Gluttons For Punishment: Oil Industry Doubles Down Against Reality

The world is facing a multi-year oil glut where the oil producers will be pumping more oil out of the ground than the world is using. This will keep oil prices at low levels – likely well below the level that most US shale oil producers can make a profit. But the U.S. shale oil and gas industry has rarely been profitable so that is nothing new. We know the oil industry is about boom and bust cycles so a situation of oversupply is expected now and then. However, it appears this time is actually different. Let’s do some math.

First it is good to point out that when it comes to global oil markets and production and consumption, it’s a bit of a murky picture so everyone is guessing at some level. That said, most forecasts that aren’t pure propaganda (like the forecasts from OPEC), are agreeing that the world is facing a big oversupply situation in the near future that is in the range of 3-4 million barrels per day (mbpd).

From a recent Wall Street Journal article. “The International Energy Agency forecast in October that the world would be oversupplied by an average 3.7 million barrels of oil a day in the current quarter. JPMorgan analysts put that number at 3.6 million barrels.”

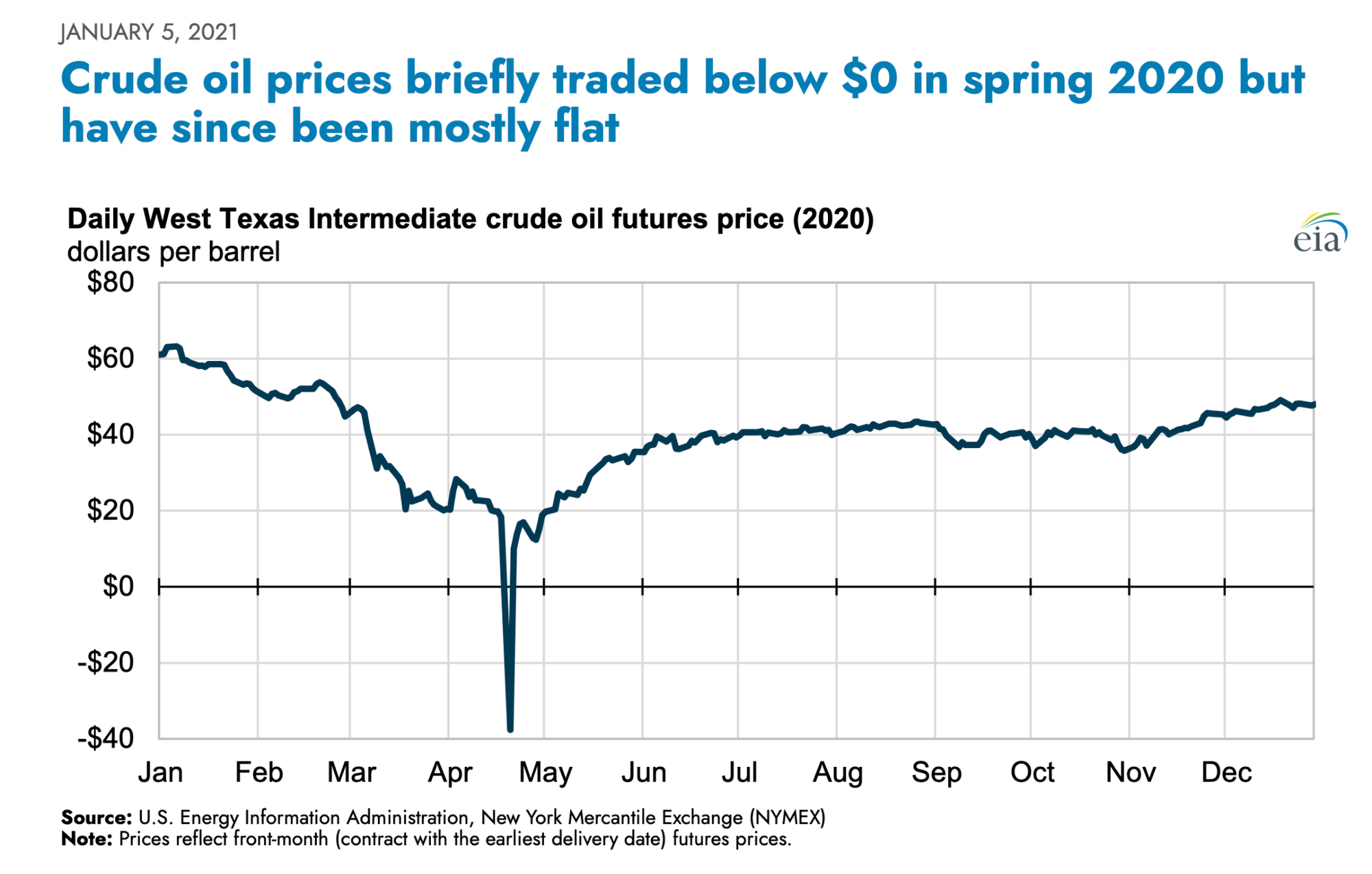

To put this in perspective, the world consumes around 103 million bpd of oil every day. So having an excess 4 million barrels per day hitting the market is a big deal. If you aren’t burning the oil, you need somewhere to put it. And there is only so much storage and when you run out of storage, prices can go negative pretty quickly as shown below.

The above referenced WSJ article is focused on how China is currently buying up more oil than it uses to fill its massive and ever increasing oil storage capacity to the tune of 1 million barrels per day. So if China stopped buying oil to store, the global oil glut would be higher by another 1 million bpd. One of the things that makes global oil analysis less than precise is that while there are likely people in China who know how much oil they can store and how much excess storage capacity currently exists, they aren’t sharing that info and we have no real idea. We do have an idea what would happen if China stopped buying this oil next year.

“If China really stops buying, the path toward low $50 would be very quick,” said Michael Haigh, global head of fixed-income, currencies and commodities research at Société Générale.

