaum’s efforts to promote a new LNG export terminal that would import gas from the U.S. and then export that to China – which is the opposite of what a climate scientist should be doing. Dr. Robert Howarth, a global leader in estimating the climate impacts of U.S. LNG exports says that based on his research LNG is worse than coal.

“Sheinbaum told local press that permitting on the 7.8 million ton/year Mexican floating export facility would be complete within a month, and that construction on the project could begin by March.

‘The liquefaction plant is not only going to export to Asia but will also help us get natural gas to the south,’ the president said.”

“It’s a very important investment and work will start in the first half of the year,” she said.”

Sheinbaum is also open to the introduction of fracking to Mexico, although she is calling it “sustainable fracking.” In 2024 Sheinbaum pledged that her government would not allow fracking.

Sheinbaum’s embrace of fossil fuels and fracking now means that while Canada and Mexico may be at odds with Trump and the U.S. over many things, all three of the leaders of North America are in full alignment on doubling down on fossil fuels.

It is very bad news for the global climate and it is economic Russian roulette for Mexico in particular.

Mexico’s LNG Export Fantasies

Exporting LNG will contribute to higher prices for U.S. and Mexican gas. However, Sheinbaum’s argument that there is a market for increased LNG exports to Asia has a serious flaw. China was the top LNG importer in Asia but lost that title in 2025 as their LNG imports declined significantly (12%) and are trending lower again in 2026. Any new LNG export terminals built in Mexico are likely to become costly stranded assets because the world is currently facing an LNG glut through the next decade and the promised LNG demand growth in China and India isn’t happening. It’s actually declining as renewable energy is far cheaper. Pakistan is another example of a country that was supposed to be increasing LNG purchases but instead they are cancelling contracts to buy LNG as solar and batteries dominate new power generation making the expensive LNG imports unnecessary.

