As Solar Dominates, the Sun Sets on the LNG Boom

Gastech is a big deal in the global methane/natural gas industry. Gastech also openly embraces the false claims that the gas industry is somehow going to “...accelerate the global shift toward cleaner, more sustainable energy.” The idea that methane in the form of LNG is somehow cleaner or more sustainable energy is false. But the oil and gas industry has always lied about pretty much everything. Whether it’s caring about workers, caring about Americans, climate science, the economics of shale oil and gas, the economics of renewable energy, electric vehicles…I could go on.

As I wrote recently, LNG is the oil and gas industry’s “last scam.” They are still lying about everything but it appears that more people are catching on if the commentary coming from Gastech 2025 in Milan is any indication. Nick Cunningham of Gas Outlook does a great job of summarizing this shift in sentiment.

“I left with a feeling of concern which can be summed up as ‘Irrational Exuberance.’”

That was from Vivek Chandra, the CEO of the proposed Gulfstream LNG project in Louisiana. An industry CEO is using the bubble-indicating language of “irrational exuberance.” Wood MacKenzie does a lot of work for the oil and gas industry and has cheered on the LNG boom with a lot of supportive publications. Earlier this month Japan’s government hired Wood MacKenzie to do an analysis of the world’s most uneconomic LNG project - the proposed Alaska LNG. Japan loves LNG and wants the world to get hooked on it for decades. If anyone can paint a pretty picture of LNG, it’s WoodMac. And yet, they also are using the bubble language after attending Gastech 2025.

“But the industry risks over-exuberance, particularly as the LNG ecosystem expands. Our team, just back from Gastech 2025 in Milan, shares its concerns that some cracks may be starting to show.”

Seb Kennedy of Energy Flux was at Gastech. Seb’s analysis strongly supports the coming global LNG glut and the economic challenges it will pose for the US LNG industry in particular. Here was his take: “They say ‘when you’re in a hole, stop digging’. The same could be said for when you’re in a bubble: stop blowing.”

But they aren’t stopping blowing. The U.S. LNG industry used Gastech 2025 as a venue to announce even more investment in expanding U.S. LNG export capacity. As you know, I’ve been explaining that the U.S. LNG market is in a massive bubble. I’m a bit of a student of bubbles having lived through a couple of them. There was the dot.com bubble. I was working in internet marketing when that happened. My job was mostly figuring out how these new search engines things could be useful. As the internet stocks collapsed, I had a Harvard educated MBA who was running brands for Johnson and Johnson look across the table at me and say, “Get back to us when the internet works.” As time has shown, the internet worked just fine but it doesn’t solve the problem of creating businesses that can’t find paying customers. That problem remains, just as it does in the current LNG industry.

After that there was the housing bubble. In my first corporate job I was making $37,000. I had student loans but no other debt. I wanted to buy a townhouse which was around $120K. The bank would only approve me for $70K. So I rented. Fast forward a decade and $37K a year salary would get you a $300,000 mortgage no problem. It seemed banks weren’t concerned about getting paid back anymore. Bubblicious!

I was thinking of the housing bubble earlier this month as I was on the Gulf Coast looking at LNG facilities and I thought about the scene in The Big Short where the hedge fund bros go to Florida and see what a bubble looks like in the real world.

In his video reporting from the floor of Gastech, Seb Kennedy also noted how the CEO of U.S. LNG exporter Venture Global seemed to be rewriting the rules of economics by saying the looming supply glut won’t impact prices. What else can he say? Venture Global had $29 billion in debt before it just borrowed another $15 billion for CP2. They are all in and will continue to talk their book to try to stay ahead of those debt payments.

Photo of CP2. Imagine breaking ground on a new project now knowing what we know. Bubble fever.

Exxon was also at Gastech and was bullish on LNG demand from China. And Colombia. China’s LNG imports are down 20% in the first half of 2025. And Colombia? Their demand is a rounding error in the global market. Exxon is also promoting LNG as a fuel for trucking but batteries are taking that role with China once again leading the way. One of the reasons that LNG is facing so much trouble is that as a fuel, it is very expensive. I thought of this as the sun set over Exxon’s Golden Pass facility that is still under construction.

Image: Exxon’s Golden Pass LNG

At one point I passed by the vacant lot that is Commonwealth LNG. A quiet expanse of financial sanity amongst the exuberance. Save your money! But, alas, they are working hard to try to build this project as well.

Image: Future home of Commonwealth LNG?

I passed by Woodside’s Louisiana LNG at some point. You can still buy a big equity stake in that one if you want. Really. Meg will take your call.

Port Arthur is down the road from Golden Pass and recently announced that major U.S. gas producer EQT agreed to buy LNG from the project. You may be confused reading that but, to be clear, a major U.S. gas producer who sells supply gas to the LNG exporters has agreed to buy U.S. LNG. When one of the biggest players in an industry is buying its own product to prop up the market, it’s a good sign of a bubble (see also: Nvidia investing in ChatGPT).

