LNG - The Oil Industry’s Last Scam

Do you remember the “algae as oil” years? For a whole ten years we were subjected to this scam from the biggest oil companies. We learned about it in 2009 and at the time Exxon predicted “it could produce fuels in five to 10 years.” And then after four years Exxon said that it might take another 25 years. Other more optimistic algae-to-oil groups said they still expected “price-competitiveness with fossil fuels by 2020” but I’m sure you know how that went. Exxon quit the algae greenwashing scam a few years ago. But what delay!! And so much material for really green ads!!

Those were the good old days of being an oil and gas CEO. Just keep promising the public you were working on solutions to reduce emissions while even if your scam was legit, in the end it would mean BURNING HYDROCARBONS in vehicles. There are no climate solutions that involve combustion.

The New Price Competitiveness in the Energy Industry

The oil industry enjoyed a good century of not having any worries about a world that offered alternatives to their products that were economically viable. That gold standard of “price-competitiveness with fossil fuels” which was promised to us back in 2013 by the algae people was never considered possible. However, now it is. Not with bio-fuels made into hydrocarbons for combustion but with electricity made from solar and wind and stored in batteries — from grid scale batteries powering Texas and California to the EVs taking over the world auto markets.

The oil companies and their partners did and continue to do a great job at misleading the public about the reality of EVs. It works. However, the economics of EVs are now just too compelling. Price-competitiveness with fossil fuels was achieved and in much of the world, surpassed. The oil companies are in trouble as their customers are leaving and not coming back. They appear to realize this and are no longer talking about a future in which we grow plants to make oil to burn in internal combustion vehicles. The future is pretty clear at this point and vehicles will either be burning good old gasoline and diesel or they will be powered by batteries. The oil industry knows the days of delay are over for transportation and we now see oil demand in China decreasing. No one invests in oil companies if they aren’t growing and oil demand will not be growing. So they moved on from selling their algae fantasies to telling the world an even bigger lie: that natural gas is clean. Natural gas is methane. It is a super-pollutant causing rapid warming due to it being over 80 times more powerful than carbon dioxide as a greenhouse gas. Right at the top of the list of the things we need to do to address the rapidly warming climate is to decrease methane emissions. As I’ve written, the idea that methane is some sort of climate solution is insane.

But the politicians and the media who all benefit from the status quo are happy to repeat this insanity. And all got on board with this effort to save the future of the oil and gas industry by getting the world hooked on methane. Let’s take a look at some of those efforts and note how in this new world, the scams are still very much about delay but they don’t have the lifespans of good old algae. Why? Price competitiveness of alternatives.

Blue Hydrogen Made From Methane

In 2020, I’d been covering the oil and gas industry in some form since 2014 and realized that the sudden appearance of hydrogen as a climate solution being touted in many places simultaneously looked an awful lot like a major public relations effort. It was and I wrote about it in 2021 and concluded that piece with this:

“The world already has an affordable solution to swiftly decarbonize much of the economy now — solar and wind plus battery storage, which continue to grow on a massive scale globally. Meanwhile, the oil and gas industry is once again trying to disrupt the process, this time with methane-derived hydrogen.”

In my hydrogen research I came across this slide where they admit the gas [methane] industry needed saving and suggested hydrogen was one path to do that.

In 2022 I wrote an op-ed in The Intercept about “Oil and Gas’s Pivot to Blue Hydrogen Is Falling Through.” In 2024 I wrote a piece titled,” Oil and Gas Industry Admits Blue Hydrogen is Too Expensive”. This month Exxon admitted that they are likely not going to build their massive blue hydrogen project because the economics don’t work. Blue hydrogen would be made from methane but as I explained in those articles, blue hydrogen is vapor ware. So while the algae scam went on for well over a decade, blue hydrogen only lasted five years as a scam. I’m confident it will continue on in some form but the ideas we were told of hydrogen being used to heat homes and to be burned in power plants are so uneconomic that they will never scale. One more example of how combustion is a dead-end from an economic standpoint.