It’s pretty clear the industry is oversupplied and will be for a few years and that means low oil prices. The U.S. oil industry will likely lose a good bit of money in the next few years. However, the oil industry and its many paid supporters want us all to believe that once the glut is over the world will be thirsty for more oil and prices will rocket higher as they do when supply is lower than demand. However, the current global oil glut is driven in part by oil demand destruction from the electrification of many types of transport which has never happened before. There appears to be a good chance that oil demand destruction is accelerating and will be significantly higher than the current expectations which would mean that oil demand stops growing while the world still has an oversupplied market. This is the structural change that will destroy the long-term economic prospects of much of the global oil industry.

Consensus Demand Destruction

In an August article about the rise of EVs it notes that the International Energy Administration (IEA) is expecting EVs to contribute 5 million barrels per day of oil demand destruction by 2030. This echoes the statistic I see more widely cited which is from BNEF and is referenced in this Inside EV’s article:

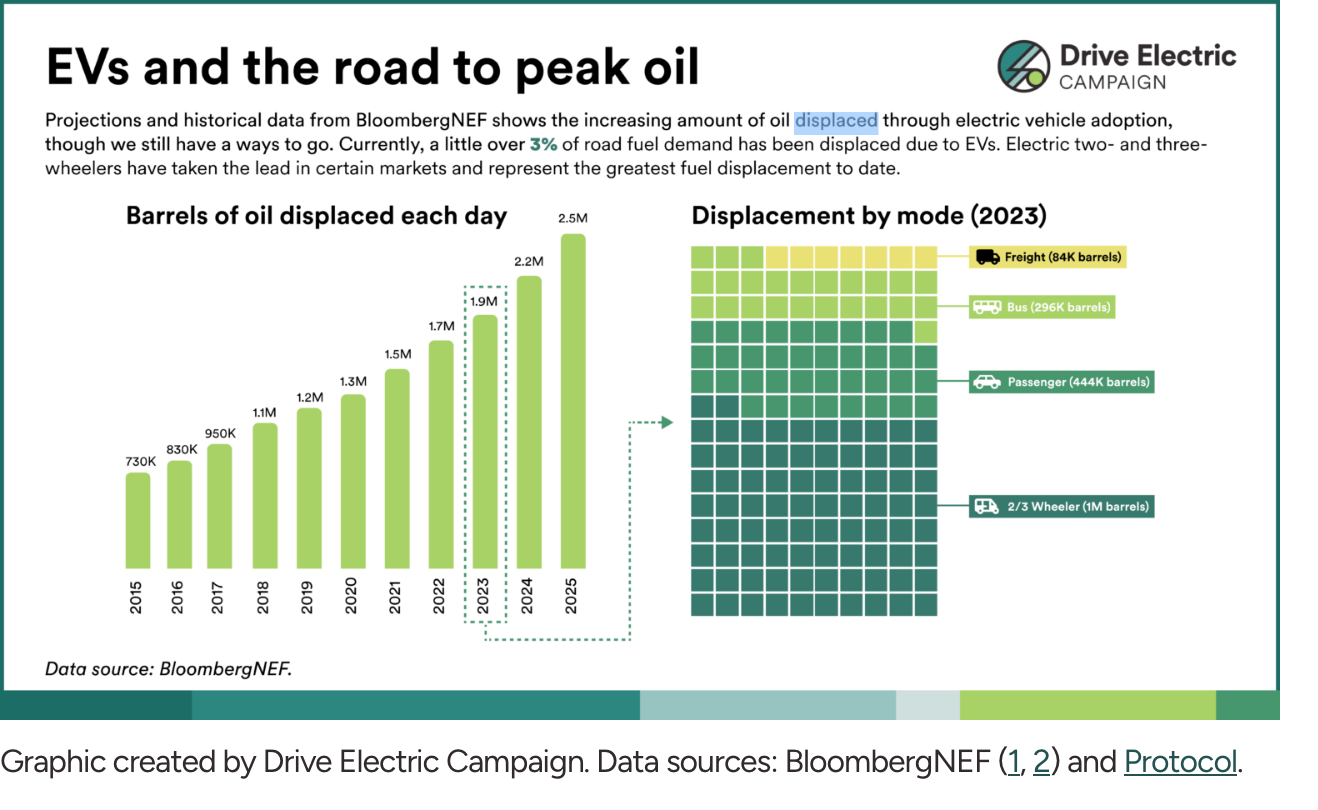

“According to BNEF’s economic transition scenario, the first million daily barrels of road fuel displacement happened in 2018 thanks to early adoption of EVs” which they say puts the world on a path where by the end of the decade, “EVs are expected to displace more than five million barrels of road fuel per day.”

So one million daily barrels of road fuel displacement happened by 2018. And then they note it took 6 years for the second million barrels per day. According to BNEF, while we reached 2 million bpd of road fuel replacement by 2024, they expect it will take until 2030 to reach 5 million bpd. I don’t see how that is possible with how quickly electrification is taking over the transportation market and I expect the oil demand destruction by the end of the decade to be significantly higher than 5 million barrels per day.

