Lessons from the Bakken

The New York Times recently profiled Harold Hamm, Continental CEO Resources chairman emeritus, and noted how Hamm is advising Trump to go all in on fossil fuels. This should surprise no one as Harold Hamm is a one-trick pony. His one trick is making bold promises about the future of shale oil production in America, riding investor optimism to create huge personal wealth, and then moving on when his formerly optimistic predictions turn out to be about as accurate as Mark Zuckerberg’s plans for us all to live in the Metaverse.

As Hamm is now apparently helping define the disastrous U.S. energy policies that are handing actual energy dominance of the future to the Chinese, it’s a fine time to review his track record in this space. If we are going to go all in on a fossil fuel future in the U.S., it probably would be good to check if we have the fossil fuels to do that.

In 2011, Hamm was very optimistic about the future of the Bakken shale play in North Dakota saying it had 24 billion barrels of oil. For comparison, the world’s largest oil field is the Ghawar field in Saudi Arabia with a total estimated lifetime production capacity (including the future) of 80-100 billion barrels.

“Out of all the oil plays in the U.S., thereʼs just one Bakken,” Hamm says. “It towers above everything else.” This was before the Texas Permian boom had begun and the Bakken was the hot new oilfield in America and Hamm was promising big things for the future.

In a 2013 article in Bloomberg continental resources CEO Harold Hamm has upped his forecast for the Bakken by quite a bit and said the following:

“Harold Hamm, the chairman and CEO of Continental, estimated in 2010 that there were 24 billion barrels of recoverable oil in the Bakken and other formations underlying the Williston basin. Now, Hamm says improved technology could eventually boost that number to 45 billion: “We’re just getting started.”

When following the U.S. shale industry it’s good to pay attention to the ever-present huge promise of “improved technology” in the future. Hamm was not alone in his optimism about the future of the Bakken and the potential for technological gains.