Carbon Capture

As the slide noted, one of the industry’s other plans to “save gas” was carbon capture. It still is but does anyone take it seriously anymore in the power industry? No. Why? It takes expensive gas power and makes it much more expensive while still producing a lot of emissions. Remember in 2021 when we were promised carbon capture to produce low-carbon liquefied natural gas (LNG) for the Rio Grande LNG terminal in Texas? It only took that three years to be scrapped.

Carbon capture on gas and coal power plants doesn’t work and certainly is not a climate solution. And it is also very expensive. So the industry clearly thought hydrogen and carbon capture could be the way to save the gas industry. But they aren’t. What to do?

The Industry Goes Big on Its Last Scam - LNG

The rapid development of the U.S. LNG industry was driven in large part by the bad economics of gas production in the U.S. after the shale boom. The U.S. was producing a lot more gas than it was using which cratered domestic gas prices. Much of the gas produced in the U.S. in the last decade has been sold for less than it cost to produce. Something had to change and LNG exports were the answer because they would drive supply shortages in the U.S and finally make the U.S. domestic gas industry profitable while also allowing LNG exporters to sell cheap U.S. gas to the rest of the world where the prices were much higher. It was a brilliant plan if you were in the oil and gas industry in the U.S. and really bad economic news if you were a person or company in the U.S. who uses electricity or gas. It’s also a blueprint for climate disaster but the industry needed this to survive so they got everyone to agree that LNG was a solution to climate change instead of one of the major causes.

LNG is worse for the climate than coal. And yet it is being sold to the public as a climate solution. That is a huge win for the industry and a big loss for the planet. The media is, for the most part, complicit in this lie – just like all of the previous ones. Large environmental and climate non-profits are supporting this lie with the ideas of methane certification and mitigation. It’s all hands on deck for the industry’s last hope to “save gas.” Meanwhile, the science is clear that if we save gas, we don’t save the planet.

However, unlike blue hydrogen which never moved beyond the press release stage for most projects, the industry bet big money on LNG and continues to rapidly build out more LNG capacity around the world. If they can get the world hooked on this form of methane, they know they have willing buyers for decades. Having the politicians and media tell everyone it is clean while this buildout is happening will be quite helpful. Perhaps we will get columns in the New York Times in 20 years from apologetic “environmentalists” who said they didn’t realize LNG wasn’t clean. It doesn’t look good for the future of the planet except for one thing...

LNG isn’t price competitive with anything. And we know real clean solutions were never adopted at scale when they were more expensive than dirty fossil fuel solutions. So can the oil and gas industry and its friends in the banking industry and its puppets in government and media get the world hooked on a very expensive and very dirty fossil fuel while telling the world it is actually a climate solution? It would be quite an achievement and with the financial outlook for oil sales looking pretty grim, it is necessary for the industry to be able to talk about growth to keep investors interested.

But it is unlikely to happen because the economics don’t work. This article in Oilprice.com is pretty fascinating. If I was shown this article back in 2020 it would have seemed impossible. Oil growth flat in China and all of Asia in 2025? Impossible.

But what would have seemed impossible in 2020 now is happening because the oil industry is losing the price war. However, look what slips into the article in Oilprice.

“Speaking of LNG, the outlook for gas demand in Asia is a lot brighter than the outlook for crude oil. There is virtually no forecast that sees gas demand getting destroyed by EVs.”

A lot brighter than oil… still isn’t that bright. And I will agree that there are no forecasts that see gas demand destroyed by EVs because…how would that even happen? The promise of Asian LNG demand is the current obvious grift from this industry of grifters. How is that going?

Japan has historically been the world’s largest importer of LNG but guess who is using less of it?

"The total amount of electricity generated from natural gas plants during January to June of 2025 was the lowest for that six-month period since at least 2019, as high natural gas prices stifled gas use in the country."

The economics of power generation from methane aren’t working in Japan due to “high natural gas prices.” LNG is not price competitive.

China recently took over from Japan as the world’s largest importer of LNG but this headline captures the current situation well.

And remember that Oilprice.com article talking about the bright outlook for LNG demand in Asia. This one came out from them a few days later.