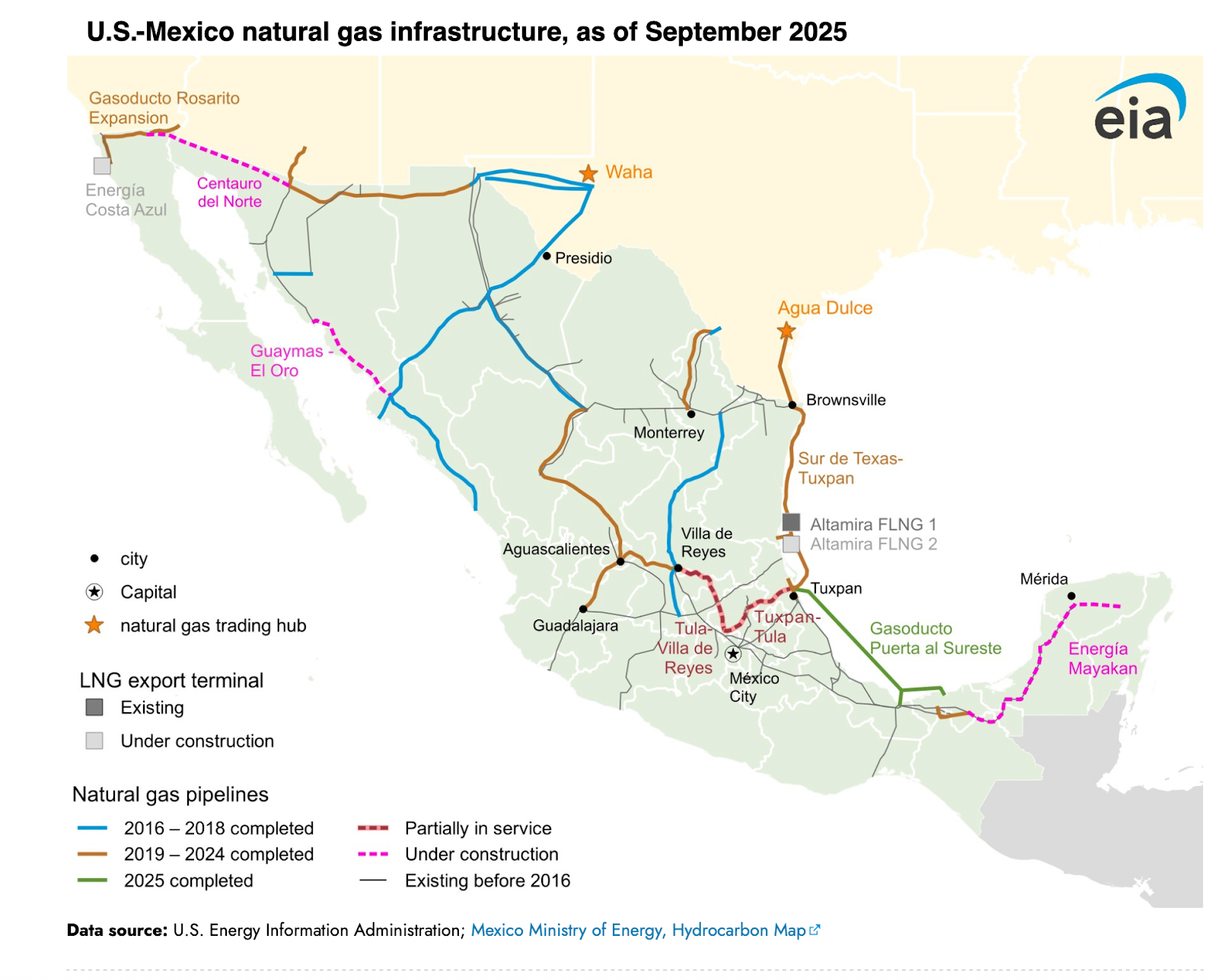

Last year Gas Outlook did an excellent overview of the plans for greatly expanding the Mexican LNG export market. In that article it mentioned that the massive Saguaro LNG export terminal being proposed by Mexico Pacific was losing momentum and noted how the CEO of Mexico Pacific expected to make a Final Investment Decision (FID) on moving forward on the terminal in early 2025. That didn’t happen, the CEO left the company and in June 2025, the Institute for Energy Economics and Finance summarized the many challenges facing the project. However, two Mexican LNG export facilities are expected to export LNG this year. The largest project is Energía Costa Azul (ECA) and is owned by U.S. company Sempra. According to Natural Gas Intelligence, “At capacity, ECA would add around 425 MMcf/d of feed gas demand from West Texas and New Mexico.”

In February 2026 Natural Gas Intelligence reported that “ECA had been expected to come online last year, but Sempra pushed the startup back to this year over labor and productivity issues. Sempra said in November it expects to produce first LNG at the terminal this spring.”The other project, Altamira LNG, is also owned by a U.S. company — New Fortress Energy — that is potentially facing bankruptcy and financial restructuring. Natural Gas Intelligence reports that this facility is expected to need 230 MMcf/d of gas.

So the current Mexican LNG exports are not a huge amount of gas at roughly 650 MMcf/d. However, the other proposed facilities including Gato Negro (9 million metric tonnes per year MMtpa) and Saguro Energia/Mexico Pacific (15 million MMtpa) and Vista Pacifico (3 MMtpa) would require significantly larger volumes of gas. That works out to 3.6 billion cubic feet per day of gas. Roughly half of the volume Mexico imported from the U.S. in 2025. While these projects are unlikely to happen due to the decade long global LNG oversupply glut that is just beginning, if they did happen they would directly result in an increase in gas costs for everyone in Mexico.

As Gas Outlook pointed out:

“There’s a competition for molecules in Mexico,” Sergio Chapa, a senior LNG analyst at Poten & Partners, told Gas Outlook. “LNG exports are going have to compete with these other projects for those molecules, and for that pipeline capacity.”

Every molecule of LNG exported from the U.S. and Mexico raises the price of gas for the rest of the U.S. and Mexico.

