End Game: US Gas Reserves Edition

While it is now becoming clear to more people that the U.S. oil boom is about to end, very few people are talking about what that means for U.S. natural gas production. Few also are mentioning that some of the major shale gas plays like the Marcellus and Haynesville are peaking or in decline.

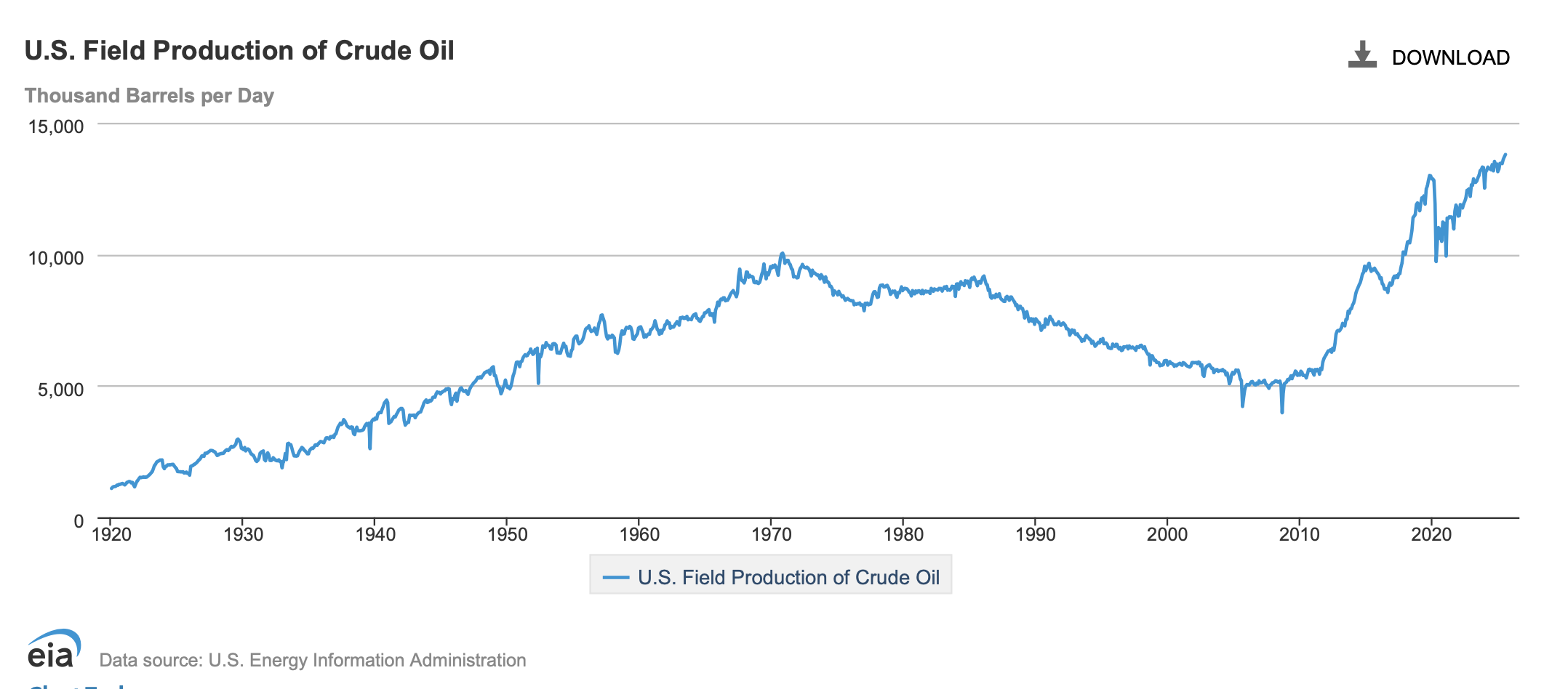