So LNG imports are down in the top two importing countries. How about India?

Why is India using less gas?

“The share of gas in India's power generation has fallen to about 1.5% from 3% in 2020, as prices have hit $12 per million British thermal units and ranged between $8 and $18 over the last two years, meaning other forms of generation are much cheaper.”India’s neighbor Pakistan is now asking Qatar to delay its LNG shipments by years.

“Pakistan plans to ask Qatar to delay delivery of liquefied natural gas supply over the next five years as the South Asian country grapples with weak demand and mounting import costs.”

So on the demand side of things the global LNG business is looking a bit tepid. Which isn’t a real problem as long as there isn’t potential for new supply on the global LNG market but dear god is there a lot of new LNG supply on the way!! From a recent Ron Bousso column in Reuters.

"Global LNG capacity is set to increase from 550 billion cubic metres last year to 590 bcm this year and to 649 bcm in 2026, before reaching 890 bcm in 2030, according to LSEG estimates"

What might that mean for the U.S. LNG industry? Ron explains:

“Clearly, such a large supply-demand disparity will lead to curtailments in LNG production, with the United States likely to make the first cuts, given that producers there are more price-sensitive than in other regions.”

You get the point. LNG is the oil industry’s big plan to convince investors that the oil and gas industry is relevant. They must sell this idea because no one invests in an extractive industry with declining demand. The only reason to invest in an oil company is the dividend. For now, oil companies are borrowing money to pay their dividends and will need to either keep borrowing or cut their dividends until those theoretical sweet LNG profits start rolling in. If oil is flat and they don’t get their LNG dreams fulfilled, will banks stop loaning them money to pay investors?

Clark Williams Derry has been doing great analysis for years at IEEFA. A few weeks ago he pointed out something we don’t hear much about with the big oil majors. ExxonMobil and Chevron have tripled their net debt since the end of 2022…

Between the two firms, total debt minus unrestricted cash stood at $17B in Q4 2022. Now it's $50B.

$XOM has kept debt levels fairly stable but burned through $19B in cash reserves in just 5 quarters. $CVX's cash stockpiles are at their lowest level in decades, and the company is taking on debt to keep shareholder payouts flowing.

Something's got to give.

Indeed. Something’s got to give. Chevron and Exxon piled on this debt with pretty high oil prices. We are now getting predictions of $50 oil for 2026. That won’t help with the debt.

The oil industry mastered delay strategies. Oil from algae!! Hydrogen!! Carbon capture!! Lying about natural gas and LNG!!!

But we are now facing the future they always wanted for their products despite all of their public relations delay scams. Just simply burning oil and gas (and making plastic) and dumping all of the pollution into the world. And this appears how they will make their last stand. Burn oil and gas while continuing to lie to the world. There has been a lot of talk of methane regulations around LNG. The EU is talking about regulations that would essentially disqualify all U.S. LNG production. What is the CEO of Exxon’s opinion on regulating methane for US LNG?

“It is going to tangle them up in more bureaucratic red tape in Europe . . . and subject [companies] to bone-crushing penalties, so that’s a big issue that is yet to be addressed, and hopefully will as part of these [trade] negotiations.”

Actual regulations to reduce the huge level of methane emissions associated with U.S. LNG production would be “bone-crushing” to Exxon. The company piling up debt, facing lower-for-longer oil pricing and betting its future (along with the rest of the oil industry, on LNG).

So that is their offer. A future of unregulated global LNG trade to bail out a dying industry. Let them pollute or they can never make money. No algae or carbon capture or mythical clean methane-based hydrogen. Just unregulated production and combustion until the money is gone and they walk away and leave us with a hot climate and a hot mess of an environment with massive clean up costs.

We are all very lucky that the rise of renewables, low-cost storage and price competitive electric vehicles showed up when it did or this would be our likely future. The algae people got one thing right. The gold standard for innovation in energy is price-competetiveness. The oil industry hoped to control that path and own it. But they didn’t and don’t and now they are on the wrong end of that equation. LNG is not price-competitive. Do the math.