Mexican Demand Plans

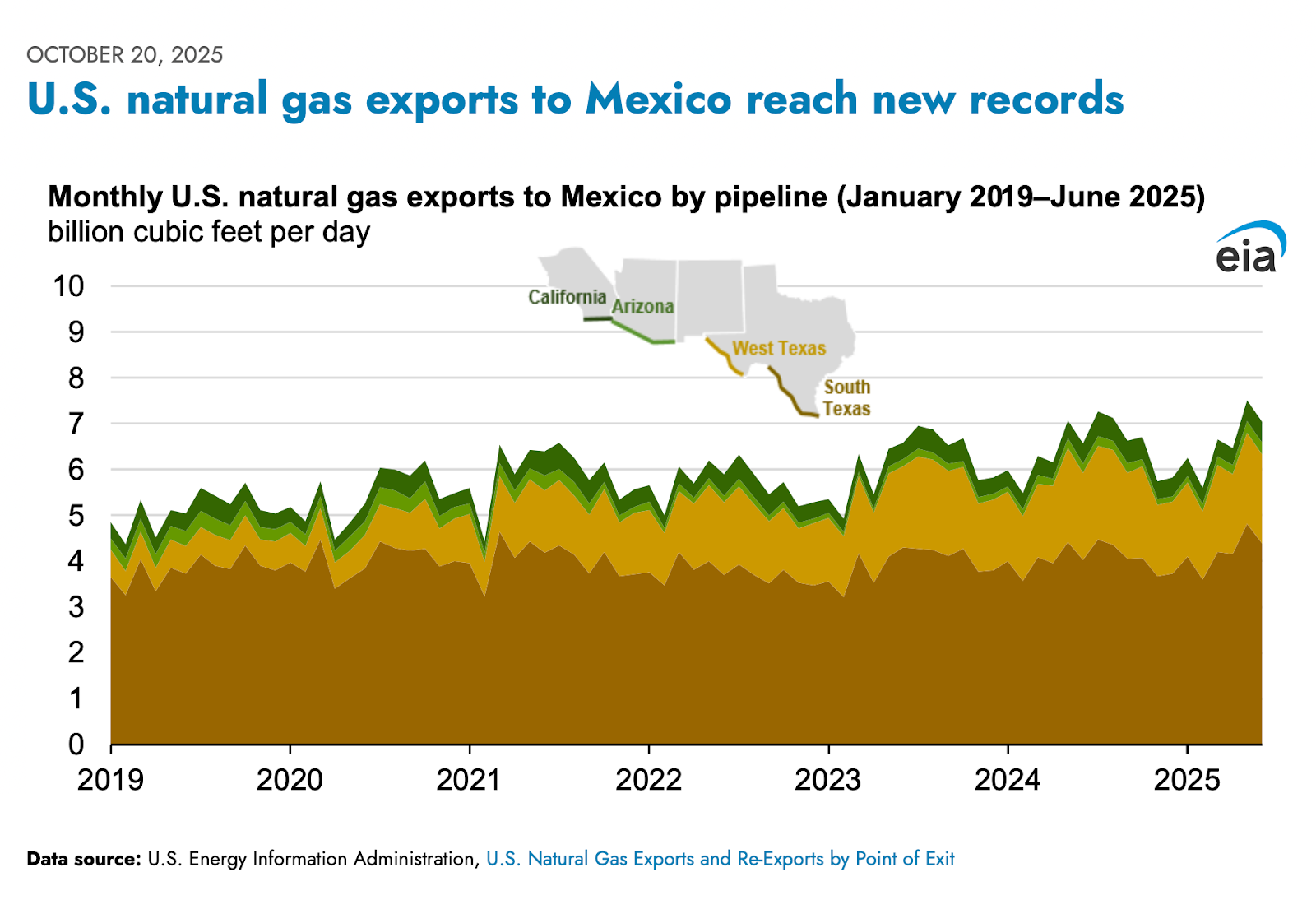

Mexico set a new record for gas imports from the U.S. in 2025 with slightly over 7 Bcf/d level for 2025. However, this was only a 2% increase from 2024 levels which was slower growth than during the big gas growth phase. According to Wood Mackenzie this represented 72% of Mexico’s gas consumption in 2025.

Mexico is planning to build 2.3 GW of new gas power capacity in 2026. There are also plans to almost double the capacity of the Waha-to-Guadalajara pipeline system (known as Wahalajara) which could add as much as 1 Bcf/d of pipeline capacity. In addition to the already existing LNG export facilities, it is likely that Mexico’s demand will increase significantly.

Source: EIA

S&P Global reported that Mexico “Pipeline imports averaged 6.4 Bcf/d in 2024 and are anticipated to reach 8.5 Bcf/d by 2030, increase to 9.5 Bcf/d by 2040, and conclude the outlook period at 11.3 Bcf/d in 2050.”