Another thing noted by Vivek Chandra was that, "At Gastech, there were countless projects and expansion projects tripping over themselves to try to get to Final Investment Decision…many of them on the back of offtake agreements with traders and aggregators – not end users."

In April I wrote that the LNG industry is setting itself up for a situation where they don’t have end users and they all are just trying to trade LNG with each other. It shouldn’t be hard to predict how that will end up. So if the bubble is so obvious, why does it continue?

LNG or Bust

The LNG industry is in a massive bubble and there will be financial destruction in its future and most analysts agree that the U.S. market is the one with the most risk for various reasons I explained in my piece “The End of the US LNG Bubble.” So why would EQT agree to buy LNG? Can’t they see the high likelihood of losing money on this? I’m guessing they can. But there is a method to their madness. Sure there is high risk of the LNG bubble bursting. But the higher risk to the future financial prospects of U.S. gas producers like EQT is that LNG exports don’t grow at the phenomenal rates that are predicted by the likes of Shell. If the LNG export market doesn’t create a domestic gas shortage in the U.S. and raise prices for domestic gas (Henry Hub) to $5 or higher, there is no money in a lot of U.S. gas production. So while the future for LNG exports doesn't look good, the chance that it works is the best hope for the entire U.S. gas industry.

This was a forecast from March of this year.

“Gas futures will need to stabilize around $5.00 through 2027 before large gas producers have an incentive to ramp up production, said Kevin MacCurdy, managing director at Pickering Energy Partners.”

Notice in the graph above how gas prices are nowhere near $5. I was expecting U.S. gas prices to be higher by now. We are exporting a lot of LNG but Henry Hub prices are still having trouble breaking $3. How is this possible? One obvious reason is because renewable power is lowering U.S. gas demand. If that continues and LNG exports don’t reach levels to raise U.S. gas prices, EQT and the rest of the U.S. gas industry will likely have trouble paying back its big pile of debt. Here is what the EIA had to say in August.

“Natural gas remains the most prevalent source of electricity generation in the United States, but so far in 2025 natural gas has lost market share in the electric power sector to coal, solar, and wind.”

Even in the U.S. where the policies are actively working against renewables, natural gas is losing market share. Which keeps prices low. How about next year?

“We expect increases in natural gas consumed in the residential and commercial sectors to offset decreases in natural gas consumed in the electric power sector. We currently forecast U.S. natural gas consumption will decrease slightly in 2026….”

Without rapidly increasing LNG exports the U.S. gas industry is facing a declining domestic gas market which is only going to get worse because even at these low prices, gas is expensive compared to solar plus storage (see: Texas).

These market realities are also the reason the gas industry is so desperate to convince us we need to build a lot of gas power plants to power AI slop generators. They need to increase U.S. domestic gas demand. I will give the AI bubble people credit for their latest new tactic to keep blowing the bubble: allow our industry to have no regulations or the antichrist will appear. The housing bubble scammers never thought of that one!