The First Million

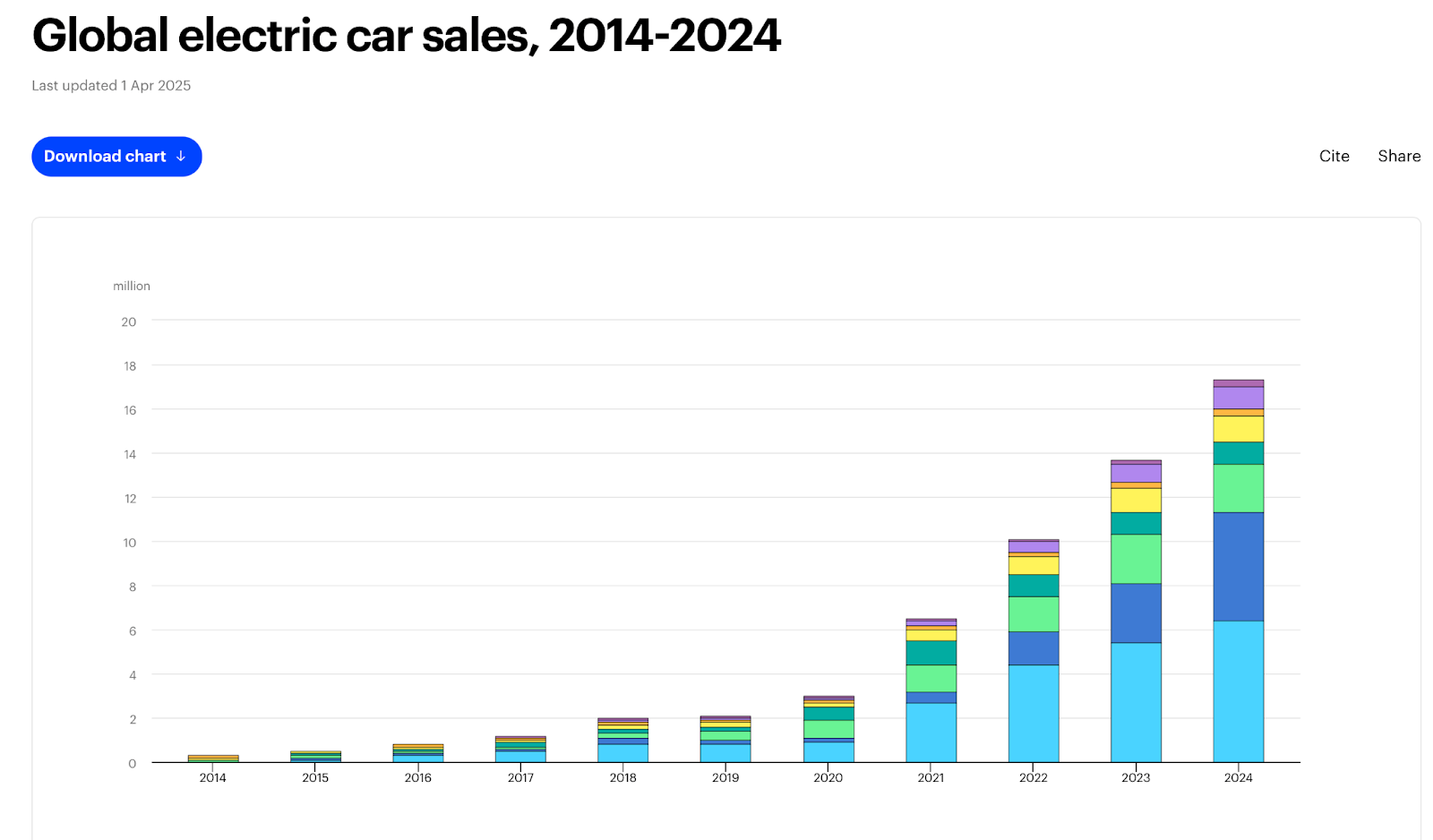

Here is a chart of the number of electric cars sold by year (not all EVs).