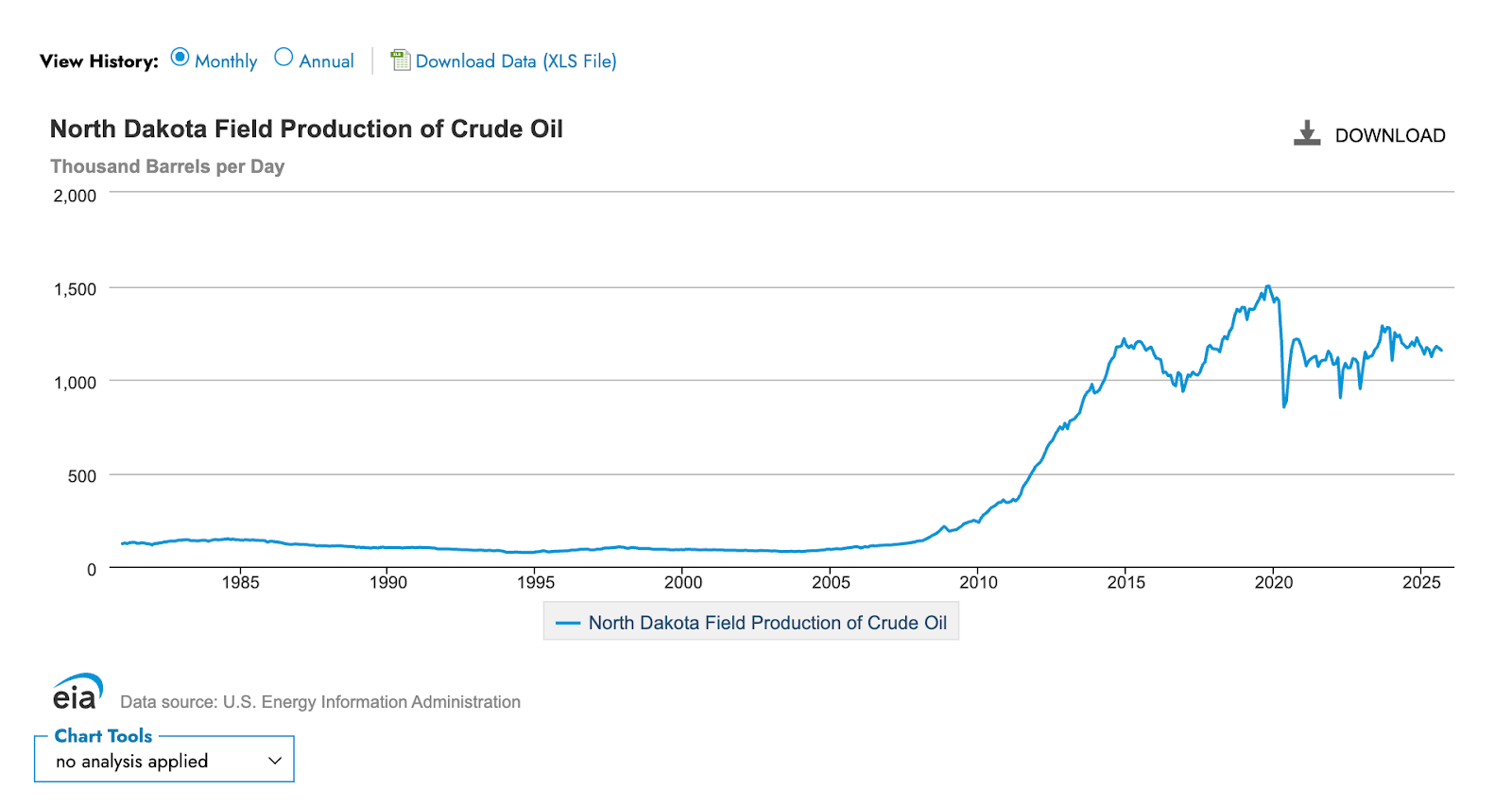

In April 2014, Bloomberg reported that according to industry consulting firm Wood MacKenzie “improved drilling techniques” meant that the Bakken shale formation would be producing 1.7 million barrels per day of oil by 2020.

In Septempber 2014 Bloomberg reported that “A boom in shale oil production that’s forecast to raise North Dakota’s output to 2 million barrels a day has boosted the number of rigs drilling for crude in the Williston Basin to the highest level in almost two years.”

