LNG Update: A Rising Tide Sinks All Boats

The world is waking up to the obvious when it comes to the global LNG glut and the havoc that it will wreak on the economics of U.S. LNG exports and the domestic gas market. What has been obvious for a long time can no longer be ignored. However, despite the mainstream financial analysts and media having to acknowledge that the LNG business model has problems, they are still pretending like this is a short-term issue and not a structural flaw in the U.S. LNG export model that will drive some LNG bankruptcies in the coming years. Here is an overview of the media reporting on how some people are waking up to reality.

The Tide is Turning

“I feel sorry for LNG projects in the US.”

Why would someone have empathy for LNG projects? Seems an odd thing to say…unless you are a commodities trader. That comment is from Richard Holtum the head of Trafigura, one of the big LNG trading houses as reported by Bloomberg in an article headlined with, “Trafigura CEO Says LNG Projects Need New Financing Playbook.”

Note: You know who commodities traders didn’t have empathy for? The people of Pakistan in the winter of 2022 when the traders took LNG that was headed to Pakistan and resold it for more money to Europe. You’ll probably find a mention of Trafigura in this article here

The article headline is “How Energy Traders Left a Country in the Cold."

It’s amusing how when someone like me goes to the bank for money and the bank looks at my credit and makes a decision, this is considered a simple financial calculation based on my income, assets and current debt. The much-beloved free market in action. Simple math based on risk, etc. However, as soon as that logic is applied to a business that affects the exceptionally rich, they say we need a new approach. I say, live by the markets, die by the markets. And yet they would call me a socialist! Watch what they do, not what they say. Remember when they invented new models to be able to loan money to people to buy houses who couldn’t afford to buy houses? How’d that go? The LNG industry doesn't need to update its financial models. It needs to find a way to make money on a long-term basis. Until then, expect trouble financing projects.

Some of the players in the U.S. LNG export industry have extraordinary levels of debt which is what will drive bankruptcies in the next decade of low global LNG prices while U.S. LNG feedgas prices climb higher. The reason no one will finance their projects is because it’s pretty obvious they are going to be money-losers.

Getting so Obvious The Big Boys Have to Comment

The big consulting and analytics firms don’t like to share bad news about their biggest clients so when they start to express some caution, it is notable. Now, they will never state the obvious because then investors would all head to the exits (as they should be doing) but they don’t want to be seen as completely missing major trends. So, they are commenting on the coming glut.

First up, McKinsey with their survey of market participants.

“About 60 percent of respondents expect prices to stabilize at $7 to $10 per one million British thermal units (MMBTU) by 2030.”