These aren’t big numbers overall and would not be overly concerning except for the fact that this is all dependent on U.S. gas and there is a lot of competition for that gas right now from the U.S. itself, U.S. LNG exports and the new potential demand from data centers. This is where the real risks lie for Mexico’s future. And they are huge risks that are becoming quite obvious in 2026.

US LNG Exports Will Drive US and Mexican Gas Prices Higher

There is a very real risk that due to the many buyers of U.S. gas that Mexico will see much higher gas prices but that isn’t the biggest risk.

Ira Joseph is a well known LNG analyst and his comments should be weighing on Sheinbaum’s mind these days. Joseph co-wrote a piece in 2023 titled “Lucrative Reward or Mounting Risk? Mexico’s Growing Reliance on US Gas” in which they highlighted potential risks to Mexico’s growing dependence on U.S.

Joseph said:

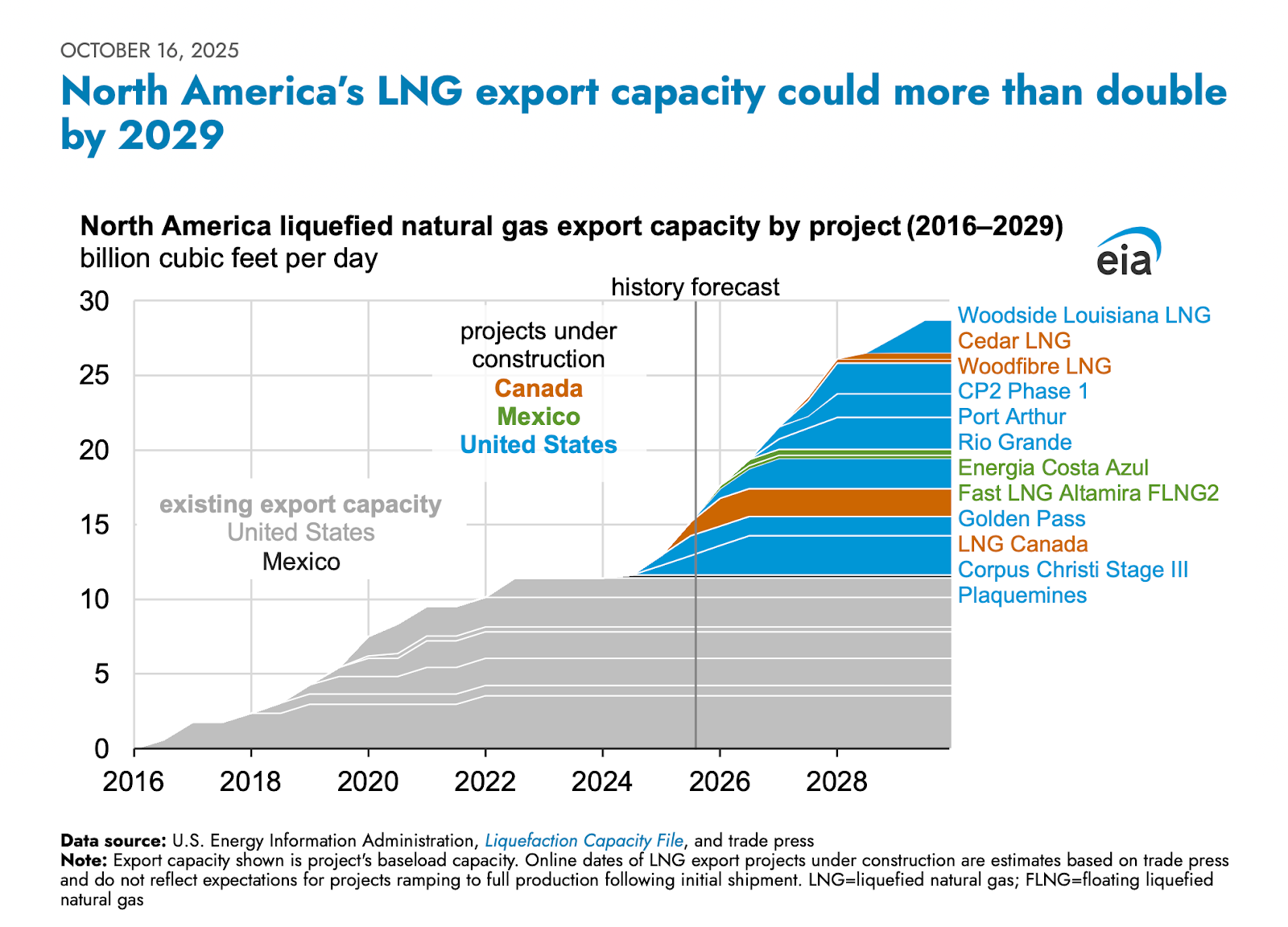

“By 2030, 25 percent of U.S. gas production is going to be exported to either Mexico or exported in the form of LNG. That’s huge”