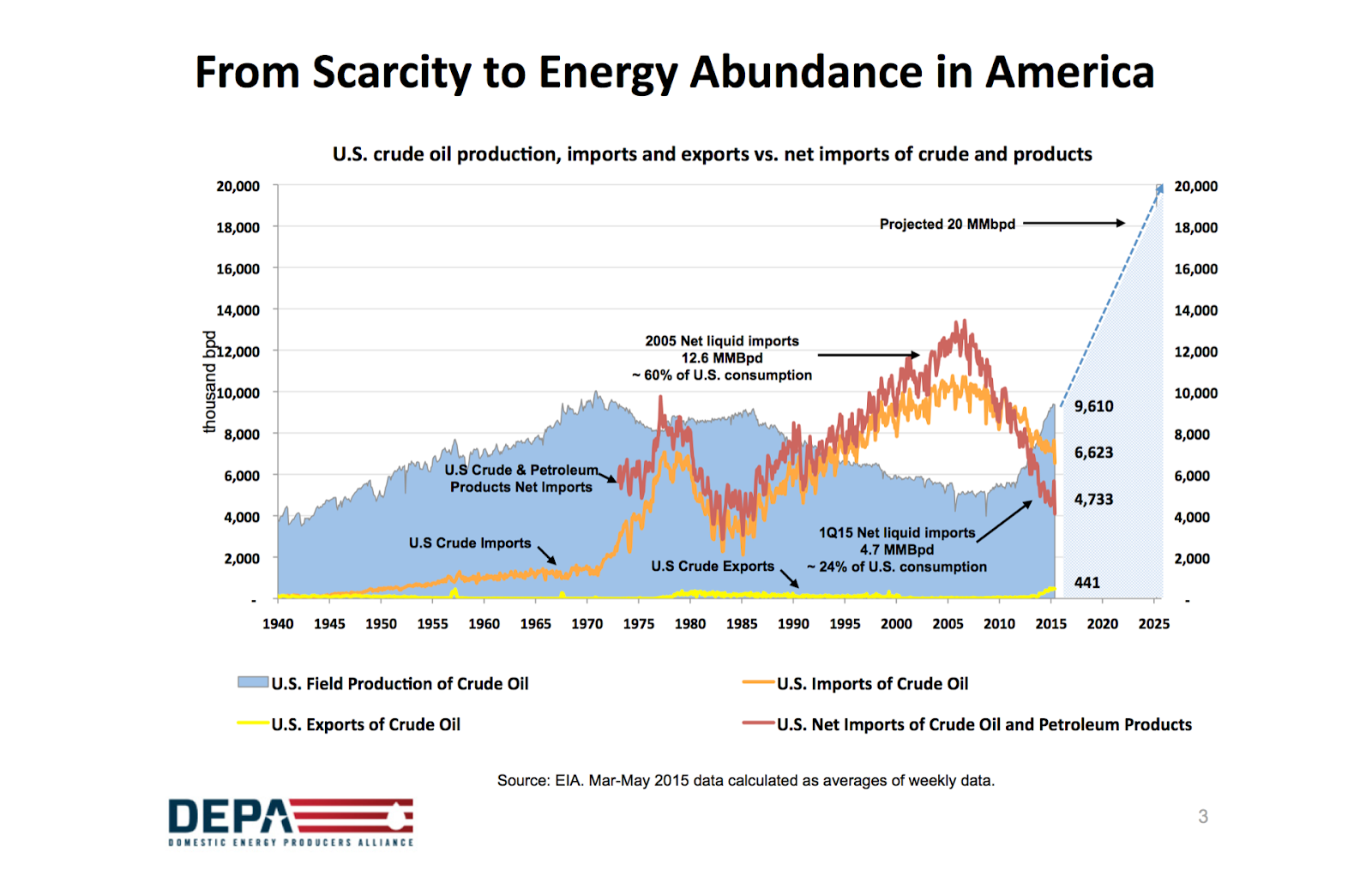

In 2015 while attending the annual Energy Information Administration conference in Washington D.C., I heard Hamm speak in person where he presented the following slide showing U.S. oil production at 20 million barrels per day in 2025 and where he may have staked his claim to being the first “abundance bro.” In reality, the U.S. produced under 14 million barrels per day of oil in 2025.

In 2018 Hamm said “Its [the Bakken’s] demise was overexaggerated. The Bakken is back stronger than ever.”

In 2020 I wrote a piece on how the Bakken oil production was peaking and what this would mean for the asset retirement obligations for the Bakken. In that piece I pointed out another aspect of the Bakken that was getting little attention. More than a decade after the Bakken boom started, North Dakota was flaring 23 percent of the methane gas produced via fracking — making a mockery of the state’s flaring regulations.

Harold Hamm, Bloomberg and many others talked a lot about technological innovation while the reality in the Bakken of North Dakota was that the industry was wasting almost a quarter of the natural gas being produced. For comparison, the target the European Union is currently using for its methane is 0.2%. Also for comparison, Iraq is flaring around 25% now.

In that article I also pointed out that the industry was creating radioactive waste which was not being properly handled.

“In 2016, a study from Duke University found ‘thousands of oil and gas industry wastewater spills in North Dakota have caused ‘widespread’ contamination from radioactive materials’”

To learn more about this issue, read Inside Climate News coverage of it in their ongoing series, “Fracking’s Forever Problem” and Justin Nobel’s excellent book Petroleum-238.

North Dakota and the Bakken will be dealing with the pollution from the fracking boom led by Harold Hamm for…ever. However, many North Dakotans certainly are willing to trade their clean air and water for massive oil wealth and Hamm promised just that.

In 2019 I wrote a piece on the Bakken that was titled, “Will the Fracking Revolution Peak Before Ever Making Money?” where I stated the following.

“Many signs are pointing to the fact that geology — how much oil and gas is present in the shale — will be the defining factor going forward for the U.S. fracking industry.”

For years I have argued that the U.S. shale industry has engaged in massive reserves fraud by promising that there are unlimited amounts of cheap oil and gas in the U.S. shale plays. I made this point again in 2024.

While CEOs are apparently allowed to just make up numbers that sound good to investors, as they say in the oil industry, “the rocks don’t lie.” You can pretend there is more profitable oil in the rocks than there is, but that doesn’t create more oil and eventually the truth is revealed.

In 2023 Hamm was once again talking up the promise of new tech to squeeze more oil out of the Bakken, just like he did in 2013 when he said that would lead to 48 billion recovered barrels of oil.

“Hamm’s endeavor is a sign of the optimism oil executives have that new technology can again be harnessed to wring crude from currently marginal sites.”

In 2023 he said, “The future is bright” and he also weighed in on the Permian when told some people weren’t as optimistic as he.

“Hamm quibbles with the estimates [for future Permian production], saying the Permian may not reach its high-water mark until 2035 and will see another 25% pop in production first.”

So how is all of that going?