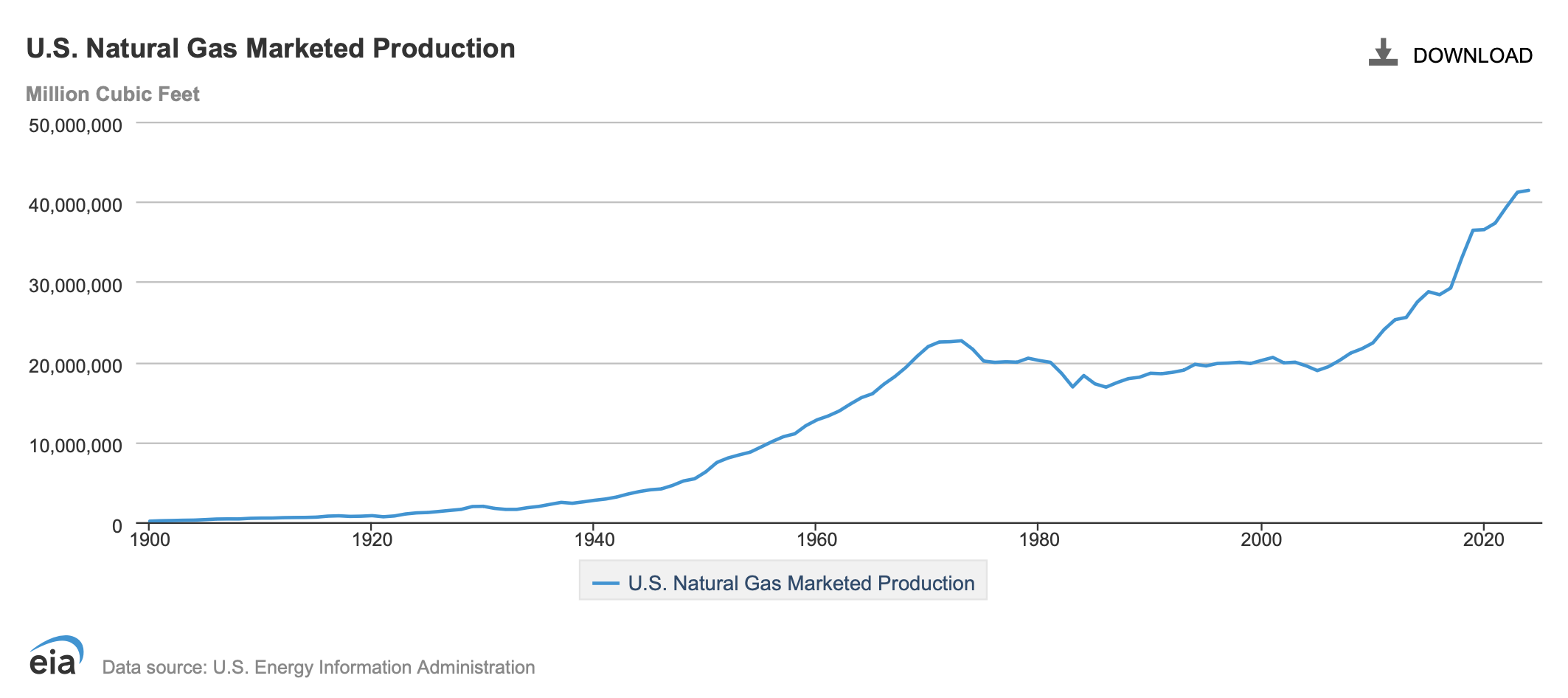

I’ve explained previously how the “drill baby drill” and “oceans of liquid gold” nonsense about the U.S. oil industry is profoundly ignorant. What does this have to do with U.S. natural gas production? A lot. Take a look at these two graphs. See how U.S. natural gas production is strongly correlated with U.S. oil production?