“If more money can be made….selling LNG overseas, the LNG plants — whether they’re in the U.S. or Mexico — are going to get filled first.”

As Joseph points out, the gas will go where the most money can be made. If that means shorting Mexico to fill LNG demand, that is the most likely scenario. His 2023 article highlights an example of how this has worked in the past with the case of 2021’s Winter storm Uri which resulted in Texas Governor Greg Abbot stopping almost all gas exports to Mexico which meant “gas flows to Mexico dropped by around 90 percent to below 1 Bcf/d.”If Joseph is correct and LNG sales will take priority over gas exports to Mexico, Mexico should be very worried as U.S. LNG exports are going to want a lot more gas in the near future.

The Institute for Energy Economics and Financial Analysis released an analysis in March 2025 warning about the highly likely scenario that U.S. and Mexican gas prices were headed higher due to U.S. LNG exports. One of the main conclusions of that analysis was that:

“The Mexican LNG industry faces the potential for disruption by forces outside of Mexico’s control, including extreme weather as well as trade, regulatory, and legal decisions in the U.S.”

The potential impacts of this situation are bigger than just higher costs for Mexico. While many of the current forecasts for LNG export expansion and increased gas needs for power generation for data centers are aspirational and unlikely to all occur, even the lower estimates are big numbers.

“Taken together, U.S. LNG exports and U.S. gas exports to Mexico via pipeline, “you’re looking at 32 or 33 bcf of natural gas per day that’s being produced in the U.S. that goes to the export market by 2027 or 2028,” Christopher Lenton, senior editor for Mexico and Latin America at Natural Gas Intelligence…“That will be a serious driver of natural gas pricing and have direct implications in the market.”

It will. Combined LNG exports, Mexican exports and U.S. natural gas consumption are currently around 100 bcf per day. Increasing that number by 30% or more in five years will require a major increase in U.S. gas production.

In February 2026 RBN Energy estimated that by 2030, the market may require as much as 25% more gas than is produced today.

Wood MacKenzie released a report on LNG in early 2026 that stated, “growth in LNG supply and data centres in the US will boost local gas demand by almost 40% in the next 10 years.” This number was echoed in the recent WSJ article as well.

While estimates vary widely on what the actual demand for U.S. gas will be in the future, everyone agrees it will be much higher. Even if only the existing approved LNG export facilities are completed.

So the risks are real and easy to see when you have all the data. There are three big buyers of U.S. gas production right now and all three have plans for increases in the short term. However, of the three Mexico is the smallest driver of growth. Mexico will live or die by the prices set by the other two sources. U.S. domestic demand, expected to increase due to data centers, and the big LNG export boom that will take place over the next five years.

As history has shown and Ira Joseph warns, Mexico is last on the list for gas if the market gets tight.

U.S. Gas Production Can’t Keep Up with Expected Demand

One critical point in this discussion that is overlooked by the majority of the analysis is that it is highly unlikely the U.S. can supply all of this gas. I have previously explained how the U.S. does not have the capacity to produce 25-40% more gas in the next 10 years. The reality of the gap between expected demand and ability to meet that demand should be giving all investors in U.S. gas serious concerns but Mexico, due to its brutal dependence on U.S. gas, should be the most concerned.