Source:IEA

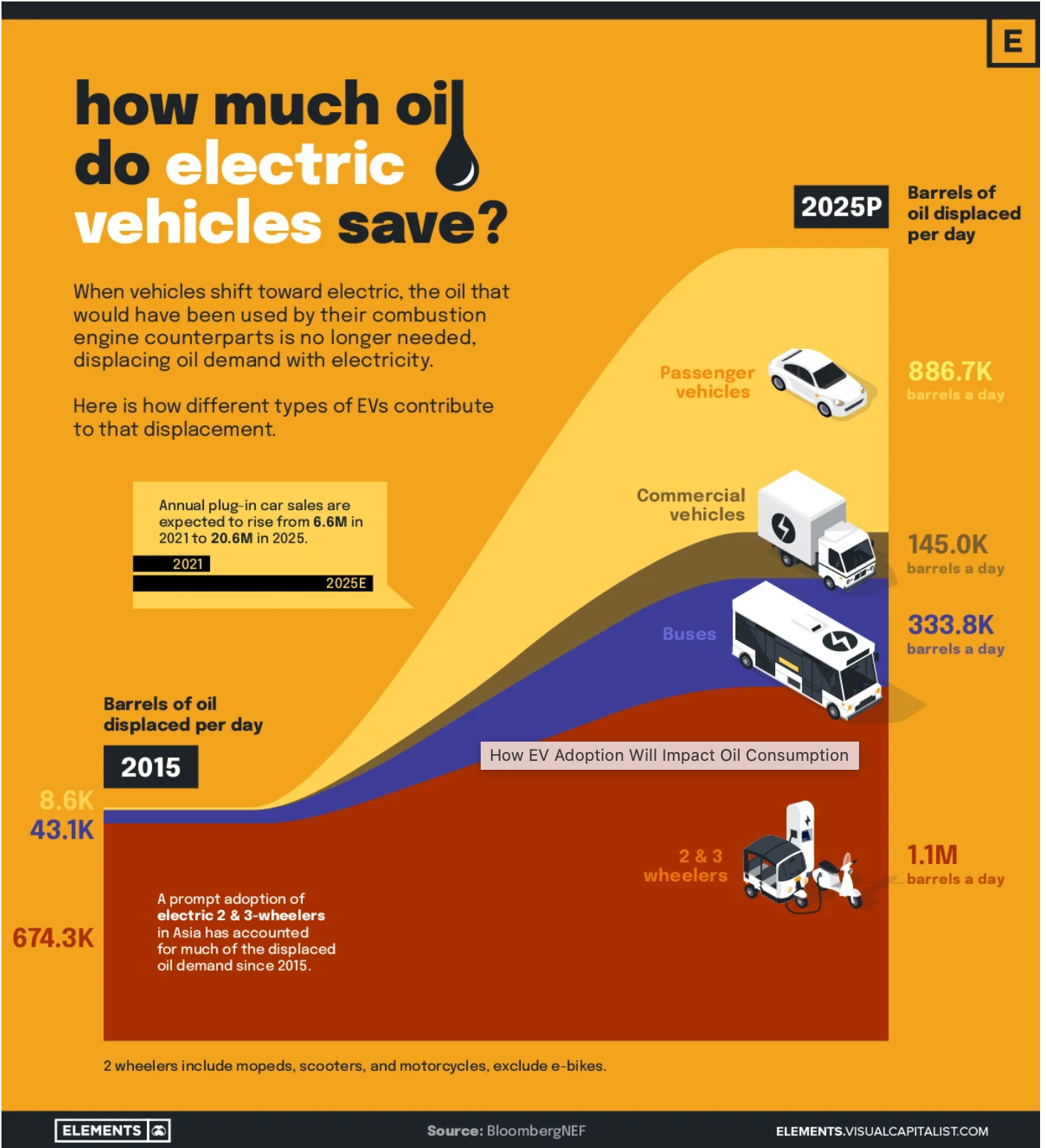

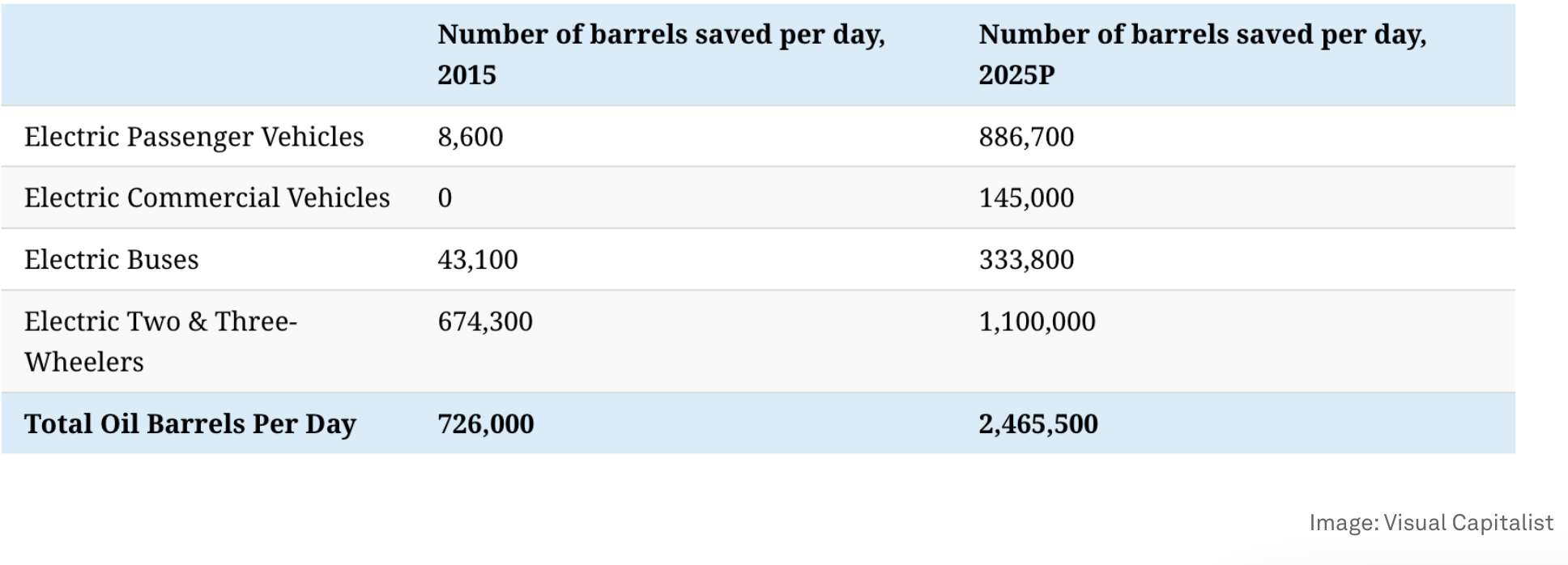

This chart is what got me interested in this subject. If the world avoided 1 million bpd of road fuel use by 2018 with that little bit of electric cars sold, how is it not increasing faster? The simple answer is all EVs are not cars and, as with everything else in this space, China moved much faster than the rest of the world in various areas of electrification of transportation. China went big early on electric city buses and according to BNEF by 2018 421,000 out of 425,000 electric buses in the world were in China. However, the really big early driver of oil demand destruction was in 2-3 wheel vehicles as can be seen in this following graphic.

Here is another take in visual form.

And here is some more info for comparison.

So these sources are saying 2.5 million barrels per day of global oil demand destruction by 2025. And despite the growth rates we are observing we are to believe that in the next five years we will only see another 2.5 million bpd of demand destruction. I am not buying it. And here are a few reasons why.

Causes of Higher Global Oil Demand Destruction

Trucking

The one graphic above says that commercial vehicles (trucks) would be displacing 145k barrels per day in global oil demand by 2025. This is repeated in the table as well. However, as with everything else, the electrification of trucking is happening faster than expected and once again China is leading the way. I can understand why people would not have predicted this. Three years ago I was doing research on the options for decarbonizing industry and transportation and green hydrogen and fuel cells were seen as the most likely path as batteries and electrification didn’t make sense from a cost standpoint. I wrote this in 2021:

“Hydrogen fuel cells are currently better suited than batteries for long distance travel and to transport heavy loads, which positions green hydrogen as the likely climate solution for long haul trucking, shipping, and aviation.”