How close is the Bakken to 48 billion barrels of production? It hit 5 billion in 2024 and is in serious decline

That 2 million barrels per day that was predicted? Never happened. Never will.

Source: EIA

What could be the problem? Well, apparently now Harold Hamm agrees with me on that as we enter 2026 (paywalled)

Hmm. Geology barriers. Interesting time to start acknowledging those. Recent research by the group Fieldnotes captured Hamm doing some more truth telling about the Bakken at a 2025 oil industry conference where he said the Bakken was “tapped out.” Does it seem reasonable that the New York Times should have included that fact in their recent profile of Hamm? The fact that the Bakken is “tapped out” after only producing 5 billion barrels of oil when Hamm promised 24-48 billion? Would it be good for Americans to know that this guy is now designing U.S. energy policy with new promises of endless cheap oil?

They still continue to talk about how with “technical advancements” the sky is the limit. Just like Hamm did when predicting 48 billion barrels of oil production from the Bakken over a decade ago. Two years ago I wrote a piece titled, “The U.S. Shale Oil Industry Asks You to Believe in Technology as Savior…Again.”

We will hear a lot more promises - technology, higher recovery percentages, magic proppants, etc, etc. Please review the Bakken chart above to see how that is going. The Bakken is five years past its peak production. Would it be even worse without technological advancements? Perhaps. Here is a stat that should tell you how things are going in the Bakken. The Dakota Access pipeline which was built to move Bakken oil is now being described as “pretty empty.”

“There’s a lot of spare capacity on that pipe — it’s flowing pretty empty,” said Gage Dwan, an energy analyst East Daley.

Apparently the pipeline operator (Energy Transfer) is now looking at using the pipeline to also move Canadian tar sands oil. That was quick.

I’ve yet to see one acknowledgement in the major financial press about how badly the Bakken performed compared to how it was sold. Why should this happen? Because the average American still thinks there is endless oil and gas in the U.S. shale. They are going to pay the price for the industry fraud in multiple ways. First, with higher electricity and heating prices as natural gas supplies become scarce. Secondly, they don’t realize how the current administration’s attempts to block renewable energy and electric vehicles in America is based on the lie that there is plenty of cheap oil and gas to use instead.

Lessons Learned and Permian Realities

So, knowing what we know, who now thinks that when Harold Hamm said in 2023 that the Permian wouldn’t peak until 2035 and that it would increase another 25%, that he is likely to be correct?