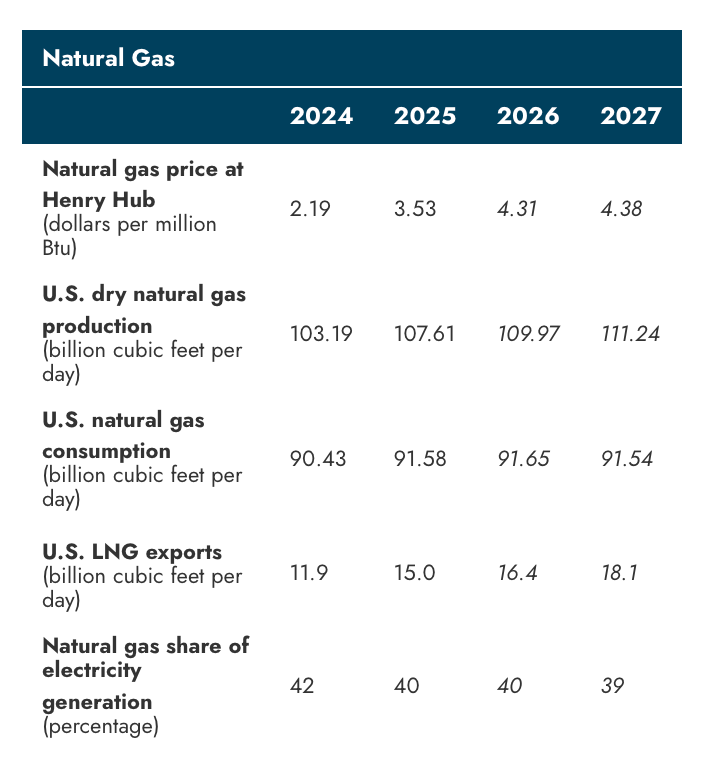

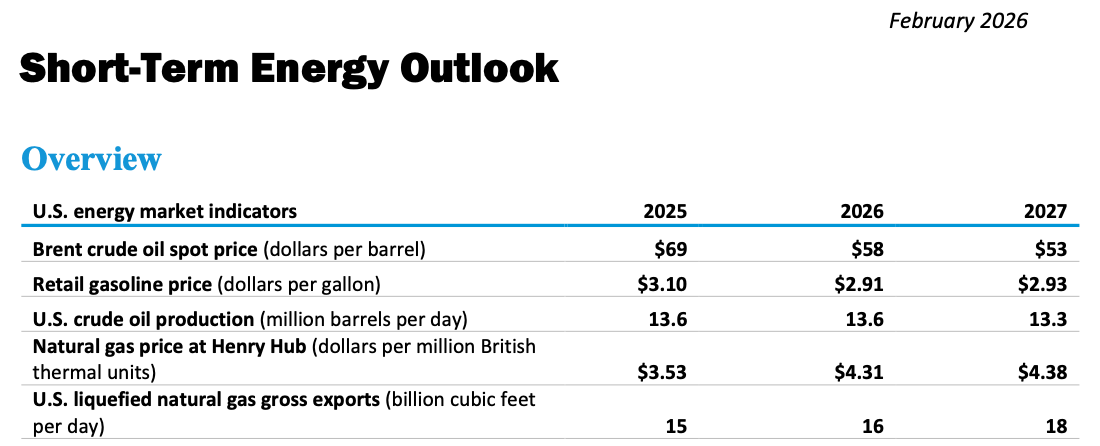

The Energy Information Administration (EIA) tracks U.S. natural gas production and these are their most recent estimates and comments. The EIA is known for its optimism around U.S. oil and gas production so these aren’t conservative estimates.

We see the EIA expects prices to go up quite a bit. Everyone agrees on this, the only debate is how high they will go. I expect they will be higher than the EIA does because of the wide gap between supply and demand that is already set in place with the LNG export terminals and increased exports to Mexico.The important number here is not price but supply. We are being told that demand from LNG exports could grow by 20-40 bcf/day in the next ten years, even by 2030 and yet despite everyone knowing this U.S. gas production is only predicted to increase by roughly 1 bcf/day from 2026 to 2027. If this doesn’t seem like it will be enough to meet demand consider this statement from the EIA.

“We now forecast the United States will produce 110 Bcf/d of dry natural gas this year and more than 111 Bcf/d next year. Both of those forecasts are more than 1 Bcf/d higher than in last month’s STEO.”

These are the most recently revised-up numbers. This is the optimistic outlook for production and it still doesn’t come close to meeting expected demand.