U.S Crude Oil Production

U.S. Natural gas [methane] production

Source: EIA

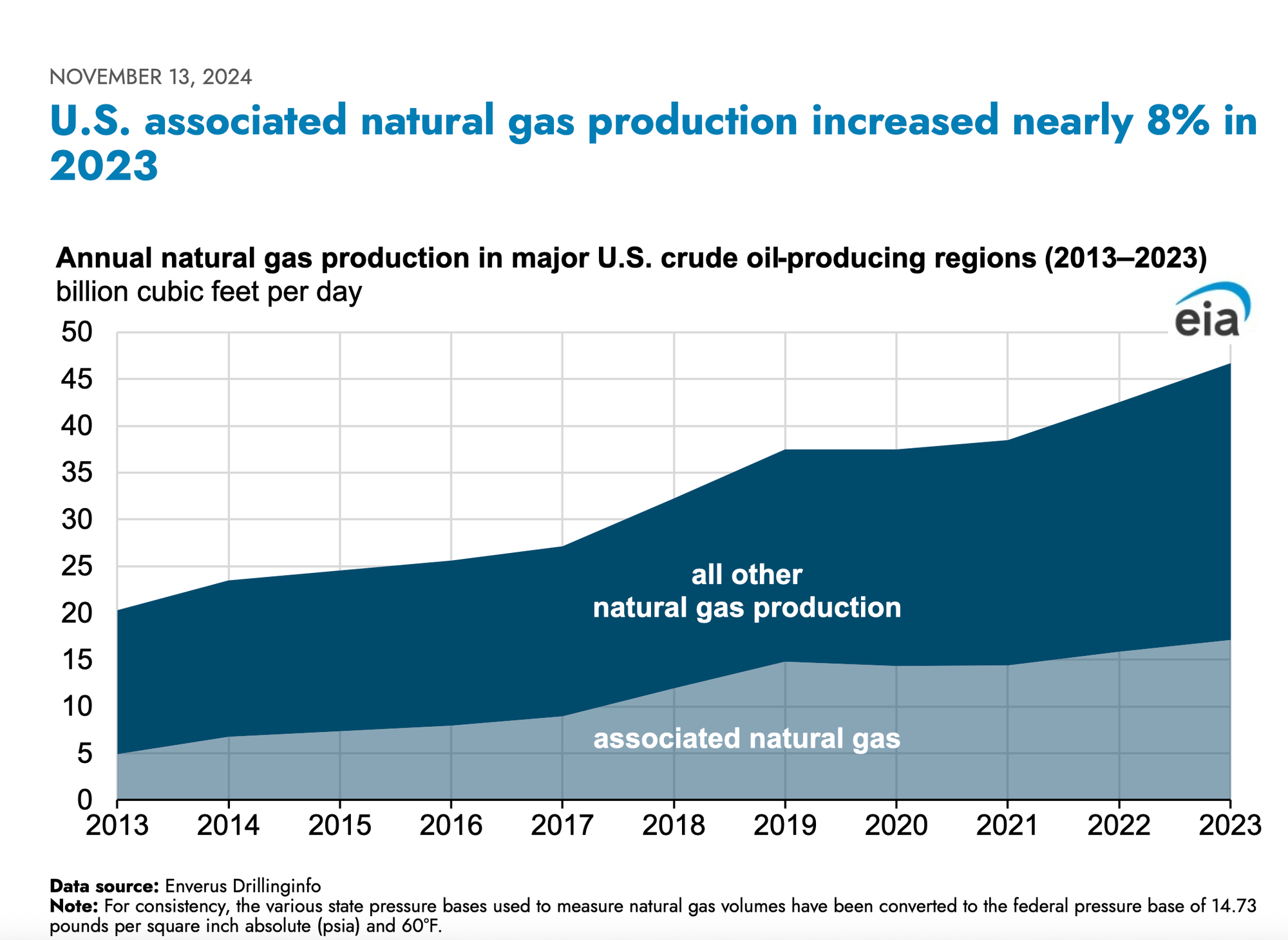

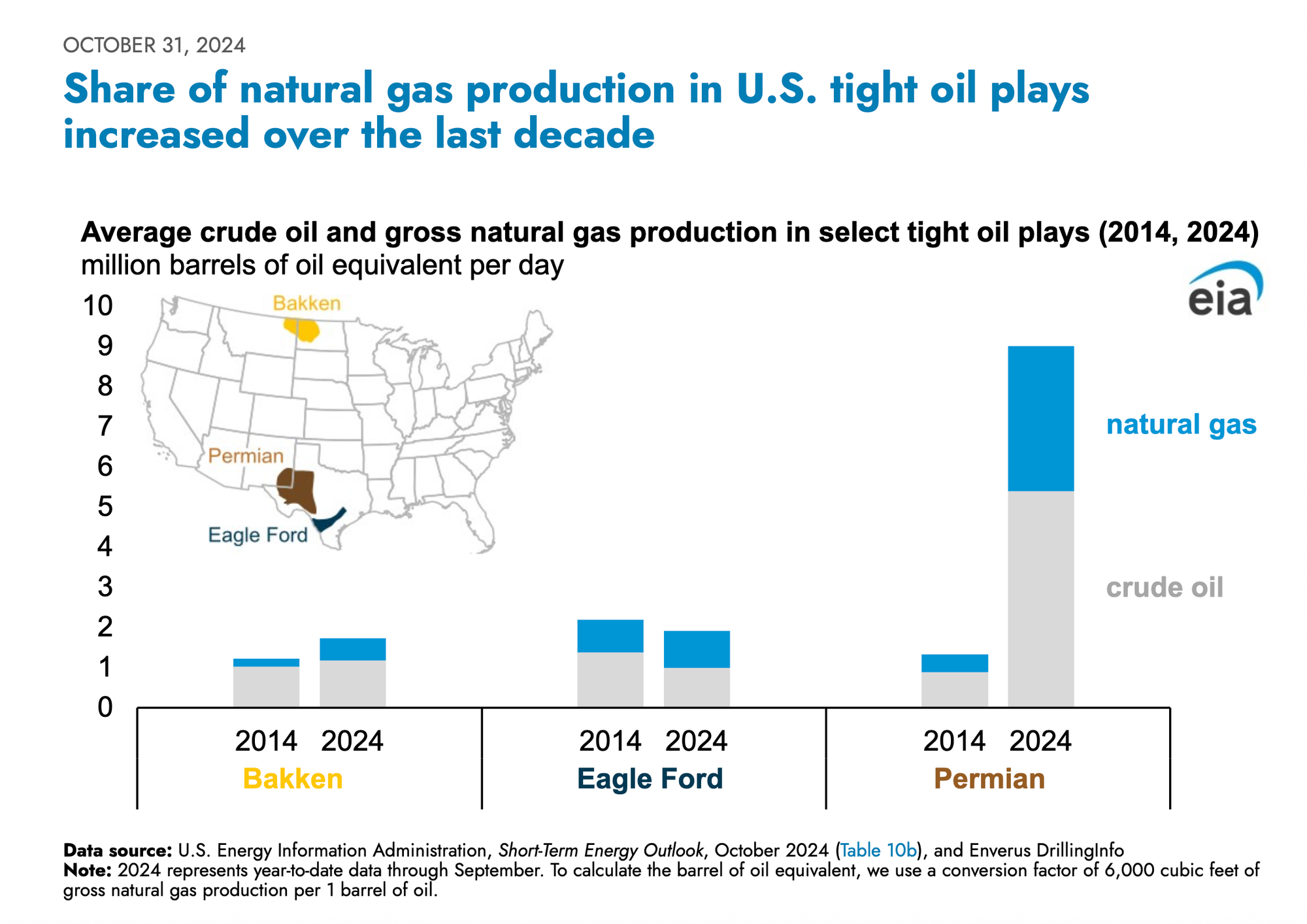

The fracking boom drove both crude oil and gas production but it also is creating a lot of associated gas, which is gas produced from oil production. This relationship means that the future of U.S. gas is dependent on the future of oil production and that associated gas, which the EIA says was over 36% of total gas production in the U.S. in 2023.

So it shouldn’t be hard to understand that if U.S. shale oil production goes down in the next few years, that natural gas graph will do the same. And U.S. shale oil will go down in the next few years. The only question left is how fast it will decline and my educated guess is “faster than a lot of people expect.” I’m not alone in that take though. The Dallas Fed survey is an anonymous survey of U.S. oil executives. Here is a recent comment from one of those execs.

"U.S. shale will decline in a similar fashion to how Hemingway went bankrupt: 'Gradually, then all of a sudden.'"

I like it when an oil executive admits they read Hemingway, or at least know his quotes.

However, the correlation between oil production and U.S. gas production will likely diverge more at some point as the gas-to-oil ratio increases in the oil fields, as always happens in aging oil fields. This makes the oil production less profitable so it is bad news for the oil companies but as the wells get gassier, perhaps the fields will produce more gas and will have a slower decline than the oil.