Boy was that wrong. As with pretty much everything in energy these days, the rapid decline in the cost of batteries combined with increased performance has made a mockery of most predictions from even a few years ago.

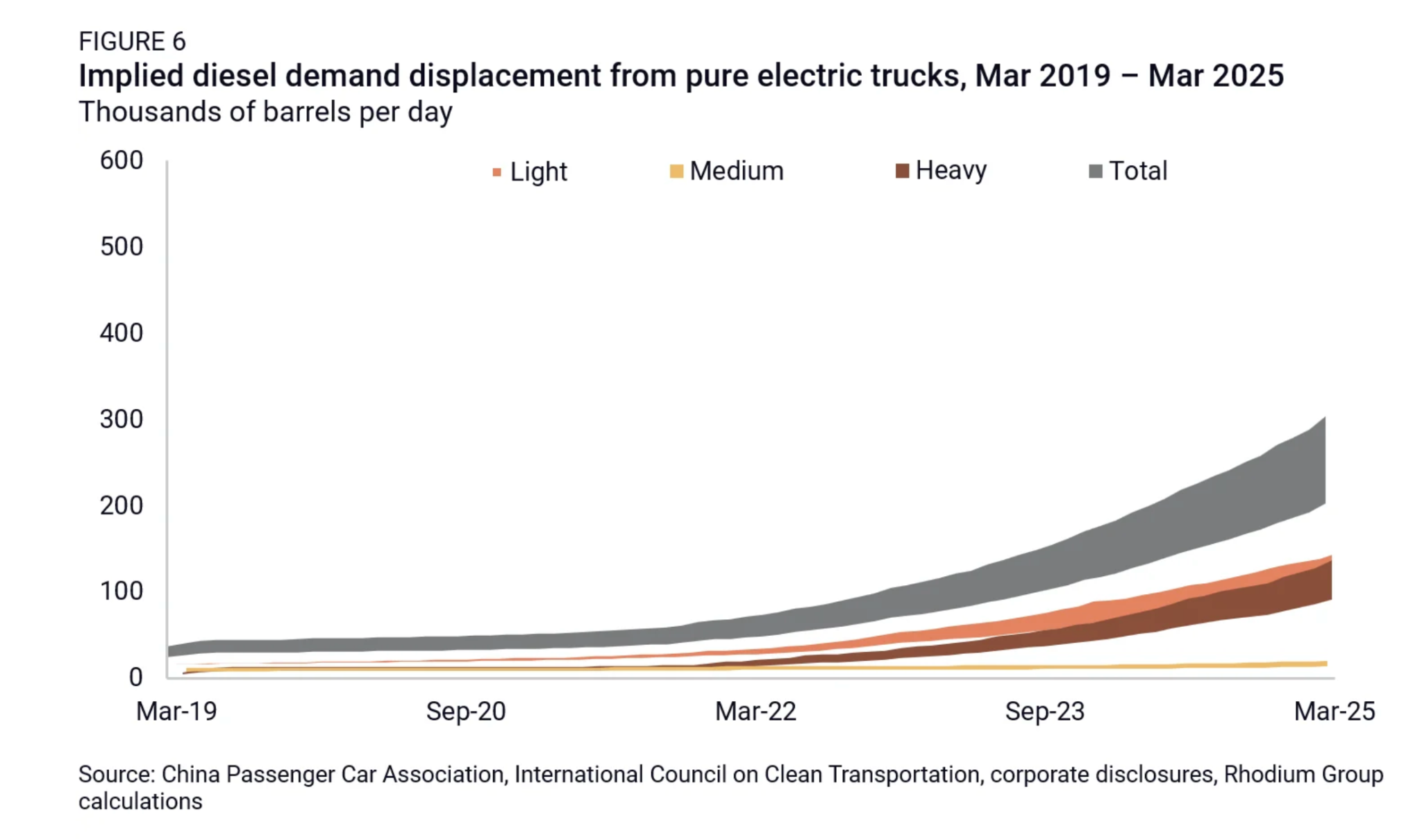

They are now estimating that electric trucks in just China were already displacing double the previous 2025 estimates and that was only through March (roughly 300K vs 145K). They say “Even with widespread recognition of China’s expanding NEV sales, the pace and scale of China’s electrification is likely still underappreciated, especially when it comes to trucking.”

And this is their take on the oil demand destruction happening in China.

“....the ongoing electrification of China’s vehicle fleet, especially in trucking, suggests long-term headwinds to diesel and gasoline demand. We estimate the total electric vehicle fleet is already displacing over 1 million barrels per day in implied oil demand—equivalent to roughly the daily oil production of Oman. That level is likely to rise by around 600,000 barrels per day over the next 12 months.”

600,000 bpd in 12 months. If China simply maintains that pace and doesn’t increase it, China's oil demand destruction alone would get us to over 5 million bpd of total global demand destruction when combined with the 2.5 million bpd that has already occurred. But China will likely continue to grow that number. And the rest of the world will be chasing them.

Have you ever been driving and got stuck behind a big truck going up a long hill? EVs solve that as was shown in Australia recently where in a head to head match-up the electric truck was faster because it can maintain speed uphill which was considered “amazing” for the trucking industry.

“Timing is a huge factor for any business, particularly a just-in-time business like ours,” said Multiquip’s National Compliance Manager David Muir.

“It was very surprising for us to see just how much time he was able to save with the vehicle being able to maintain that speed over distance.

“I was frankly quite shocked. Constantly being able to maintain that speed is amazing.”