The Associated Gas Problem

Robert Rapier is an oil industry veteran including being Editor-in-Chief of Shale Magazine so it is fair to say he supports the oil industry. Even he is raising the alarm about a situation I and others have been warning about for some time. Much of the boom in U.S. gas production is from “associated gas” which comes out of oil wells so if the amount of oil production goes down it likely ends the role of associated gas as production driver of U.S. natural gas. Rapier points out that:

“The U.S. natural gas market relies heavily on associated gas production from oil wells. Currently, about 25% of U.S. natural gas production comes from fracked oil wells in the Permian (20%), Bakken (3%), and Eagle Ford (5.5%) basins.”

He then notes the risk:

“Unlike conventional gas fields, where production declines slowly, fracked wells see rapid declines after just a few years.”

This is just one more example of the “speed of shale.” It’s great on the way up but brutal on the way down. And guess where U.S. shale oil production is headed? Down. Rapier explains what this could mean for U.S. gas production:

“If oil drilling slows due to falling global prices, U.S. natural gas production could drop sharply. If this coincides with increased domestic gas demand for power generation, LNG exports may face restrictions to protect U.S. energy security. A future administration could impose limits on LNG exports rather than allowing market forces to dictate supply and demand.”

Now, if the U.S. decides to start limiting who can buy U.S. gas, where is Mexico in the line of buyers? At the front? Remember Ira Joseph predicted that was an unlikely outcome.