Source: EIA

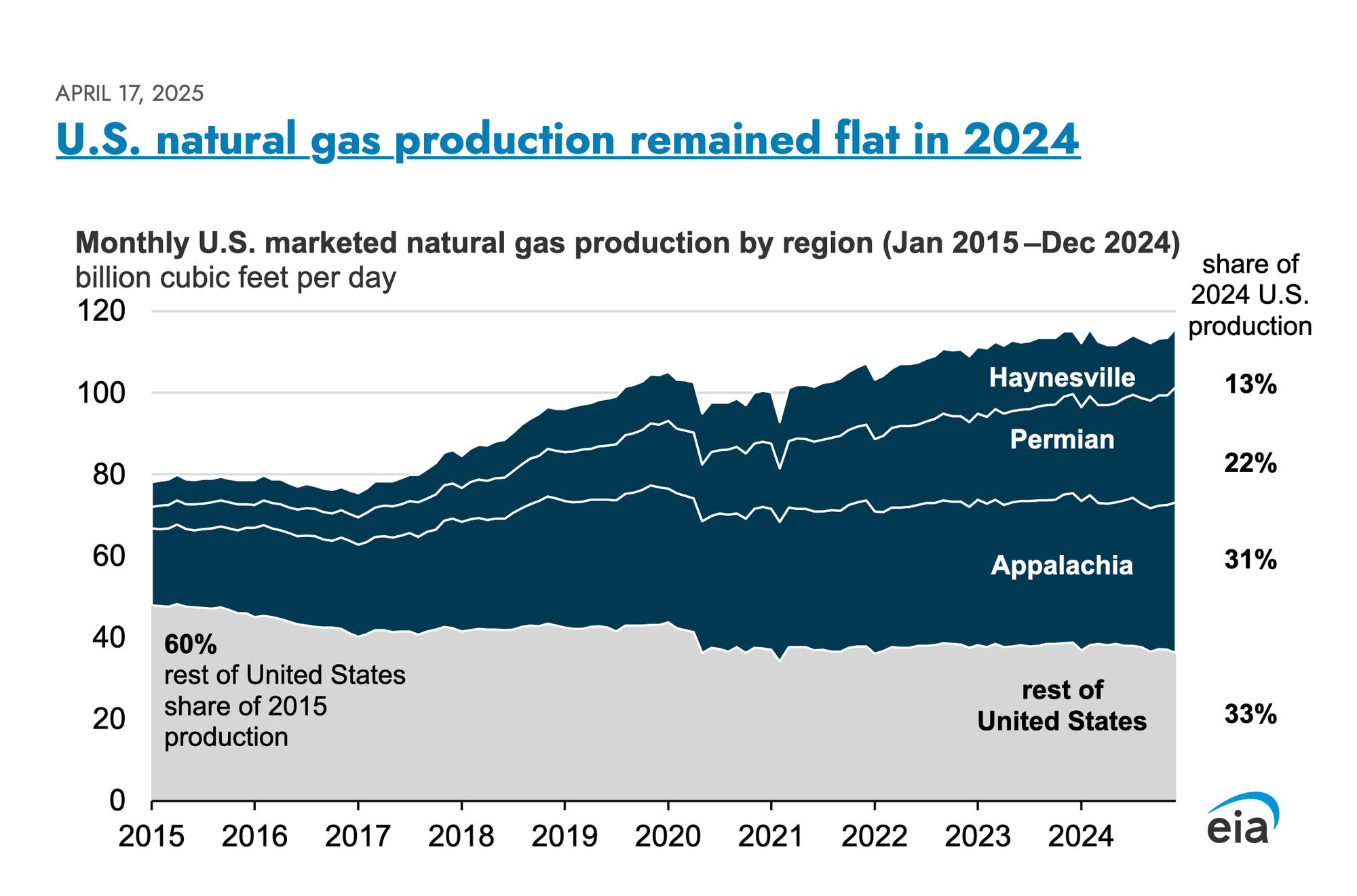

So, knowing that, how is U.S. natural gas production looking these days?