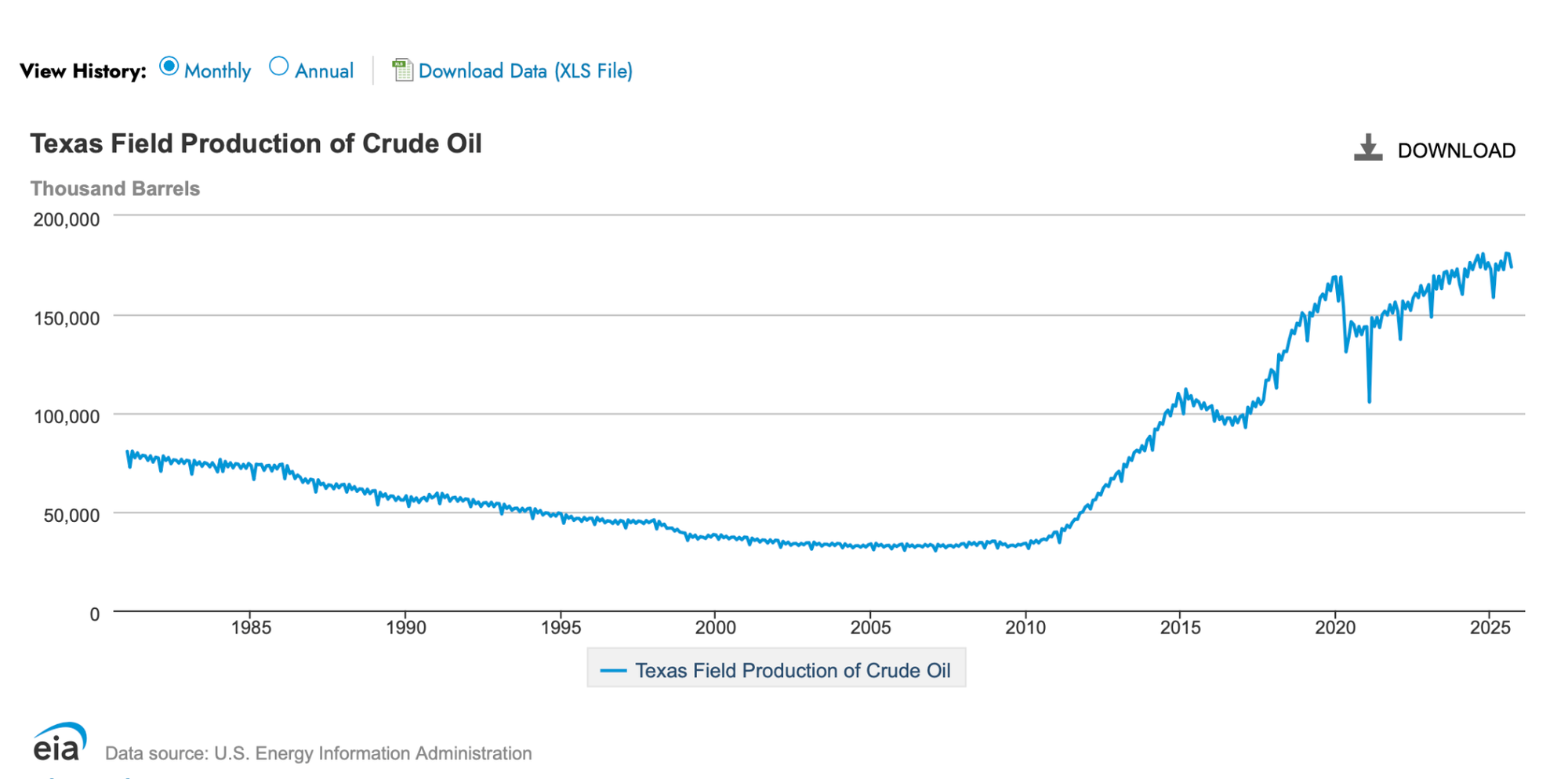

The Texas Permian is the story of U.S. shale and it has peaked. In October of 2019 Texas oil production topped 165 million barrels. In October 2024 it topped 180 million barrels. In August 2025 it was back to levels first hit in 2019 and the initial numbers for September 2025 were 144 million barrels. These are state numbers but even the more optimistic EIA numbers show a flatlined Texas Permian.