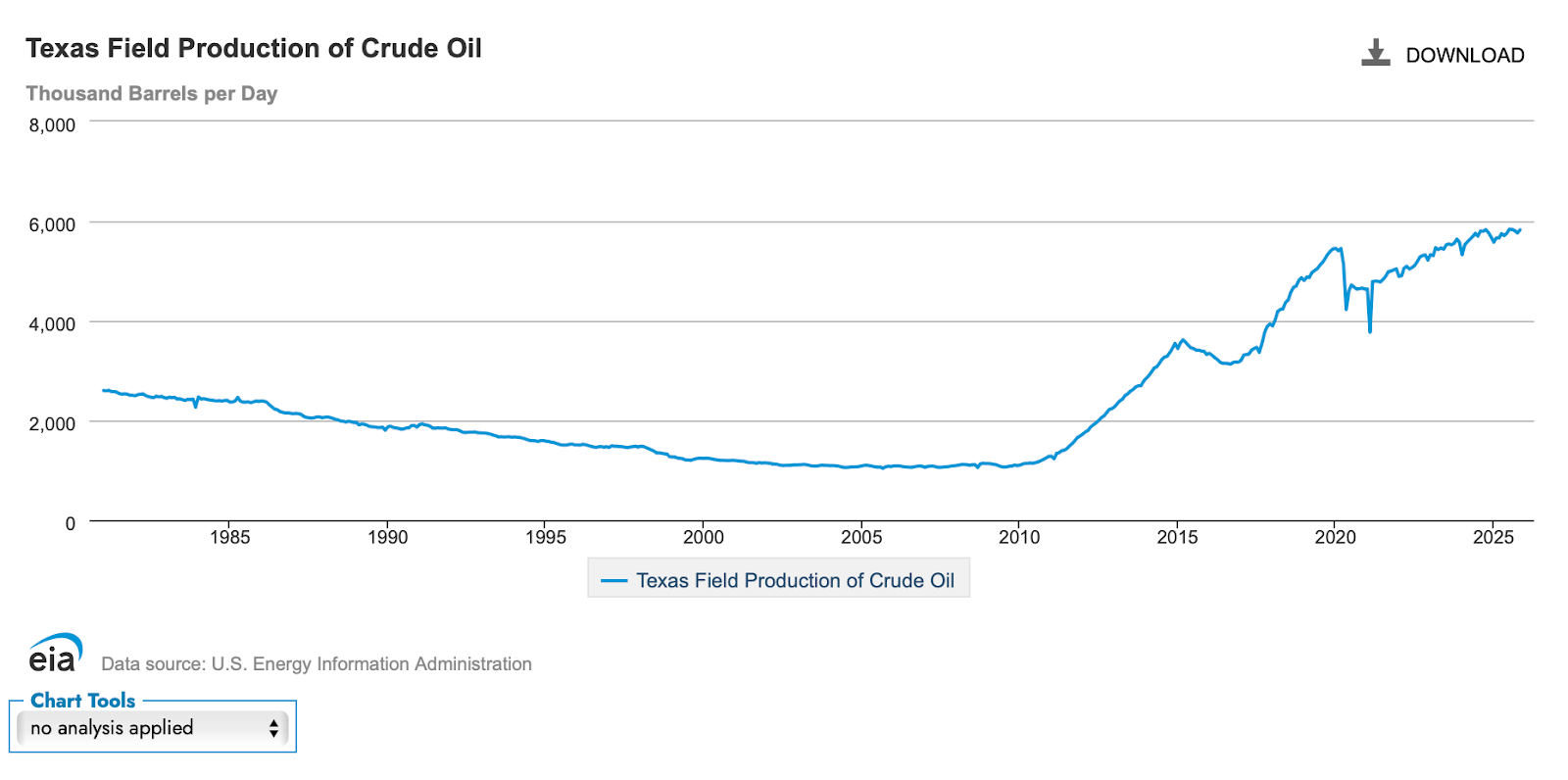

Rapier points out the potential risk to future gas production growth is linked to U.S. oil production. History will show that U.S. oil shale oil growth peaked in 2025. Which month it actually happened doesn’t really matter. Reuters reported that U.S. oil production peaked December, other data points to earlier peaks but the point that is most relevant is what Reuters concludes, “This monthly figure may never be topped, given that most of the Permian’s top-tier oil acreage has been tapped and sharply depleted after more than a decade of drilling.”

Remember that Rapier noted that 20% of U.S. gas production comes from just associated gas from the Permian oil production. And the Permian oil production has peaked. The Bakken peaked in 2020. Eagle Ford in 2019.

According to the EIA Texas oil production is looking pretty flat.

There are a lot of people getting paid a lot of money to influence investment and expectations for the U.S. oil and gas industry. There also are people with careers in oil and gas production in Texas who offer a different view but one I would suggest is worth more. Mike Shellman at Oilystuff is one of those people. He doesn’t charge for his advice, he just shares it. He predicts that the belief that associated gas production will support the volumes needed for U.S. LNG exports is wrong. He wrote this recently.

“Most of my colleagues working in the Permian Basin and elsewhere do not believe three quarters of these power plants and AI data centers in West Texas will ever be built. Maybe this one will, maybe not.

We all basically share the same belief: the associated gas potential of the Permian to fuel these power plants that will in turn provide energy for AI data centers has been grossly over exaggerated." (emphasis added)

I share this opinion. Shellman refers to a specific data center project in this comment. It is a proposed project in Texas that would require one billion cubic feet of gas per day. For one project. Meanwhile, the EIA only expects U.S. gas production to grow by that amount from 2026 to 2027. It’s also good to remember that this project alone would be using a volume of gas that would be highly significant to Mexico’s expansion plans.

The growth of associated gas with the oil fracking boom caused an oversupply of U.S. gas for the domestic market which led to the development of the U.S. LNG export industry to monetize this supply and increase U.S. gas prices. It worked. The problem is that the oil growth is over and that means so is the associated gas boom. The EIA’s latest forecast has U.S. oil production declining through 2027.

You might notice that while the oil production is declining in their forecasts, LNG exports are going up and so are U.S. gas prices.

Mexico Could Choose Solar

Knowing all of these risks it seems obvious Mexico should be developing policies to lessen dependence on the U.S. for natural gas imports. The good news is there is an obvious solution that is detailed by the energy think tank Ember. I recommend reading the whole report but this is the important point.

“Mexico has all the ingredients to be a solar powerhouse,” said Wilmar Suarez, Latin America energy analyst at Ember. “By harnessing its world-class solar resources and pairing them with increasingly affordable batteries, Mexico could power its future with homegrown clean energy instead of imported gas.”

All countries have challenges. It can be easy to point at renewable power success stories like China, Pakistan or Uruguay and say, “that isn’t possible elsewhere.” But look at the last bar on that graph above. If Mexico matched the solar installation pace of Greece it could be free of U.S. gas dependence. Greece. Notable economic stories out of Greece in the past decade have been about the country needing financial bailouts. If Greece can do it, why can’t Mexico?

When it comes to being able to harvest solar energy, Mexico won the lottery and is one of the best positioned countries in the world. And yet they are choosing to double down on gas. It is economic suicide.

Reports like this normally cost a few thousand dollars. I make it available for free and just ask for donations.

Comments ()