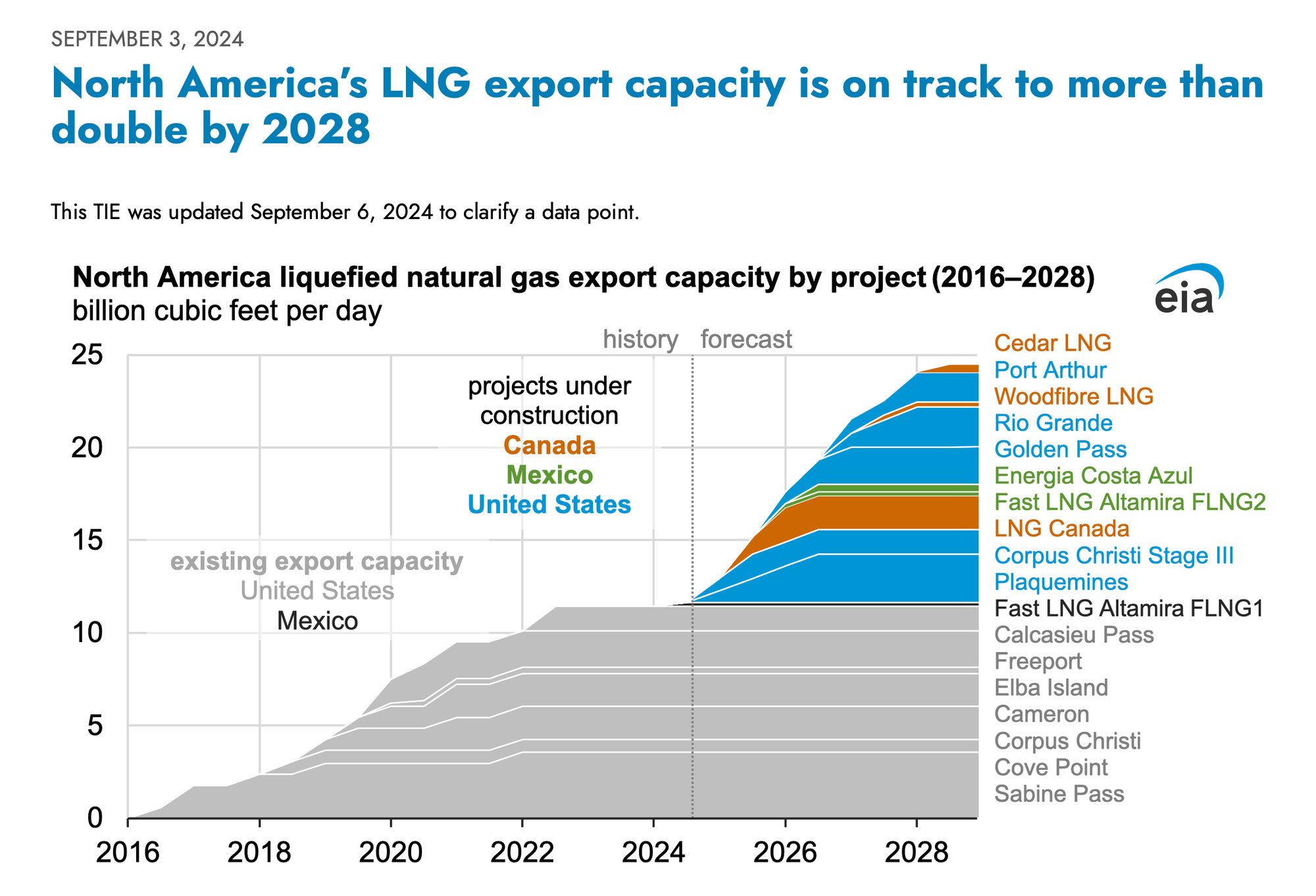

Gas production was flat for the year in 2024. Should this be of concern to you if you are about to drop $15-30 billion on another LNG export facility based on everything you read in the financial press? Is that due diligence? Look at that above graph and then think about the one below.

Source: EIA

Lower gas production in 2024 and oil tycoons warning they have no plans to meaningfully increase oil production (hint: they can’t) which means no increase in associated gas. So, as an LNG investor, you either are going to have to greatly ramp up conventional and unconventional gas production or you aren’t going to get that gas unless, and I’m sure this poses no problem to the average ethics-free oligarch but…you are going to have to take that gas from the U.S. public and U.S. industry and drive prices for gas sky high in the U.S. and also put to rest all those dreams of Exxon’s gas power plants for AI as gas power production in the U.S. will get really expensive. Not exactly what the Republicans currently in control promised when they said they’d cut U.S. energy prices in half, is it?