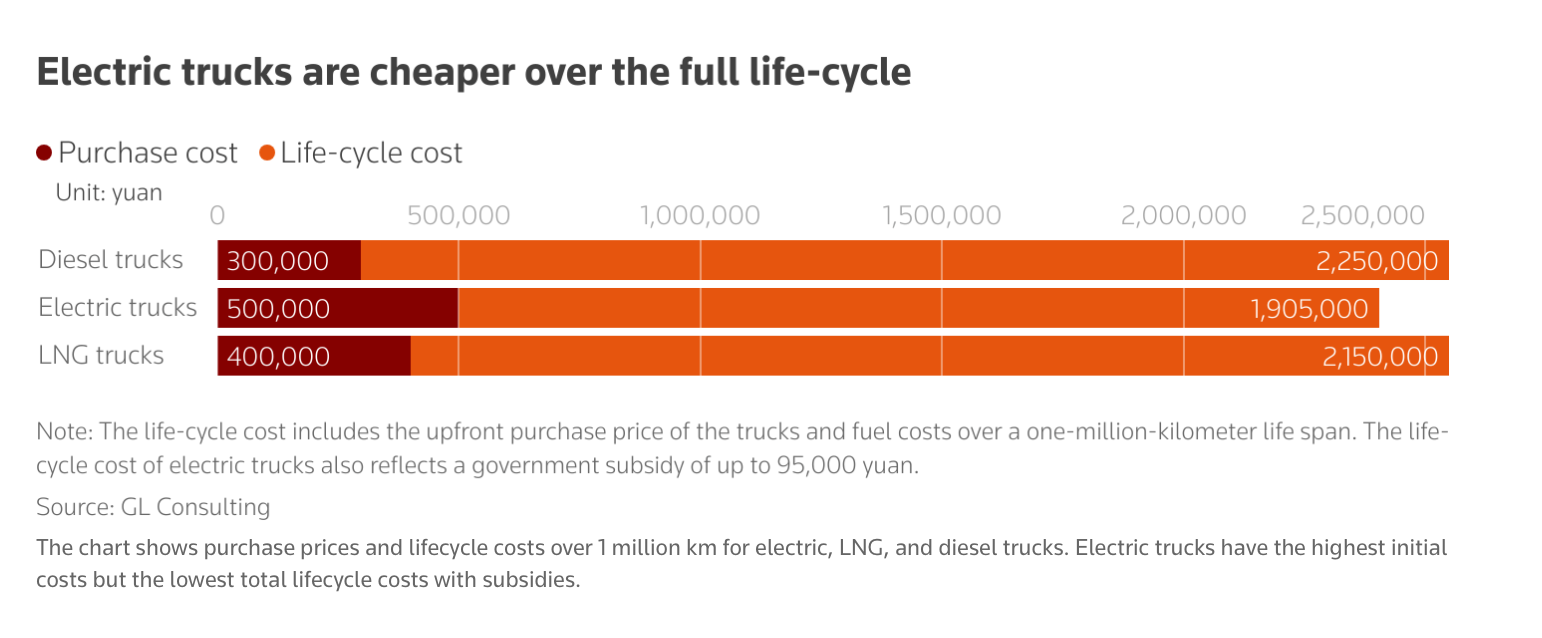

The rapid transition to clean energy and electric transportation is about money. And electric trucks will make money for the trucking industry. Trying to compete using diesel will be a disadvantage. Remember how China went all in on electric buses. If the same happens for their trucking industry it will be significant for global oil demand. So how is that going? From Reuters: "The surge in electric heavy trucks was a surprise and has become a new factor accelerating China’s oil consumption to peak, most likely this year," said Ye Lin, vice president at Rystad Energy, who had previously expected a 2026 peak.

It’s the economics

"We expect electric heavy trucks to account for 70% to 80% of new sales within as little as two to three years, driven by lower operating costs and more comprehensive charging infrastructure," said Zhaoting Yue, SANY's vice president of international marketing.