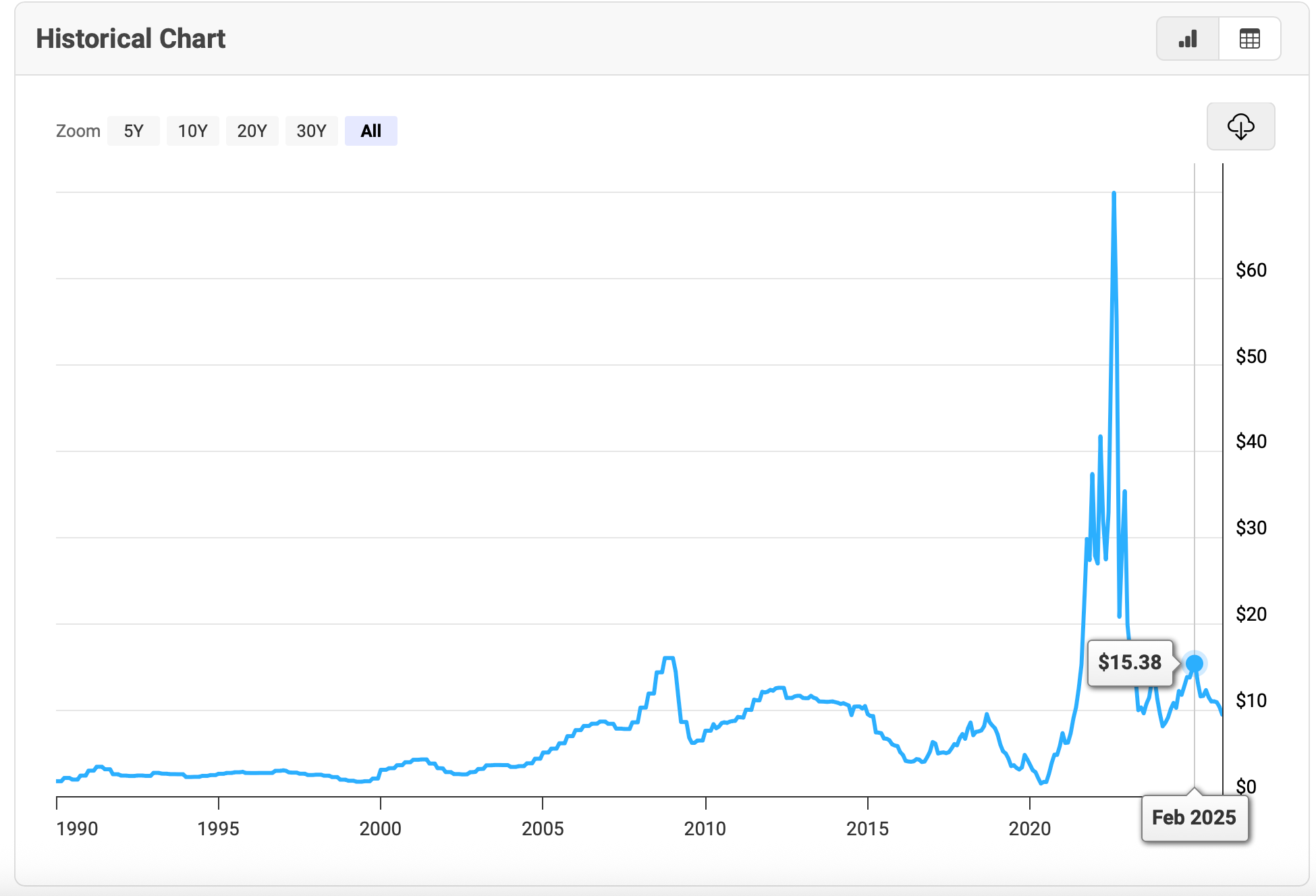

This makes sense. There is a massive oversupply baked into that time period. So prices will go down. No one can deny that. For reference here is the historical price chart for EU gas markets.

McKinsey then reports that “At these prices, latent demand would likely materialize, especially in Asia.”

Which also seems obvious, right? When prices go lower, demand should go up. If you are an LNG investor, this is the story you tell yourself but to do so you have to ignore the current global energy dominance of the much cheaper solar plus storage. So what McKinsey fails to mention is that LNG is competing with coal and renewables and while $7-$10 is in the range of pricing where U.S. LNG exporters lose money, it is still too high to compete with coal and renewables in the major Asian markets.

In late January the CEO of the top LNG importing company in India commented on what price would be needed for them to increase LNG imports.

“Prices would need to be between $6 to $7 per million British thermal units for consumption in the South Asian nation to increase significantly, Petronet LNG Ltd. Chief Executive Officer Akshay Kumar Singh said at the India Energy Week conference in Goa on Wednesday.”

So global LNG prices need to be below $7 for India to buy, a level at which no US LNG exporter can make money.

McKinsey has a similar comment on China,

“Chinese buyers—which demonstrate the greatest price sensitivity—report that they would switch from coal to LNG when the prices are equal, at around $8 per MMBTU.”

An important point to understand is that U.S. LNG is the highest cost in the world of the major producers and Qatar is the lowest. Can Qatar survive in a world of $7-$8 LNG? They can probably do ok. Can the US exporters? No.

I wrote this two years ago.

How low could LNG prices go? I included this bit from Goldman in a piece from December.

“Meanwhile, Natural Gas Intelligence reported that Goldman Sachs analysts now are estimating TTF (European gas pricing) could fall to around $4/MMBtu in 2028 and 2029.”

Remember those bankruptcies I mentioned that are on the horizon? At those prices you can bank on that.

Wood MacKenzie

Wood MacKenzie are optimists about oil and gas markets. They get paid a lot of money from the industry so this makes perfect sense. Their new analysis is titled, “The LNG lifeline: Will cheaper global gas resuscitate European industry?” I would have gone with a more comprehensive title “Will cheaper global gas resuscitate European industry at the expense of US industry?” but I don’t get paid by the oil and gas industry.

Wood Mac shares a prediction that even shocked me.

“growth in LNG supply and data centres in the US will boost local gas demand by almost 40% in the next 10 years lifting domestic Henry Hub prices to an average US$4.9/mmbtu in the 2030-2035 period ‒ 50% higher than the average price in 2025.”

40% increase in U.S. gas demand? That is insane. Why? Because, as I’ve explained before and will do in much more detail in another update soon, that amount of gas isn’t available from U.S. production. So, that ain’t happening. But perhaps Wood Mac doesn’t know that. Which is what helps explain their other prediction: that increasing U.S. gas demand by 40% will only raise Henry Hub prices to just under $5. Nope. Henry Hub prices will be well over $5 with a 40% increase in demand. They will be higher than $5 at a much lower increase in demand, which is the only increase that is possible due to geological constraints - the gas isn’t there. Everyone is pointing to the Haynesville formation to meet new supply. Haynesville requires $5 to breakeven but it’s likely closer to $6-7 for any sizeable increased in gas production. If you want more gas in the U.S. you will be paying at least $5.