If You Build It, You Will Strand

In December 2024, U.S. Secretary of Energy Jennifer M. Granholm released a statement on the future of the U.S. LNG which included some big numbers for expansion.

“The [LNG] quantities already approved for export equate to roughly half of the U.S.’s total current natural gas production today.”

Those are the export facilities that weren’t even affected by the political theater that was the pointless Biden LNG ban. Based on that estimate the U.S. will either need to greatly expand gas production or, as I mentioned before, the export companies will take gas currently used by the U.S. public and industry and sell it to other countries. This will be a huge bummer for the U.S. economy.

If the dim future for U.S. crude oil production comes as a surprise there is time to not make the same mistake with gas. Longtime oil industry supporter and geologist Art Berman was calling the coming decline in U.S. oil production years ago.

Would that make you want to know what Art thinks about the future prospects of U.S. natural gas production or would you rather get your info from Mr. Oceans of Liquid Gold. Personally I’m going with Art on this one. Almost exactly a year ago Art wrote this:

“The United States is the biggest producer of natural gas in the world and recently became the largest exporter of LNG. The industry is scrambling to build LNG (liquefied natural gas) export terminals as fast as permitting and funding will allow.

This couldn’t come at a worse time. Instead of having an almost infinite amount of natural gas as many believe, we may be witnessing hard limits to that supply.”

I recommend reading the whole thing but it is interesting to note last January Art wrote, “Shale gas plays are beginning to look like a graveyard” and then, as we now know, U.S. gas production declined in 2024.

Art is not alone in this take which shouldn’t surprise you when you do all of the simple math we are looking at here. I’ve also been reading the analysis of Goehring & Rozencwajg Associates, LLC. (GnR) for a few years. They also were in the small crowd of people warning about the coming decline in U.S. crude oil production while the mainstream crew were talking about doubling U.S. crude exports.

The boys at GnR have this to say about the future of U.S. natural gas production.

“Natural gas production is plummeting—a condition noted by almost no analysts. Between December 2023 and May 2024, U.S. dry gas supply has contracted by a notable 5 billion cubic feet per day—a nearly 5% reduction.”

Since, as they say, “almost no analysts have noted this condition” it should surprise no one that almost no analysts are asking the question GnR does next:

“The next two years will witness the fastest growth of LNG export capacity in U.S. history. Where the industry will source the gas remains an open question.”

Seems like the sort of question LNG investors should spend a little time considering.

Quantum Energy partners is a Houston-based private equity firm that invests in fossil fuels. They are behind the proposed Saguaro Energia LNG, located in Puerto Libertad, Sonora, Mexico, a massive LNG export facility that would be supplied gas by a pipeline from the Permian. The project was supposed to have reached final investment decision in 2024. It hasn’t. Perhaps one reason why is that Wil VanLoh, CEO of Quantum Energy, can do simple math. Here is VanLoh on the current situation in U.S. oil and gas production.

“The US shale revolution has run its course,” VanLoh told Bloomberg in an interview.

Which means U.S. gas production is facing a hard limit. VanLoh explained more reality:

“We’ve tripled oil production in the last 15 years,” VanLoh said, “and we have doubled natural gas production…there’s not a lot of gas left in the tank.”

Did he say gas on purpose there?

Maybe he reads Hemingway, too.

Trump will reverse the silly Biden LNG pause just like the silly off shore drilling ban. But the odds are good that there will be a hard LNG pause nonetheless for the reasons I’ve outlined. Based on their plans I’m not sure most LNG investors understand what LNG stands for - liquefied natural gas. Where do they plan to get the natural gas to liquefy? In the short term they will take it from American people and American businesses. It’s already happening.

Note: I will be writing about LNG demand soon. The U.S. needs countries to sell their dirty LNG to and Europe is already having second thoughts since the gas is so dirty. At the same time Qatar, which can sell LNG much cheaper than the U.S. is going to add huge amounts of capacity right at the same time the U.S. does. It is very unlikely there will be demand for all of the currently approved LNG terminals, much less all of the fantastic plans for many more. This is the point in the energy transition where a lot more investors will learn that stranded assets don’t make for good returns on investment.

Comments ()