2-3 wheelers

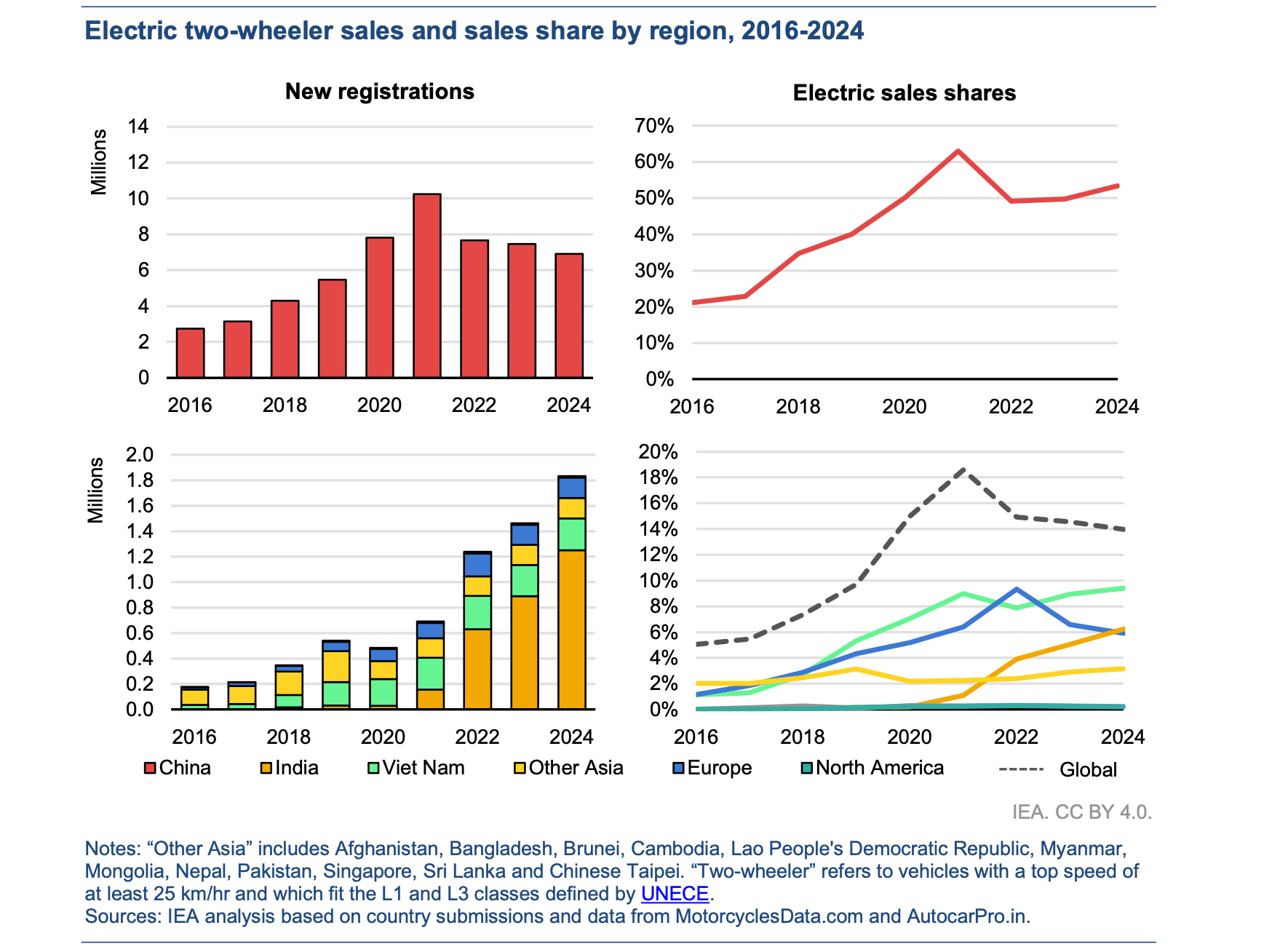

Now with the stunning rise of 2-3 wheel vehicles driving early demand destruction it is reasonable to ask why that isn’t continuing. Did we electrify the world’s fleet of 2-3 wheelers already? Not quite. From the IEA: “Two- and three-wheelers (2/3Ws) remained the most electrified road transport segment in 2024, with more than 9% of the global fleet now electric.”

There is no doubt the sale of electric 2 wheelers has flatlined in China. However, one reason that the IEA gives actually means higher oil demand destruction, not lower. “Sluggishness in China’s 2W market reflects an increasing preference for cars for personal transport, and may also be a sign that consumers are responding to tighter restrictions on 2W use in major cities.” How about the rest of the world? There is a lot to learn from this graphic.

Top left shows electric 2 wheeler sales in China. And then the rest of the world is below that. I would expect we are going to see a lot more demand destruction from 2-wheelers in the rest of the world in the next 5 years. However, it is pretty clear that one of the technologies that drove early oil demand destruction (that first 1 million bpd by 2018), is many times the size it was in 2018 and increasing everywhere but China.