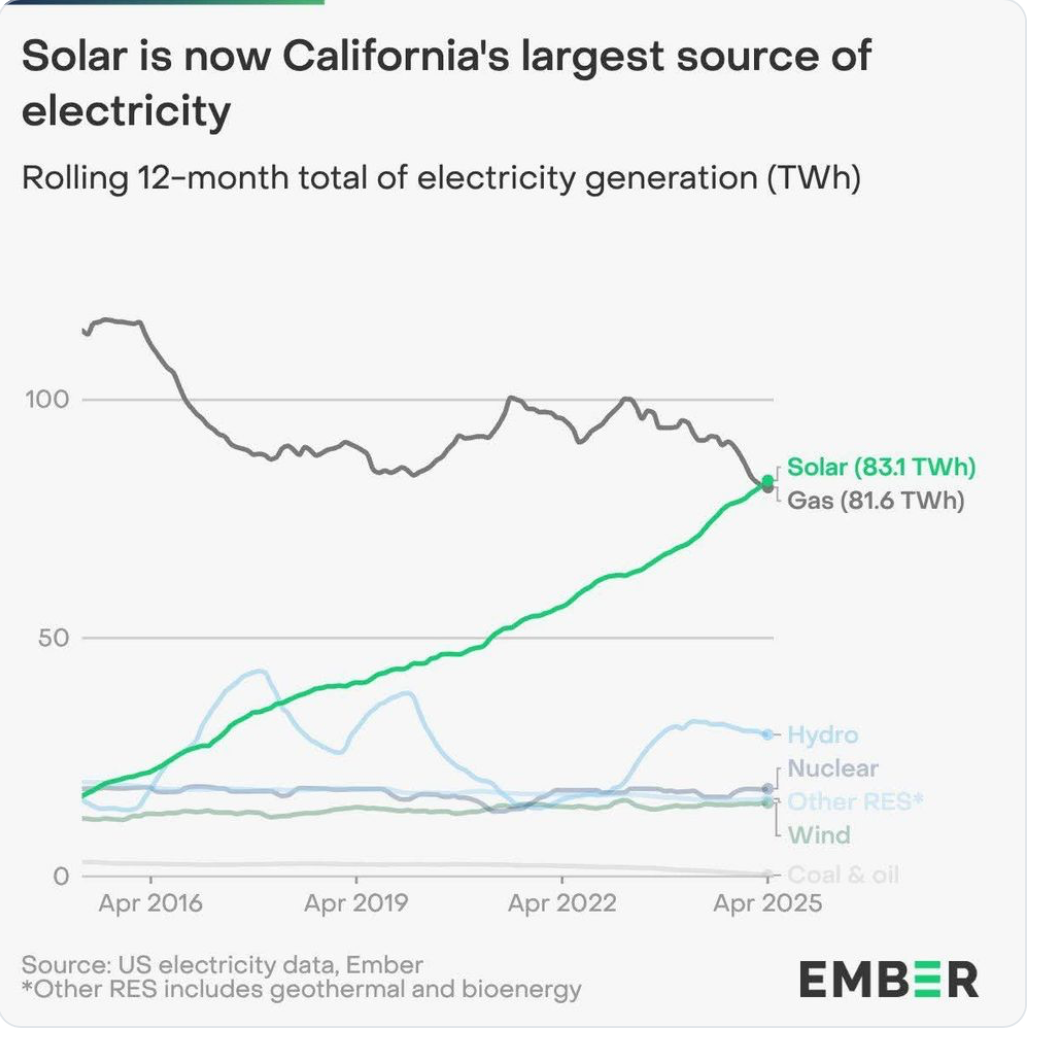

So despite everyone knowing there is a bubble and the leaders of the LNG industry spouting nonsense, it is a rational approach for them to continue to double and triple down on the future of LNG as it is the only hope they have to remain financially viable. There is still a chance they can sucker countries into using LNG before it just becomes obvious to everyone that natural gas will be replaced by solar, wind and storage much sooner than they expected. Look at this new graph of the power generation sources for California if you want to understand why the industry has to make LNG exports work or they are done.

But why would Goldman Sachs loan money to keep the bubble going? Same reason they do for every bubble. They get rich doing it and then they buy up cheap assets after the crash and get richer and there also are no penalties for financial fraud for bankers in America.

How long can the bubble go on? Investors are clearly starting to realize that investing in LNG is not the path to riches. The Venture Global IPO was supposed to have started that frenzy and instead it lost investors many billions. The bubble can easily continue while they spend tens of billions of dollars moving all those cranes around to build those export terminals. It may not burst until they are all up and running just as the world moves on to cheaper alternatives.

As more and more people admit that the bubble is obvious we are starting to hear about how the money will be made in LNG exports after 2030. Be patient, they say. Meanwhile, the reality is that the world will have a lot more solar, wind, hydro and storage by 2030. Odds are the financial outlook for LNG will be worse at that point. Did you know Canada also has big LNG dreams? They also need a new market for their gas because due to oversupply issues the price of gas in Western Canada (just like the price of gas in the Permian in Texas), was negative.

“Some natural gas producers in Western Canada are aggressively cutting output in an effort to ease an ongoing glut that this week tipped prices for the fuel into record negative territory, companies and analysts said.”

I believe the oil and gas industry is crippled by its own powerful combination of ignorance and arrogance. They don’t see what’s coming. Many of their arguments against renewables have proven to be false but they still cling to one: sure renewables are doing well but they don’t have the high profit margins that oil and gas have so investors aren’t interested. Really? ConocoPhillips just announced it was laying off 25% of its workforce. 25%!! Is that the sign of a healthy industry? What is the plan for ConocoPhillips to get back on track? They just announced they are buying more US LNG!

The U.S. oil, gas and LNG industry is about to go on an epic money losing spree with oil prices dropping and LNG prices dropping due to the global LNG glut that will last for at least 5 years. Meanwhile, Venture Global’s CEO is arguing that the laws of supply and demand don’t apply to the LNG industry (and yet they do, see Canadian example above). If you needed a good indication of a bubble it is when these con artists start telling you that this time it’s different. Back before the big housing crash it was quite common to find people telling us that there had been a fundamental change in the housing market and now…housing prices only go up.

Works until it doesn’t.

Coming soon: Much more on the latest on the U.S. and global oil industry. Last week we got the new Dallas Fed survey with a few interesting quotes. Here was one: "We have begun the twilight of shale," an executive said, adding "the U.S. isn't running out of oil, but she sure is running out of $60 per barrel oil."

Comments ()