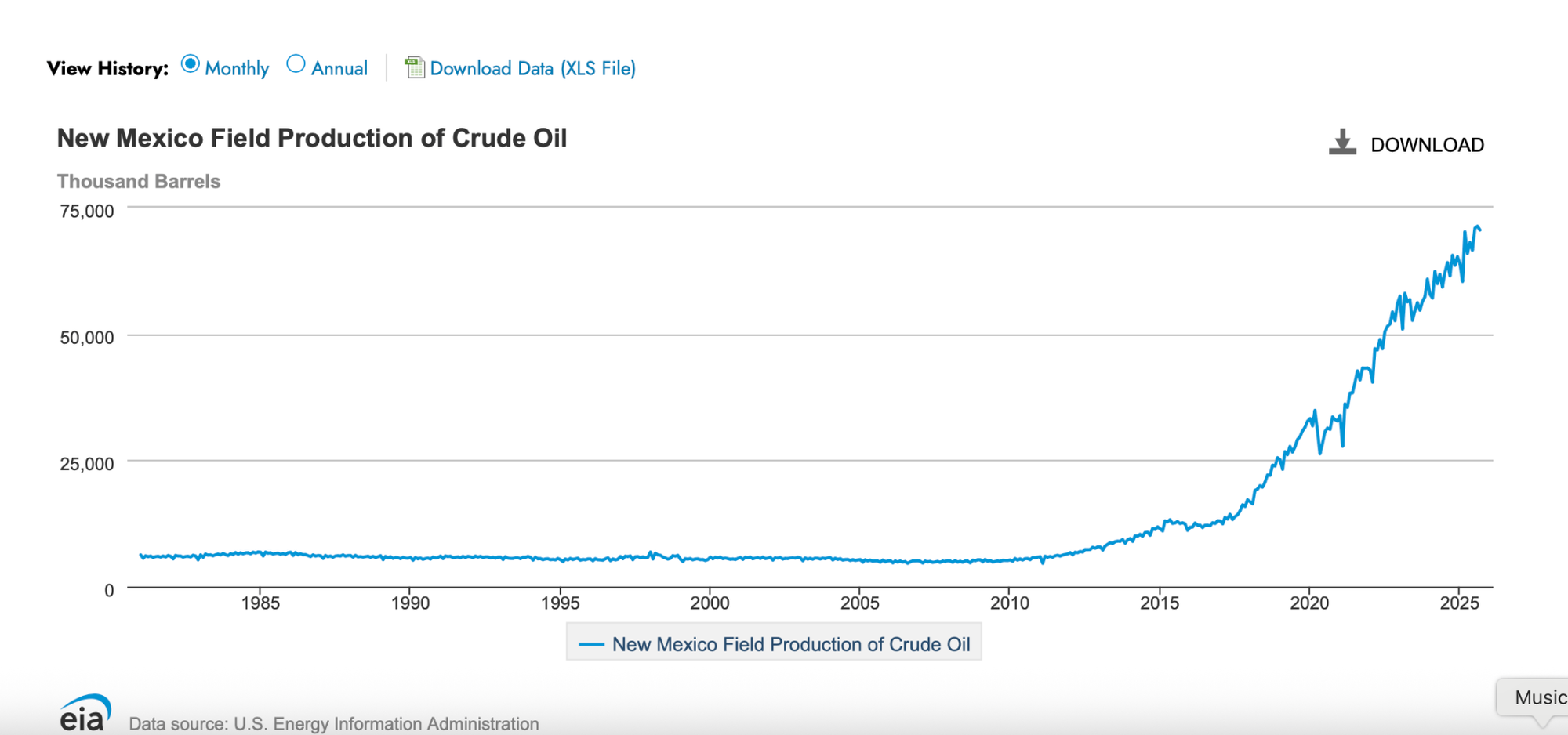

New Mexico is still booming but it will follow the same lifecycle as the Bakken, Eagle Ford, Texas Permian and all of the major shale plays. There is one county left in the New Mexico Permian that is still increasing production. Tick tock.

So where will the 25% increase in Permian production come from that Harold Hamm is predicting? Perhaps it will come from Exxon?

In December 2025 Exxon announced it planned to double its Permian oil production by 2030 which would require an increase of 1.25 million barrels per day of oil production. This would seem in line with Hamm’s forecast except for one problem. Where is that coming from? While the Texas Permian is in decline we are to believe Exxon is going to double its production? There is still an ongoing fraud lawsuit over the last time Exxon made such predictions about its Permian oil production. Two days after Exxon made this latest prediction, Reuters ran a piece stating the Permian would peak in December 2025.

Here is a fun thought experiment. If Exxon doubles its Permian production which would, in theory, add another 1.25 million barrels per day to the Permian output, how has the Permian peaked? If Permian production is flat until 2030 (actually it will decline) and Exxon doubles its output that means the rest of the Permian producers would have to lose 1.25 million barrels per day of production. The math is simple. Exxon will not double its Permian production in the next 5 years. Why? Geological constraints which are highlighted in the Reuters piece.

“This monthly figure may never be topped, given that most of the Permian’s top-tier oil acreage has been tapped and sharply depleted after more than a decade of drilling.”

Did this reality impact Exxon’s outlook? Not at all as documented in this recent piece from Natural Gas Intelligence which quotes Exxon’s chief financial officer Kathy Mikells.

“While others are claiming ‘peak Permian,’ we see continued growth well into the 2030s.”

Mikells continued with her fact-free fantasies stating that “drilling and completion costs in the basin are expected to fall about 40% from 2019 levels, pushing the basin’s cost-of-supply down to about $30/bbl.” Expect to hear a lot more about technological improvements, drilling efficiencies, magic sand, etc. It’s the same smokescreen Hamm, Exxon and many others have been using for over a decade. And yet they have been fantastically wrong. But they are all also very rich so it will continue. Expect the mainstream press to continue to play along and expect the American public to be quite surprised in the next few years as geological constraints become apparent.

The New York Times reported that Harold Hamm said “We’ve just gotten started” when it comes to the current U.S. oil industry. You may recall he said the same thing in 2013 back when he was promising 48 billion barrels from the Bakken. So where is Harold Hamm investing now that his pal Trump is in charge, they have thrown out all the regulations, and it is open season for U.S. industry wildcatters like Hamm? Where is he getting started?

In March Hamm invested in oil fields in Turkey.

In November he invested in shale fields in Argentina.

Hamm admitted the Bakken is “tapped out.” The reason he is buying shale assets in other countries is because the reality is that the U.S. oil industry is tapped out.

Comments ()