Wood Mac then delivers a global LNG price forecast that should make every US LNG investor want to sell now.

“Benchmark European gas prices are forecast to fall to an average US$8/mmbtu in the 2030-2035 period.”

$8 through 2035? No U.S. LNG exporters can meet their debt payments at that price.

However, Wood Mac is correct. Lower gas prices will be great for industrial users in the EU who are too short-sighted to invest in getting the bulk of their electricity from renewables. But, just as that makes perfect sense, the higher prices coming in the U.S. are going to crush U.S. industrial users who are also too short-sighted to invest in getting the bulk of their electricity from renewables. Wood Mac touches on this.

“the Trump administration’s efforts to lure manufacturers to the US with a combination of lower energy costs, import tariffs and less red tape have rocked both European policy makers and industries. Falling European traded gas prices combined with rising domestic Henry Hub prices and electricity bills in the US could derail this goal.”

Natural Gas Intelligence weighed in on the Wood Mac report with the following:

“Effectively, U.S. LNG supply growth will come at a cost to U.S. consumers and benefit those in Europe,”

I guess we will have to wait and see how this plays out. Or not. From another recent Natural Gas Intelligence article.

“The head of the Industrial Energy Consumers of America (IECA) sent a letter to the U.S. Department of Energy on Wednesday warning that extreme cold and soaring electricity and natural gas prices are forcing manufacturers to shut down.”

This is all set in motion. The cake is baked. If the U.S. LNG export model somehow manages to export the amounts of gas it is contracted to export, it will drive domestic gas prices much higher and cripple U.S. industrial users reliant on gas (see also: Mexican industry reliant on U.S. gas). And all of the people in the U.S. who depend on gas for heat and electricity are going to be very angry. Remember when Trump promised he would cut their energy costs in half?

The Shell Sells LNG By the Sea Shore - Or Not

Shell is the company that likely has the biggest bet on LNG. The Shell analysis is used by many to justify the mind numbingly stupid continued investment in new LNG export capacity which is reported by the major financial press as if it is somehow fact-based.

So how is that going for Shell? Nick Cunningham does great work on the gas industry for Gas Outlook. His most recent piece is a must read. Nick has been reporting on the Vaca Muerta oil and gas field in Argentina longer than most and his latest piece provides an update on that situation with an interesting bit about Shell’s plans there.

“Given there has been significant change in the project scope, Shell will not be participating in the initial phase of the Argentina LNG project. Shell will continue to explore future expansion options at a later stage,” a spokesperson for Shell told Gas Outlook.

Watch what they do, not what they say. Could Shell finally be getting scared by reality? It would seem so as they are also reportedly trying to sell their equity stake in LNG Canada.

“Oil major Shell and Japanese conglomerate Mitsubishi Corp are exploring sale options for their respective stakes in the C$40 billion ($28.8 billion) LNG Canada project, three sources familiar with the matter told Reuters.”

I found this Financial Post headline amusing.

Are Shell, Mitsubishi trying to pull out of LNG Canada? Probably not, analysts say

I would have put a “some” in front of the “analysts say” in that headline. However, while the headline was amusing, the one quote in the article was a real laugher.

“One executive from a large oil and gas producer in Western Canada said the news is likely a positive signal for LNG Canada’s expansion.”

I bet they did!!

The U.S. LNG Export Business Model is Broken

The Qataris were brilliant to bribe Trump with a plane. Ok, maybe not brilliant. I guess it was more the boldness to think they could so brazenly bribe the U.S. president and get away with it. Qatar is like the Saudi Arabia of gas. Massive reserves and very low production costs. They are both positioned to be the “last producer standing” in their respective markets. And they both talk their book to such extremes it’s just comical.

At the big global LNG conference in Doha last week, Qatar Energy CEO Saad al-Kaabi said,

“If all this pans out, I think there will be a shortage, instead of an oversupply by 2030."

He knows he needs to keep people building new LNG infrastructure to try to lock in long term gas demand.

Meanwhile, the U.S. LNG industry needs this even more as it will break financially long before Qatar due to the economics of the U.S. LNG export model which simply doesn’t appear to have a way to make money for the next decade.

Can the U.S. LNG industry survive that decade and then rebound in 2035? No. Renewables and storage will be so cheap and dominant at that point it won't be a fair fight. LNG competes with renewables in power production. But it can’t now and it will have no chance in 2035.

I’ve covered the details of why the US LNG business model will not work here, here and here.

More people are apparently catching on to that as Richard Holtum of Trafigura pointed out:

“signing a 20-year contract or a 25-year contract that starts in 2030 is inherently problematic,” Holtum said. “And it doesn’t necessarily make a lot of sense to be doing that.”

It does not.

However, without those, he is going to have to continue to feel sorry for the U.S. LNG industry.

Donations welcome to support these efforts.

Comments ()