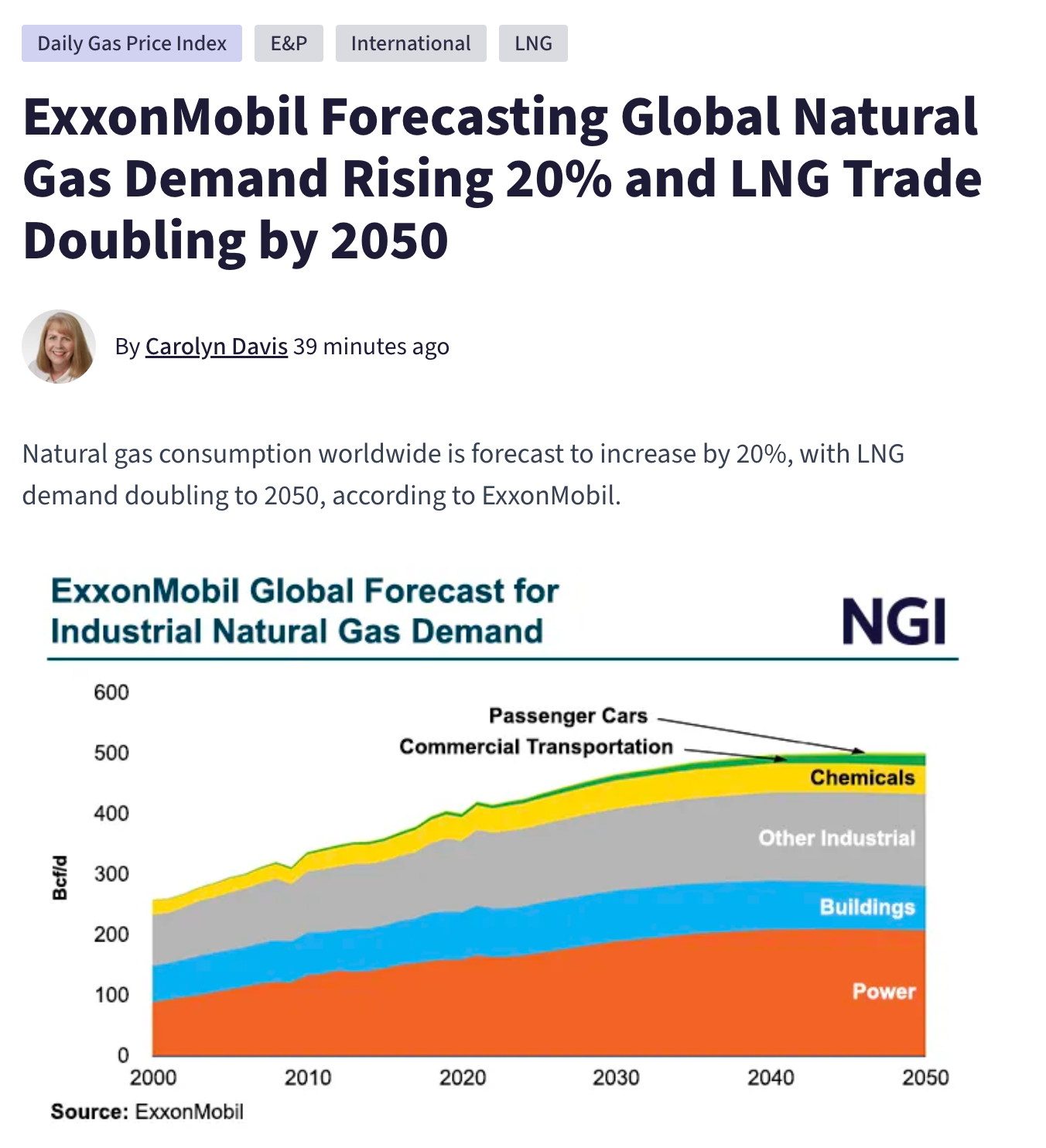

UPDATE: This article on Natural Gas Intelligence was published at almost the exact same time as the article you just read.

Comments ()