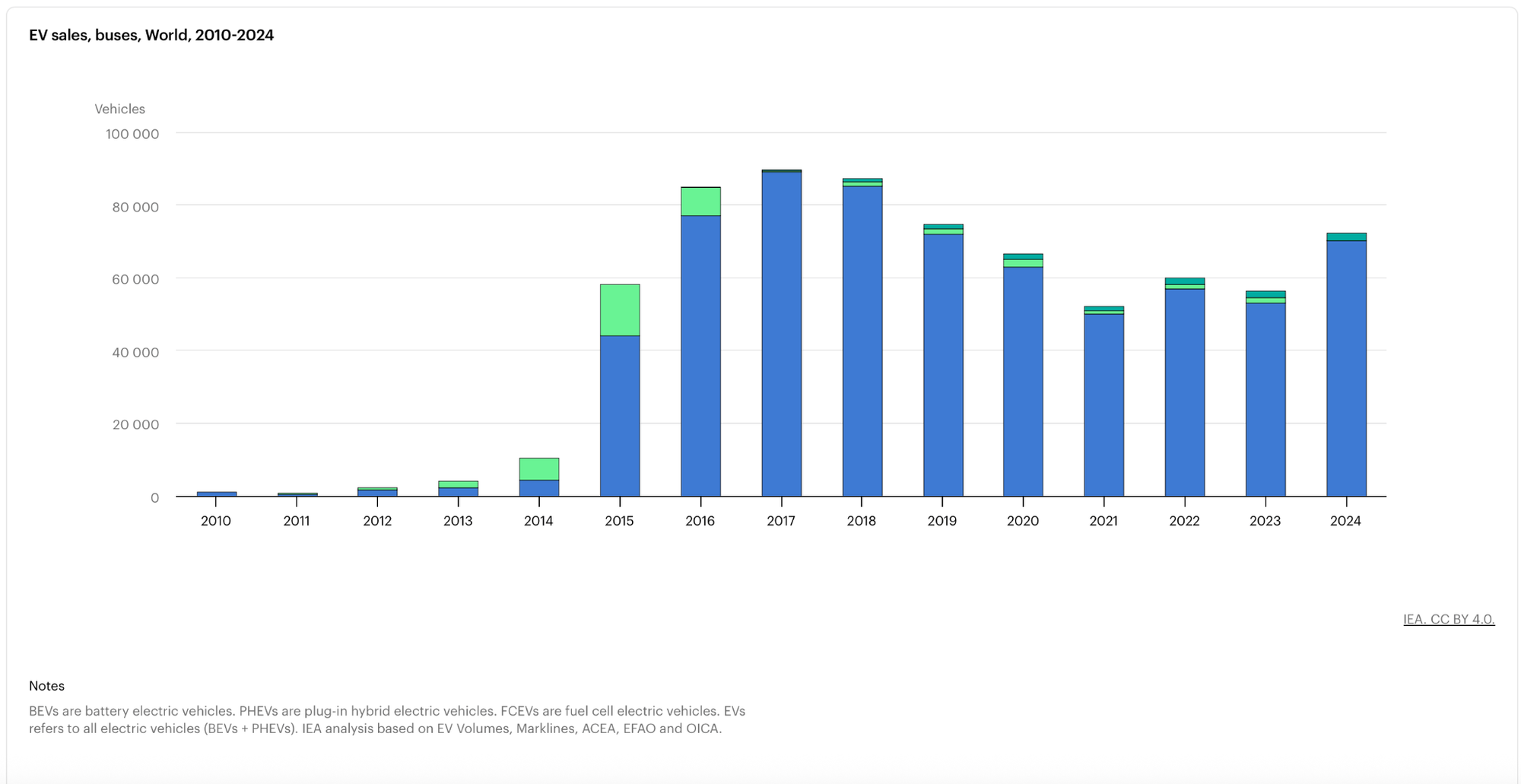

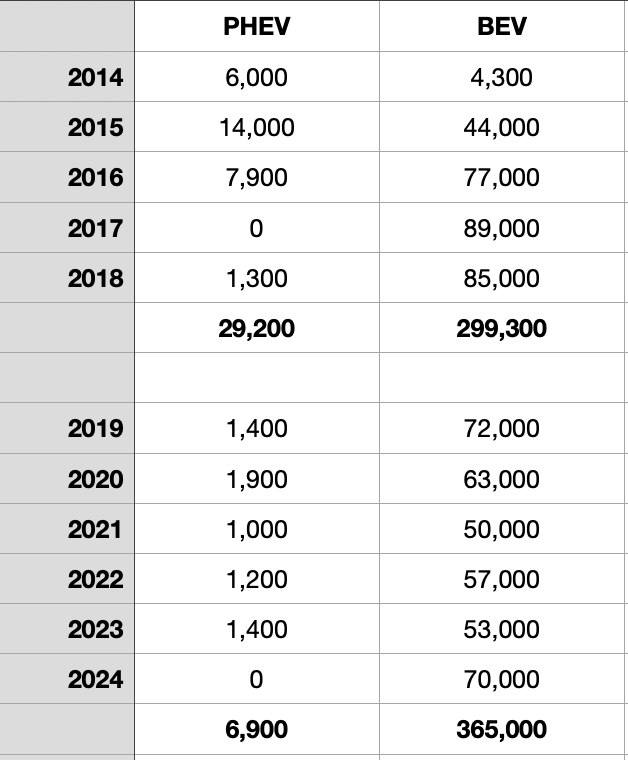

Buses

Source: IEA

So it’s easy to see why buses were a big driver of oil demand destruction through 2018. However, it’s also important to note that more electric buses have been sold since 2018 than were sold through 2018. Chinese Electric Bus Sales

So if buses were a big driver of the first million barrels per day through 2018, why didn’t adding even more buses in the years since 2018 drive another 1 million bpd through 2024? Could be plenty of reasons why but logic suggests that current estimates of demand destruction are missing a chunk of this. And since China knows how to do this well when it comes to world domination of markets, what do you think they are doing with all of that electric bus capacity if the domestic market is not demanding more buses?

Sell them to the world and export oil demand destruction.

After the Glut

We expect a glut of around 4 million barrels per day of oil in 2026. And global oil demand growth is only expected to grow by something like 750,000 bpd. However, the estimates for global oil demand growth from the major forecasters all were much too high for 2025 so there is certainly a chance that we hit the under in 2026. I believe the facts outlined above help explain why we keep consuming less than expected. We are in a scenario where if the oil industry doesn’t cut production it would take roughly four years for demand to catch up to supply based on 2026 demand expectations. However, demand destruction will ramp up significantly in those four years so the reality is oil demand will have to grow at a faster pace than expected to keep up with the rapidly increasing global oil demand destruction.

The oil industry is desperate to keep the world hooked on its products. However, their big plans for LNG are not going well as the world will be massively oversupplied with LNG for the next five years and likely much longer. Why? Demand destruction. One of the LNG industry’s big plans for demand growth was long haul trucking in China. That won’t happen due to economics as LNG trucks can’t compete with electric ones. Meanwhile, solar plus storage is replacing LNG in the market for power production around the world. Will the world pass through the LNG glut and see the 60% growth predicted by the industry? No. It also seems highly likely that the current oil glut facing the world is due to structural changes in the world’s use of oil and that oil demand destruction will be significantly higher than 5 million bpd by 2030 which will likely be an economic catastrophe for much of the world’s oil and gas industry.

In 2018 I wrote my first article about the failed finances of the U.S. shale oil industry created by fracking and stated that “The oil industry has always been a boom or bust industry. And during each boom someone inevitably declares that ‘this time is different,’ assuring everyone there won’t be a bust.” Back then I quoted an energy asset manager in this WSJ article who was encouraged to think the oil industry had learned its lessons and the days of the boom and bust cycle were behind the US shale industry. He said,

“Is this time going to be different? I think yes, a little bit,”

He was wrong then but the evidence is piling up that this time it really is different. For the first time in its history the oil industry has an economically superior competitor. It appears that most people are not yet aware of the impacts this will have by 2030. In 2018 I warned about the very challenging economics of trying to make money in the US shale oil and gas industry. Seven years later and the U.S. shale industry is facing another prolonged period of losing money due to low oil prices and the fact they already drilled all the good acreage and it appears the industry as a whole will never even break even financially.

I like to think of the oil industry in 2025 as a big rig starting up a long hill. There is an electric truck in their rearview mirror but it looks just like any other truck so they ignore it. Then they start to slow going up the hill due to the limitations of internal combustion vehicles and the electric truck quickly passes them on the hill and leaves them behind.

The age of electrification of transport is here. The rather interesting question that remains is when will the investment class realize this and decide they want to stop losing money on fossil fuels.

Comments ()